BlackRock’s spot Bitcoin ETF enters the top 20 most traded ETFs in 2025, reflecting strong investor demand and growing mainstream crypto exposure

BlackRock’s Bitcoin (BTC) IBIT ETF has entered the top 20 most-traded ETFs this year, according to Bloomberg ETF analyst Eric Balchunas.

IBIT is ranked 13th, just behind Direxion Daily Semiconductor Bull 3X Shares (SOXL US). The SPY US continues to dominate the chart. SPY US has been the most frequently traded exchange-traded fund for the past decade.

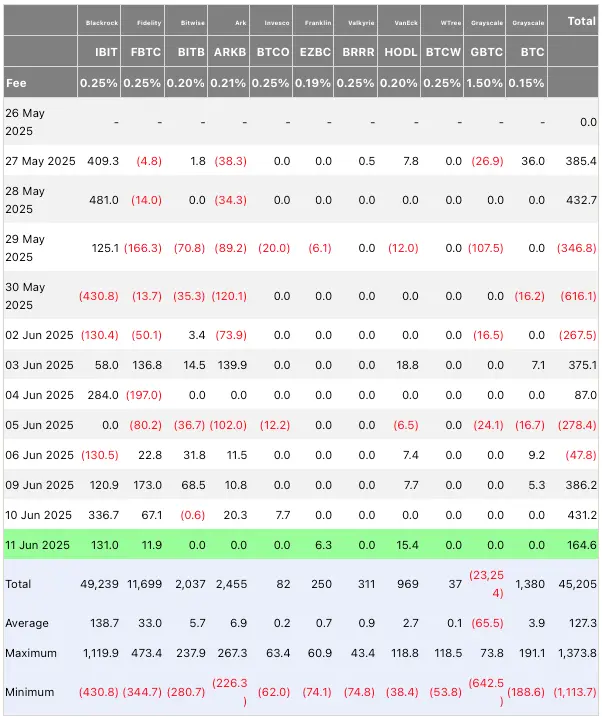

BlackRock’s Acquisition of Bitcoin Persists

BlackRock acquired Bitcoin (BTC), valued at $930.6 million. In the same time frame, the world’s largest asset manager has liquidated $260.9 million in Bitcoin.

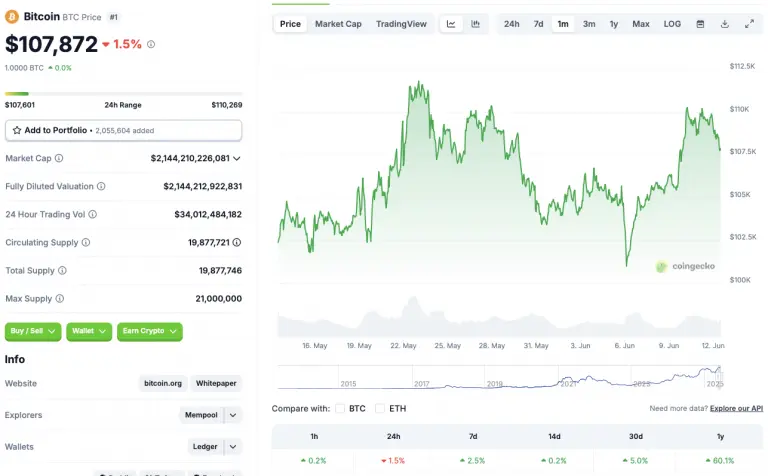

Earlier this month, the price of BTC experienced a significant decline. After reaching a high of $111,814 on May 22, the asset’s valuation plummeted to $100,000. BTC has since recovered to the $109,000 price threshold but has since fallen to the 107,000 mark.

BTC is down 1.5% on the daily charts but up 2.5% on the weekly charts, 0.2% on the 14-day charts, 5% over the previous month, and 60.1% since June 2024. However, it is down 1.5% on the daily charts.

What is the likelihood of the asset’s continued upward trajectory?

The past few weeks have witnessed persistent institutional inflows into BTC. The price of an asset is significantly influenced by institutional funding. BTC may continue to experience an upward trend if BlackRock and other financial institutions continue to acquire the asset.

Retail investors appear to be neglecting the matter at present. If retail purchasers also participate, we may observe a more substantial rally.

At the $110,000 price point, Bitcoin is currently encountering substantial resistance. BTC may achieve a new high if it surpasses the $110,000 threshold.

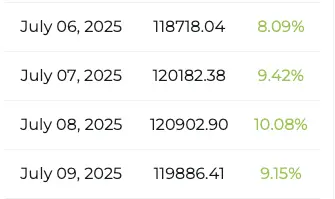

Changelly anticipates that BTC will continue to rally over the next month. According to the platform, the asset is expected to reach a new all-time high of $120,902.90 on July 8, 2025. If the $120,902.90 target is achieved, the price of BTC will increase by approximately 12.08%.