Bloomberg’s lead ETF analyst claims that ETFs and BlackRock have “repeatedly saved BTC’s price from the abyss.”

Due to growing investor worries over Coinbase’s onchain settlement methods, the largest asset manager in the world has filed for an adjustment to its Bitcoin exchange-traded fund (ETF).

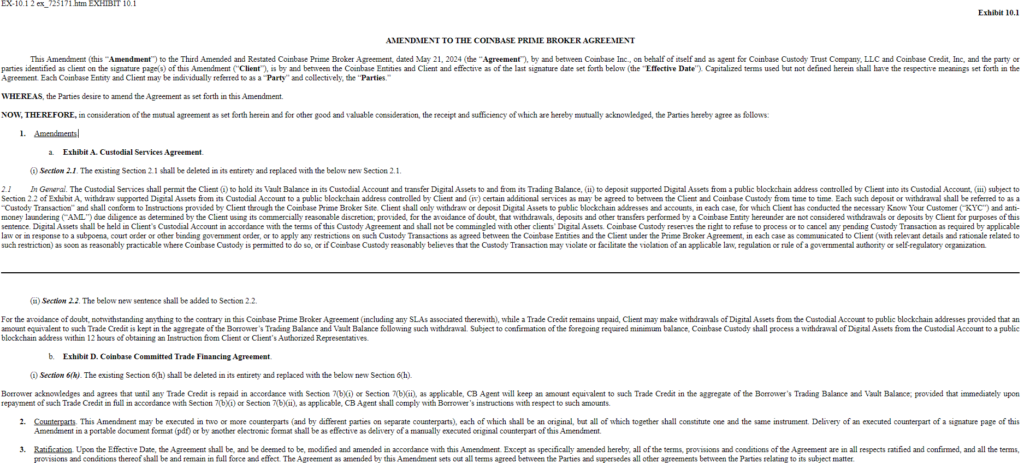

An amendment to compel Bitcoin BTC$63,301 withdrawals from the ETF custodian, Coinbase, within 12 hours has been filed by BlackRock, according to a filing with the Securities and Exchange Commission (SEC) dated September 16.

According to BlackRock’s filing:

“Subject to confirmation of the foregoing required minimum balance, Coinbase Custody shall process a withdrawal of Digital Assets from the Custodial Account to a public blockchain address within 12 hours of obtaining an Instruction from Client or Client’s Authorized Representatives.”

Widespread industry concerns regarding Coinbase’s ETF custodial methods led to BlackRock’s latest adjustment. Investors are requesting more and more from Coinbase to furnish onchain evidence of the Bitcoins purchased by the spot ETFs.

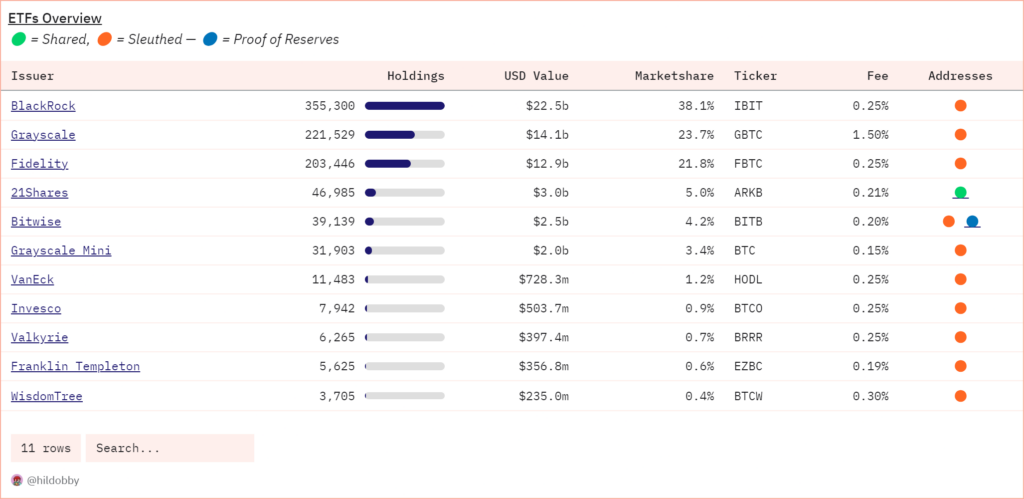

Eight of the nine recently approved Ether (ETH) ETFs in the US and ten of the eleven spot Bitcoin ETFs are custodianed by Coinbase.

Investors worry about Coinbase’s Bitcoin ETF custody procedures, which the company’s CEO allayed

The bitcoin price has been flat for the last three months, even with the recent institutional inflows from the Bitcoin ETFs.

This is partially responsible for the general investor anxiety that Coinbase was lowering the price of Bitcoin by purchasing “paper BTC,” or Bitcoin IOUs, on behalf of Bitcoin ETF issuers.

Though not all ETF addresses are disclosed publicly, all ETF transactions are eventually resolved onchain, according to Coinbase CEO and co-founder Brian Armstrong.

Armstrong responded to investor worries in a September 14 X post by writing:

“If you want audits, Deloitte audits us annually, we’re a public company. I doubt our institutional clients want people dusting all their addresses, and it’s not our place to share for them. This is what it looks like if you want a bunch of institutional money to flow into Bitcoin.

When Coinbase first hinted at creating a new Wrapped Bitcoin (WBTC) called Coinbase BTC (cbBTC), investor fears grew in August.

Analyst: BlackRock and Bitcoin ETFs aren’t to blame for the decline in the price of BTC.

Dune data shows that the ETFs had accumulated onchain holdings of approximately $59.2 billion since their inception in January.

Currently holding more than $22.5 billion in onchain assets and a market share of more than 38%, BlackRock’s IBIT is the most significant Bitcoin ETF.

Despite the growing charges, senior ETF analyst at Bloomberg Eric Balchunas claims that local Bitcoin investors were the source of the recent decline in the price of Bitcoin, not ETFs.

In an X post dated September 15, the analyst wrote:

“I get why these theories exist and ppl want to scapegoat the ETFs. Bc it is too unthinkable that the native HODLers could be the sellers. But they are… All the ETFs and BlackRock have done is save BTC’s price from the abyss repeatedly.”

By February 15, when the value of new Bitcoin investments crossed the $50,000 threshold, ETFs were around 75% of the total.