BlackRock Bitcoin ETF (IBIT) saw its largest outflow since launch, following Fidelity’s FBTC recording its biggest outflow earlier this week.

The US Spot Bitcoin ETF has reached the conclusion of its 16-day inflow sequence this week, as the crypto market experienced a significant decline.

In this context, the BlackRock Bitcoin ETF (IBIT) experienced its most significant outflow since its inception, which caused investors to express apprehension.

Concurrently, Fidelity’s FBTC experienced the most significant decline earlier this week, which was indicative of the investors’ diminishing risk appetite.

BlackRock Bitcoin ETF Has Experienced Its Largest-Ever Outflow

The recent crypto market collapse has had a significant impact on the sentiment of investors, as evidenced by the substantial decline in digital assets.

In the wake of the recent Bitcoin collapse, the US Spot Bitcoin ETFs also experienced an outflow this week, bringing an end to their 16-day inflow streak on December 18.

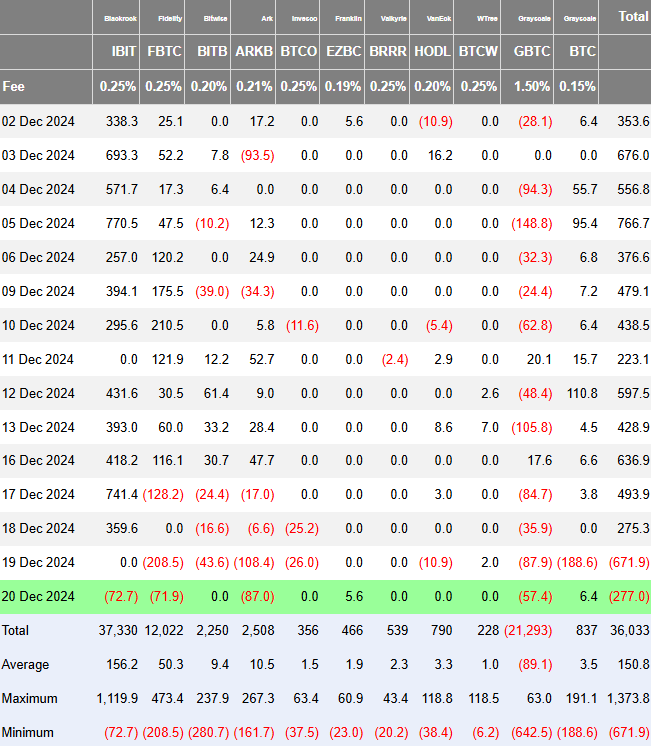

According to data from Farside Investors, the BlackRock Bitcoin ETF (IBIT) experienced its largest outflow of $72.7 million on Friday, December 20.

This occurred one day following the discharge of $208.5 million by Fidelity’s FBTC, which was the largest outflow since the investment instruments were introduced in the United States in January 2024.

On December 19 and December 20, the US Spot BTC ETF experienced an aggregate discharge of $671.9 million and $277 million, respectively.

In contrast, Bitcoin has experienced a significant increase in value this year, particularly following Donald Trump’s election victory in November.

It reached a new all-time high of $108K earlier this month, amidst a surge in optimism regarding the US Bitcoin Strategic Reserve.

Conversely, other global leaders, such as Europe, also suggested that a comparable course of action was imminent.

Concurrently, corporations have intensified their attention on the investment instrument.

In order to provide context, MicroStrategy has maintained its BTC purchasing strategy, which is indicative of its increasing confidence in the asset.

Additionally, Bitcoin miners such as Hut 8, MARA, and others amassed substantial amounts of Bitcoin.

Nevertheless, the investors’ sentiment appeared to have been affected by the recent outflows from BlackRock Bitcoin ETF and other sources.

What Will Happen To Bitcoin?

Speculation regarding the future of the investment instrument has been exacerbated by the recent outflow recorded in BlackRock Bitcoin ETF and other funds.

In addition, it suggests that institutional interest in the digital assets sector may be diminishing.

Nevertheless, it seems that the recent selloff was primarily precipitated by the US Federal Reserve’s recent hawkish statements, which are indicative of their upcoming rate-cut plans.

To provide context, the US Federal Reserve has announced an additional 25 basis points in rate cuts this month, while also suggesting that they may proceed with their rate cuts in a hawkish manner.

As a result, the crypto market has experienced a decline, in addition to the broader financial sector.

Nevertheless, despite the temporary decline, Bitcoin and the US spot Bitcoin ETF’s long-term trajectory were viewed with optimism by industry professionals.

The price of bitcoin has increased by nearly 5% today, reaching $98,431, following a low of $92,175 in the previous 24 hours.

Nevertheless, CoinGlass data revealed that Bitcoin Futures Open Interest remained near the flatline, despite the surge, suggesting that investors have not yet fully entered the market.