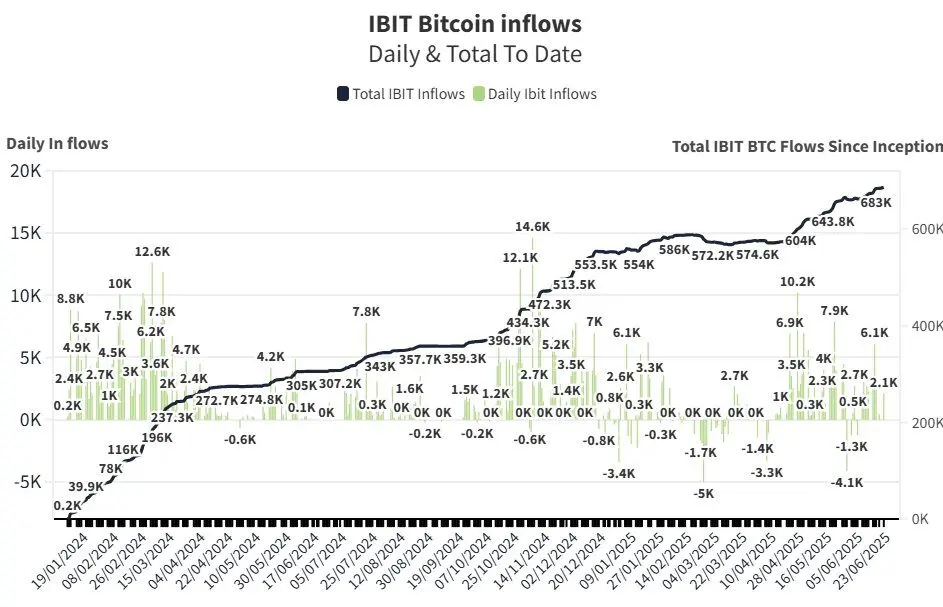

BlackRock Bitcoin ETF (IBIT) led spot ETF inflows, adding $436M and 4,134 BTC on Monday, with total net inflows hitting $588M by Tuesday.

BlackRock Bitcoin ETF (IBIT) is again at the forefront, as net inflows into spot ETFs increased by $588 million on Tuesday.

BlackRock’s IBIT alone contributed $436 million in inflows, consuming 4,134 Bitcoins, bringing its total Bitcoin holdings closer to 700,000.

Additionally, the IBIT share price experienced a 2.5% increase on Tuesday, regaining the critical $60 level.

BlackRock Bitcoin ETF Is Currently Experiencing Significant Buying Spree

BlackRock iShares Bitcoin Trust (IBIT) has been on an unstoppable Bitcoin purchasing spree, acquiring an additional 4,134 BTC valued at $488 million.

Michael Saylor of MicroStrategy also believes that BlackRock’s IBIT will be the leading source of BTC inflows in 2025.

The iShares BlackRock Bitcoin ETF has maintained its extraordinary streak of inflows for 11 consecutive trading days.

Strong and consistent investor interest is underscored by the $3 billion in new investments the ETF has attracted during this period.

This is achieved despite the ongoing Iran-Israel conflict and geopolitical tensions.

The total holdings with BlackRock’s IBIT are currently 685,584 BTC, with net assets under management of $72.3 billion, according to the official IBIT website.

In addition to IBIT, other market participants contributed to net inflows on Tuesday.

Ark Invest’s ARKB experienced inflows exceeding $43 million, while Fidelity’s FBTC secured the second position with $85.2 million.

Since its inception, this Bitcoin investment product has gained significant attention, with net inflows surpassing $47.5 billion.

IBIT Surpasses $14 Billion In Inflows

Since the inception of 2025, the BlackRock Bitcoin ETF has received over $14 billion in inflows as of Tuesday’s closing.

In addition, it surpassed the SPDR Portfolio S&P 500 ETF (SPLG) to take the fourth position on the year-to-date (YTD) flow leaderboard.

Eric Balchunas, a strategist at Bloomberg ETFs, has noted that IBIT has accomplished a remarkable feat by ranking fifth in three-year flows despite being operational for only 1.5 years.

This achievement underscores the company’s sustained investor interest and rapid growth.

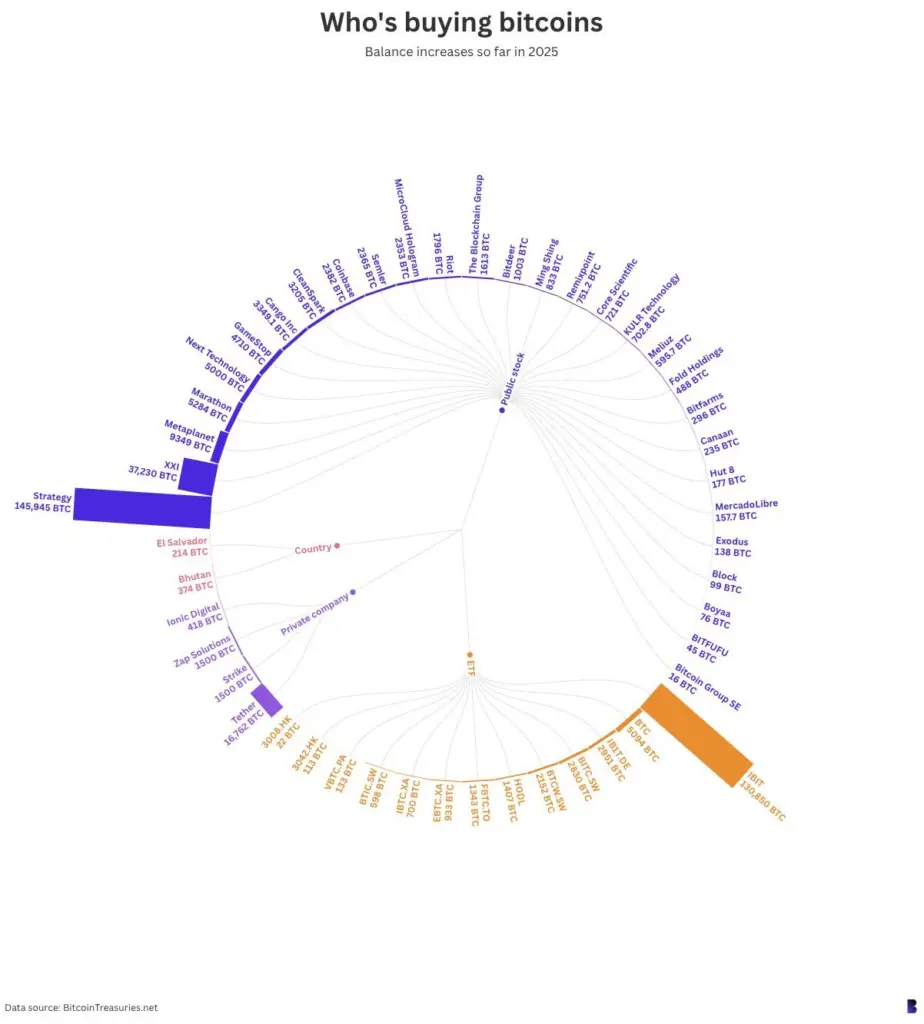

According to Nate Geraci, President of ETF Store, governments, corporations, and ETFs acquired over 400,000 Bitcoins in 2025.

This figure is equivalent to approximately 2% of the total Bitcoin supply.

As illustrated below, BlackRock’s IBIT is the second most significant asset class, following Strategy (MSTR).

The Bitcoin price is trading at $106,300, gaining over 1.5%. Nevertheless, the daily trading volume has decreased by 27% to $47 billion as traders adopt a wait-and-see stance.