BlackRock Bitcoin ETF saw an inflow of $597M despite the crypto market crash, marking its third day of net inflows among spot Bitcoin EFTs.

On Tuesday, the iShares Bitcoin ETF (IBIT) of BlackRock experienced an inflow of more than $597 million.

After investors became cautious due to robust US JOLTS job openings and ISM Services PMI data, the BlackRock Bitcoin ETF can save the floundering crypto market.

A net inflow of $53.46 was observed in the spot Bitcoin ETF in the United States.

Fidelity, Bitwise, Ark 21Shares, Franklin Templeton, and Grayscale all reported outflows in their Bitcoin ETFs.

Inflows Were Observed In BlackRock Bitcoin ETF Despite Cryptocurrency Market Crash

On January 7, Miners mined only 450 new BTCs, while BlackRock’s iShares Bitcoin ETF (IBIT) acquired 6,078 BTC valued at $208.7.

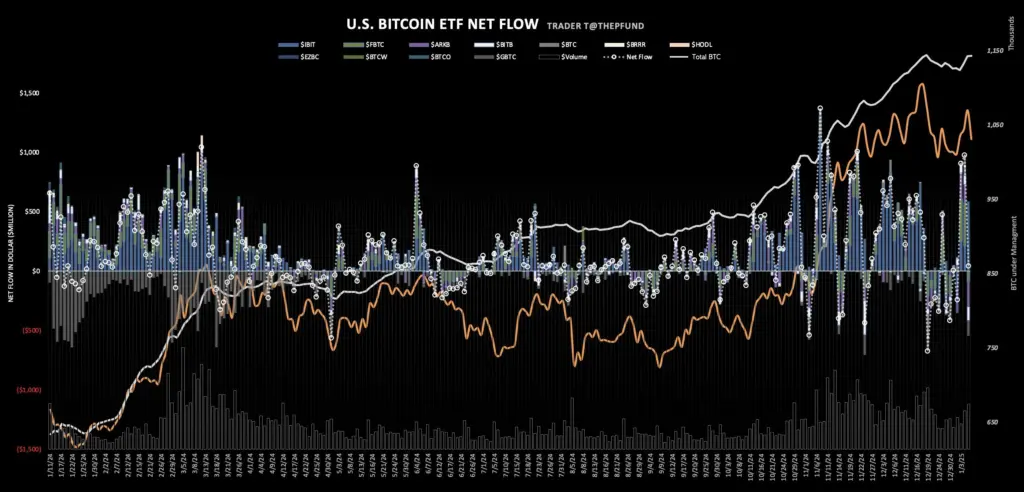

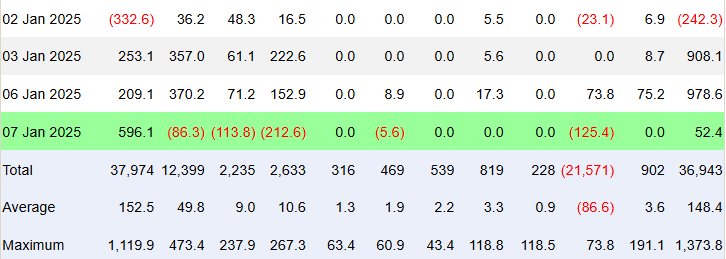

According to data from Trader T, IBIT experienced an inflow of $597.18 million.

This marks the third consecutive inflow into IBIT, despite a significant decline in the cryptocurrency market.

It is worth noting that the US Bitcoin ETF experienced an inflow of $978.6 million on Monday, which sparked optimism as the flagship crypto surged past the $102K mark.

In contrast, Bitwise’s BITB, Ark Invest’s ARKB, and Fidelity’s FBTC experienced outflows of $113.85 million, $212.55 million, and $86.29 million, respectively.

Additionally, Franklin EZBC experienced a $5.58 million outflow.

Grayscale’s GBTC also experienced a $125.45 million outflow.

Invesco, Valkyrie, VanEck, and Grayscale Mini experienced no flows.

The total net inflow for Bitcoin spot ETFs reached $52.4 million, as per Farside Investors.

A net inflow of $596.1 million was observed in the iShares Bitcoin Trust by BlackRock.

Conversely, the extent of outflows in other exchange-traded funds (ETFs) varied.

Bitcoin, Crypto Market Experienced Decline Due To Macroeconomic Concerns

The JOLTS job openings increased by 259,000 to 8,098 million in November 2024, as reported by the U.S. Bureau of Labor Statistics.

Additionally, the ISM Services PMI index exceeded expectations, demonstrating the current resilience of the U.S. economy.

Because of this, the price of Bitcoin plummeted by over 5%.

In reality, the US dollar index (DXY) maintains its rise above 108.50 today, following a two-day low that triggered a Bitcoin price recovery.

Additionally, the yield on the 10-year US Treasury note reached a 35-week peak of 4.68%.

The Federal Reserve’s expectations for additional rate reduction were diminished by the robust economic data from the United States.

In contrast, the price of Bitcoin (BTC) continues to decline, despite the superior performance of the BlackRock Bitcoin ETF.

At present, the price is $96,259. The 24-hour low and high are $96,132 and $102,022, respectively.

Additionally, the trading volume has declined by 23% over the past 24 hours.