BitMine’s $6.61B Ethereum treasury tops MARA, while BMNR’s stock, down 3.24% to $55.93, ranks 10th in U.S. trading volume at $6.4B daily.

BitMine Immersion’s Ethereum treasury has surpassed $6.6 billion, surpassing MARA. Despite a recent price decline, its stock remains among the most actively traded in the United States.

Bitmine’s Ethereum holdings surpass $6.6 billion amid a surge in stock liquidity

According to a press release, BitMine has reported holdings of over 1.52 million Ethereum, valued at $4,326 per token, and 192 Bitcoin (BTC) as of this writing. Compared to the previous week, when it held $4.9 billion worth of ETH, this represents a substantial increase in cash terms. It is indicative of the company’s rapid expansion of its ETH holdings.

Tom Lee, the chairman of BitMine and a co-founder of Fundstrat, contended that Ethereum is one of the most significant transactions of the upcoming decade. He emphasized that Ethereum is a more viable investment in the long term due to the institutional demand, the migration of Wall Street, and AI onto blockchain.

Lee’s remarks suggest that the role of Ethereum in the finance industry’s revolution would only intensify as blockchain and traditional markets are integrated. BitMine employs additional strategies beyond accumulation. It also endeavors to establish a dominant position regarding institutional credibility and trading liquidity.

BitMine has implemented an aggressive expansion strategy that has attracted the attention of prominent institutional investors, including Kraken, Founders Fund, Pantera Capital, and Cathie Wood’s ARK Invest. Its goal is to increase its ETH holdings and acquire 5% of the total ETH in circulation, which has sparked increased investor interest.

The trading activity of BitMine’s stock has also increased, with an average daily volume of $6.4 billion, as per Fundstrat. This is the 10th most liquid stock in the United States, surpassing industry titans such as Alphabet and JPMorgan.

BitMine surpasses MARA as the second-largest corporate crypto treasury amid a 775% stock surge

This purchase has placed the corporation as the second-largest corporate crypto treasury, overtaking Marathon Digital (MARA). BitMine’s Ethereum-focused strategy has now surpassed MARA in total crypto reserves, as evidenced by data from BitcoinTreasuries.

BitMine’s ETH treasury is released when institutions rebalance their portfolios to incorporate crypto endowments. MicroStrategy continues to be the largest crypto treasury in U.S. dollar terms, with its assets valued at $74 billion following its most recent BTC acquisition. BitMine follows with $6.6 billion in holdings.

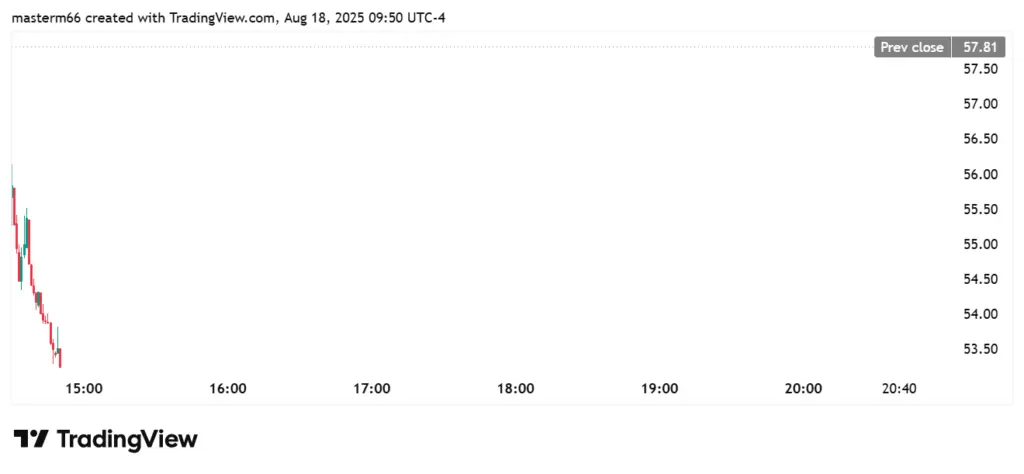

BitMine’s (BMNR) share price has declined by 4.37% in a single day, as the TradingView chart indicates. Nevertheless, it has generated extraordinary long-term benefits. BMNR has outperformed the previous six months, with a 775% increase in price and a year-to-date increase of over 600%. This year, it has been one of the most successful equities in the U.S. markets, as evidenced by these returns.