Since its January inception, BlackRock’s iShares Bitcoin Trust (IBIT) exchange-traded fund (ETF) has experienced withdrawals on just two occasions.

Bitcoin’s price fell below $59,000 on the second day of outflows from BlackRock’s Bitcoin ETF.

On August 29, BlackRock’s ETF reported a net outflow of $13.5 million, the second since May 1, when it recorded a net outflow of $36.9 million. This was also the worst combined outflow day ever for the Bitcoin BTC$59,321 ETFs, at $563.7 million, according to data from Farside Investors.

Together, the 11 spot Bitcoin ETFs with US bases had net withdrawals of $71.8 million on August 29.

The Fidelity Wise Origin Bitcoin Fund (FBTC), which experienced net outflows of $31.1 million, the highest amount for the day, surpassed BlackRock’s fund in third position. Second place went to the Grayscale Bitcoin Trust (GBTC), which had $22.7 million in outflows.

IBIT reported net inflows of $224.1 million on August 26, the most since July 22, when inflows totaled $526.7 million. This marks IBIT’s net outflow day.

On August 29, only one ETF saw net inflows: $5.3 million went into the ARK 21Shares Bitcoin ETF (ARKB).

The most recent withdrawals from Bitcoin ETFs coincide with a broader decline in the cryptocurrency’s price, which, according to CoinMarketCap, has dropped by about 3.43% over the past seven days to trade at $58,751 as of this writing.

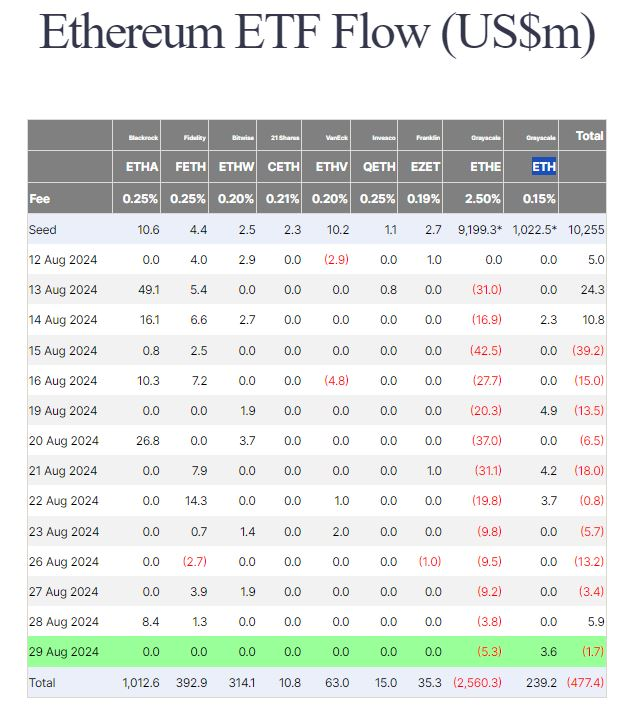

On August 29, slightly combined outflows of $1.7 million were observed by US-based spot Ether ETH$ 2,516 ETFs, with several of the funds experiencing zero flows.

The only ETF with a net inflow of $3.6 million was the Grayscale Ethereum Mini Trust (ETH). Still, it could not stop the $5.3 million net withdrawals from its sister trust, the Grayscale Ethereum Trust (ETHE), which has higher fees.

Since its inception in July, ETHE has experienced net outflows nearly every day, totaling $2.56 billion in outflows to date.

According to CoinMarketCap, the price of ETH has also been declining, falling 5.64% over the past seven days to $2,517.06.