Bitwise’s latest Solana staking ETP, BSOL, has entered the European market with competitive rewards and low fees, surpassing its competitors.

While it awaits registration approval in the United States for its Solana exchange-traded fund (ETF) offering, Bitwise, a crypto index fund manager, has reportedly launched a Solana staking exchange-traded product (ETP) in Europe under the stock ticker BSOL.

According to a Blockworks report, the cryptocurrency investment firm introduced its Solana (SOL)–based crypto-staking ETP in Europe on Dec. 17 in collaboration with Marinade, a self-custodial automation tool.

By the time of publication, the cryptocurrency investment firm had not responded to Cointelegraph’s request for additional information regarding the partnership.

The new ETP surpasses its European competitors, such as 21Shares, which provides a 5.49% annual percentage yield (APY) to investors, with a rate of 6.48%.

To Compete With Extant European Players, Bitwise Has Implemented Low Fees

BSOL’s management fee is competitively set at 0.85%, which is considerably lower than 21Shares’ 2.5%.

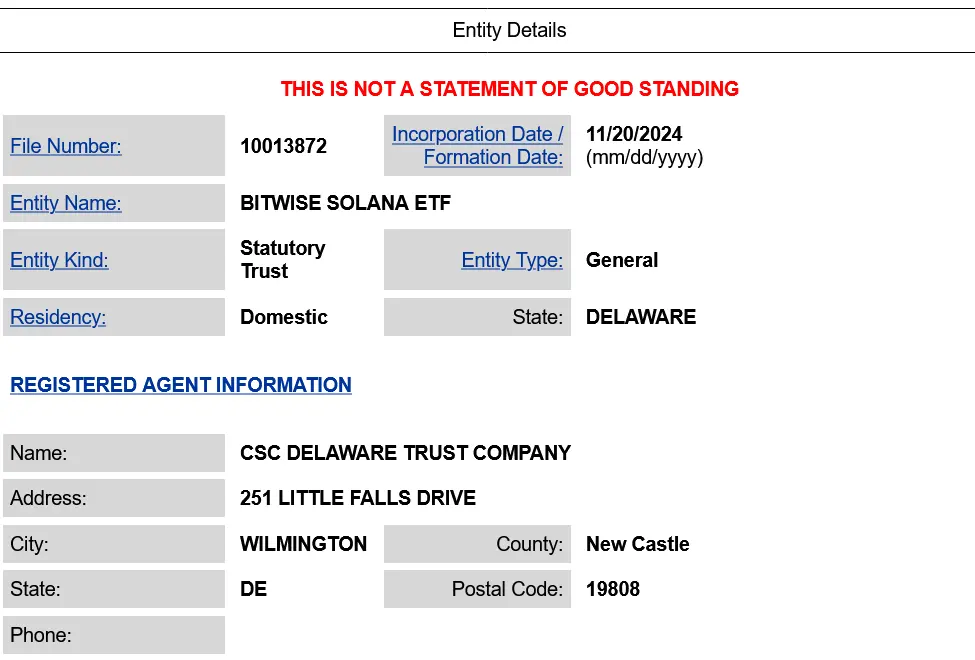

In November, the cryptocurrency investment firm also registered a statutory trust in Delaware for its proposed spot Solana ETF.

This would necessitate additional regulatory filings with the Securities and Exchange Commission.

Matthew Sigel, VanEck’s chief of digital asset research, stated that the likelihood of a US-approved spot Solana ETF by the end of 2025 is “overwhelmingly high” while the cryptocurrency investment firm continues to await approval in the US.

The ETC Group acquisition resulted in the introduction of Bitwise’s first Solana ETP in Europe, ESOL, in August. By incorporating the feature, BSOL intends to address a significant void in ESOL’s support for staking rewards.

Bitwise Optimistic Regarding Approval Of Exchange-Traded Funds (ETFs) In 2025

The acquisition expanded Bitwise’s portfolio to include nine European-listed crypto ETPs and increased its assets under management to over $4.5 billion. At present, the ESOL product is managing $24 million in assets.

Matt Hougan, the chief investment officer at Bitwise, and Ryan Rasmussen, the research director, recently forecasted that at least five “crypto unicorns” will go public in 2025. These companies include Kraken, a crypto exchange, and Circle, a stablecoin issuer.

Furthermore, the cryptocurrency investment firm predicted that Bitcoin will surpass gold’s present $18 trillion market cap by 2029 and will reach $200,000 or more by the end of 2025.