Director of digital assets at Blackrock said that clients see Bitcoin and Ethereum as complementary components of their crypto portfolios rather than substitutes.

Robert Mitchnick, BlackRock’s head of digital assets, stated at the Bitcoin2024 conference in Nashville, Tennessee, on July 25 that there is “very little interest” among clients in crypto beyond Bitcoin (BTC) and Ethereum (ETH).

He anticipates the creation of only a few crypto exchange-traded funds (ETFs) beyond these two core digital assets.

Our client base is primarily interested in Bitcoin, with a slight interest in ETH. At a panel titled From Strategy to Innovation: BlackRock’s Bitcoin Journey, Mitchnick stated, “And there’s very little interest today beyond those two.”

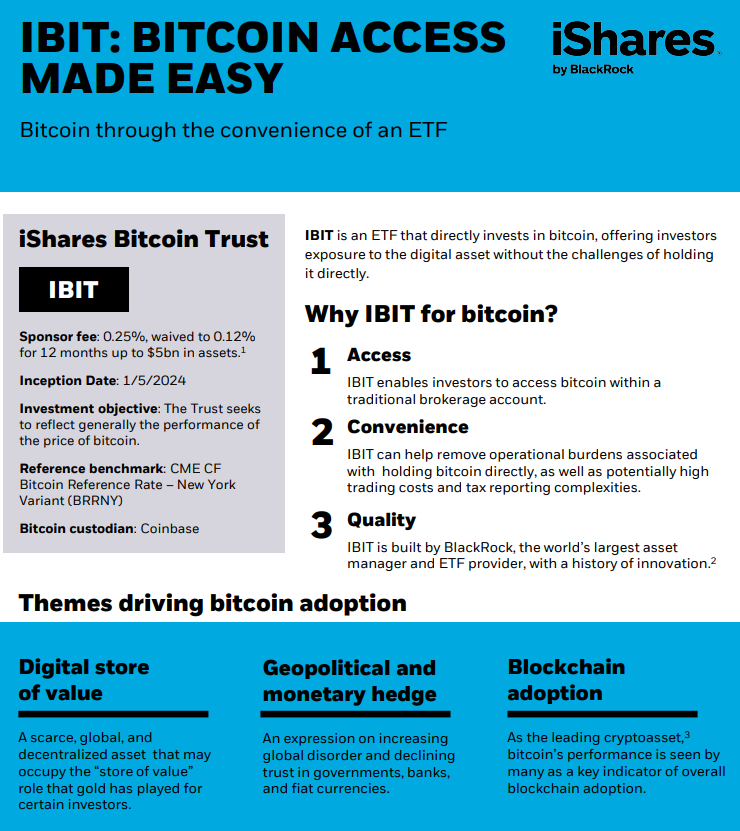

Mitchnick stated, “I do not anticipate that we will encounter an extensive list of crypto ETFs.” Blackrock introduced its inaugural crypto exchange-traded funds in January and July: the iShares Bitcoin Trust (IBIT) and the iShares Ethereum Trust ETF (ETHA).

Not all asset managers concur. Franklin Templeton, also a BTC and ETH ETFs provider, is optimistic about the potential for additional cryptocurrency ETFs, such as a Solana product.

In an X post on July 23, Franklin Templeton stated, “In addition to Bitcoin and Ethereum, there are other significant and exciting developments that we anticipate will propel the crypto space forward.”

Mitchnick stated that most of Blackrock’s clients regard BTC and ETH as complementary assets rather than competitors. Mitchnick further stated that clients supplement their current crypto portfolio allocation with ETH ETFs rather than divesting from BTC.

He advised that the data on investor flows into ETH ETFs, which commenced trading on July 23, is restricted.

Mitchnick stated, “The entire store of value use case within crypto is pretty definitively territory that Bitcoin owns.”

“ETH is attempting to implement a variety of applications that Bitcoin is not currently attempting to do,” he continued. So, in reality, they are more complementary than they are competitors or substitutes.

Mitchnick anticipates that investors will allocate approximately 20% of their crypto holdings to ETH, with the remaining balance going to BTC.

After only a few days of trading, ETHA has approached $270 million in assets under management (AUM), and IBIT has approximately $22 billion in AUM. Blackrock’s crypto ETFs are among the most popular in the industry.