BlackRock’s $547M Ethereum purchase outpaces its $497M Bitcoin buy by 5X when adjusted for market cap, signaling a strategic shift toward ETH.

The recent purchases by BlackRock underscore a significant shift in focus among institutional investors, as institutional interest in Ethereum is on the rise. The asset managers’ Ethereum inflows have significantly outpaced Bitcoin, indicating a dramatic preference for ETH over BTC. What is the reason for this change?

BlackRock’s ETH Buys Eclipse Bitcoin

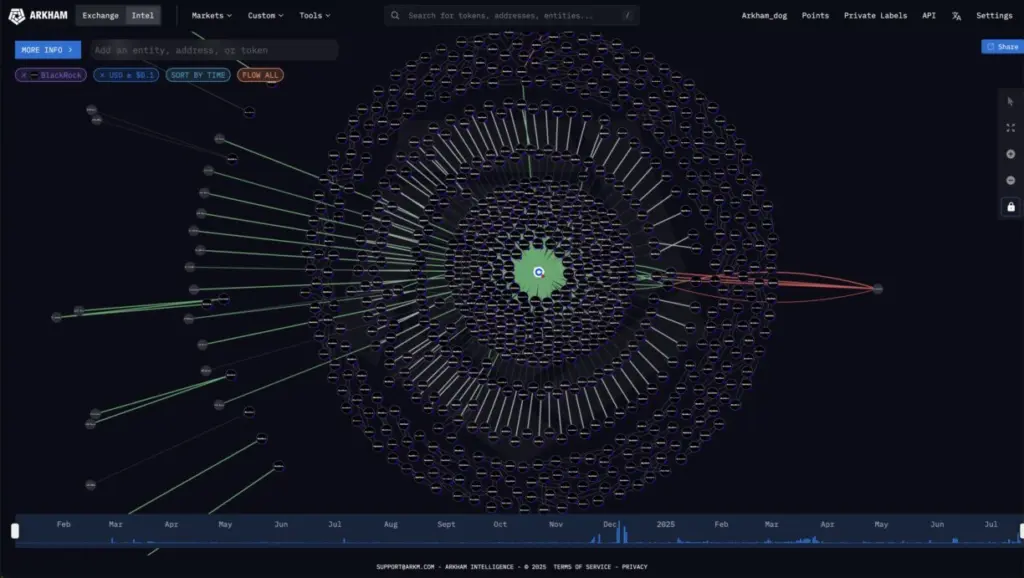

As indicated by Arkham Intelligence’s data, BlackRock continues to acquire Ethereum at a greater rate than Bitcoin. Arkham Intelligence disclosed in an X post that the investment organization has acquired $547 million in Ethereum (ETH).

Concurrently, the organization’s Bitcoin investment is $497 million, which is $50 million less than its Ethereum holdings. This is predicated on the net inflows the asset manager recorded for its crypto funds on July 17. BlackRock’s Ethereum ETF raised $546.70 million, according to SoSoValue data, while the Bitcoin ETF raised $497.30 million.

It is important to note that the data indicates that BlackRock’s Ethereum purchases are five times greater than its Bitcoin purchases. The Arkham X post stated,

The acquisition of over $547 million in ETH surpassed its Bitcoin inflow of $497 million by USD 50 million. Compared to BTC, BlackRock purchases over five times the quantity of ETH, weighted by market cap.

This data further supports the previous report, which identified BlackRock’s preference for ETH over BTC. BlackRock’s focus has changed since the beginning of July, as its ETH inflow has increased compared to pioneering crypto. BlackRock’s ETH holdings were valued at $156 million at the time, while their BTC holdings were valued at $125 million.

The recent filing further reinforces BlackRock’s preference for Ethereum to incorporate staking into its iShares Ethereum ETF. This is a significant development. Nasdaq is purportedly considering the removal of a clause that forbids the staking of ETF assets in favor of including a new clause that permits it.

It is also important to mention that the Ethereum ETF had its most successful week of inflows last week, and these figures are expected to continue increasing due to the hopeful outlook regarding the SEC’s potential approval of staking for the fund.

BlackRock is not the sole institution experiencing FOMO Purchase of Ethereum (ETH)

Intriguingly, their acquisition of Ethereum is consistent with the increasing trend of institutional ETH accumulation. For instance, Bitmine Technologies and SharpLink Gaming, publicly traded companies, are acquiring ETH at an increasing rate.

It is important to note that the institutional interest in ETH has been significantly influenced by the escalating favorable sentiment surrounding the Ethereum token. The asset manager’s acquisition of Ethereum follows the current upward trend, as the token currently trades at approximately $3,600. The token’s value has increased by 6% to $3,624 at publication. The altcoin has experienced substantial gains of 21% and 46% in the past week and month, respectively.

Furthermore, whale activity has been on the rise, as large institutions accumulate ETH. The current trend is evidenced by the growing number of resurfacing dormant whales.