Matt Hougan, the CIO of Bitwise, has disclosed two outcomes if the United States government disposes of its Silk Road Bitcoin inventory.

Matt Hougan, the Chief Investment Officer (CIO) of Bitwise, has expressed his opinion on the potential consequences of the United States government’s sale of its $6.5 billion Silk Road BTC hoard under the leadership of Joe Biden. The Bitwise CIO’s comments are in response to the court’s authorization for the government to sell these assets.

CIO of Bitwise Provides His Opinion Regarding the Potential Bitcoin Sale of the United States Government

Bitwise CIO Matt Hougan stated in an X post that the market will absorb the $6.5 billion Silk Road hoard if the US government truly sells it in the remaining days of the Biden Administration.

He also stated that the new administration would repurchase the bitcoins, which Donald Trump heads if the Biden administration sold them. Nevertheless, it is uncertain whether this will occur, as Trump has not yet provided an official statement.

Hougan’s remarks are in response to the court’s authorization for the government to liquidate the 69,000 BTC ($6.5 billion) it confiscated from the dark web marketplace Silk Road.

In the interim, other nations are exploring the establishment of a crypto reserve even though the United States may seek to dispose of these coins. Gelephu Mindfulness City in Bhutan has recently disclosed its intention to incorporate Bitcoin, Ethereum, and BNB into its reserves.

Peter Schiff Adopts a Differing Perspective

While the Bitwise CIO is optimistic that the Trump administration will repurchase these currencies, Bitcoin critic Peter Schiff doubts this possibility.

The esteemed economist stated in an X post that the US president-elect will not acquire these coins or any additional amounts if Biden’s government disposes of the BTC holdings before his inauguration.

Schiff also believes that the Biden government will dispose of these coins before January 20. He stated that since the November 2016 election, he has warned that the current administration would sell all US-owned BTC before Trump assumes office. He also said that Trump’s sole campaign pledge was to refrain from selling the US-owned Bitcoin. However, he never committed to purchasing any additional Bitcoin.

The Bitcoin price could be substantially influenced by the US government’s $6.5 billion BTC sale. Intriguingly, this potential price decline is occurring. In light of the company’s Bitcoin exposure, Peter Schiff has also foreseen a stock collapse in MSTR.

The Bitcoin price may be poised for a rebound

In the wake of the recent Bitcoin price collapse, crypto analyst Ali Martinez expressed some optimism. In an X post, he announced that BTC may be poised for a rebound.

The analyst disclosed that Bitcoin must surpass $94,600 to experience an upward trajectory. A further rally to $96,300 or even $97,000 could occur if this resistance level is breached.

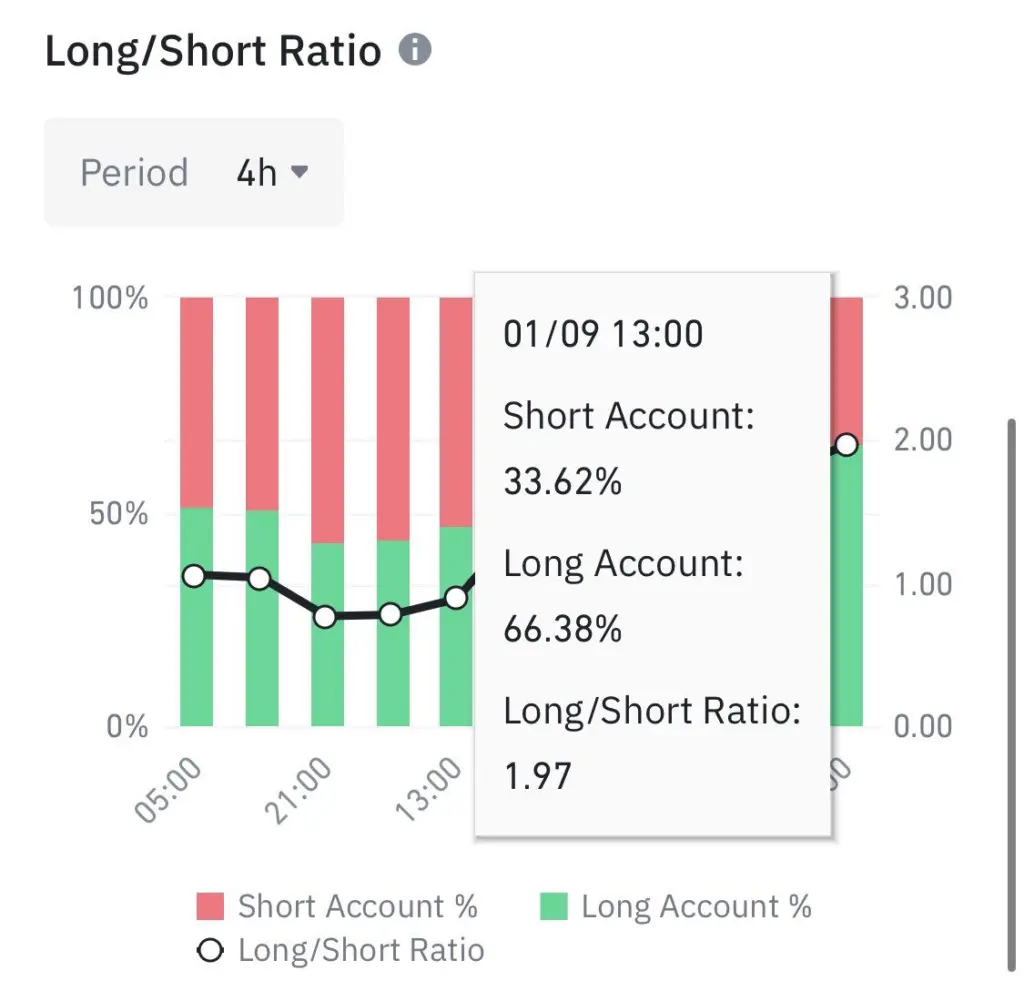

In the interim, the analyst also disclosed that 66.38% of merchants on Binance anticipate a Bitcoin price increase. The analyst observed that these speculators have a history of being correct.