BlackRock’s IBIT ETF surpasses $50B in inflows, holding 54% of Bitcoin ETF market with $72B AUM, driven by strong institutional demand.

BlackRock Bitcoin ETF (IBIT) is again amassing Bitcoins in significant quantities, with $266 million inflows on Monday and the $50 billion inflows milestone achieved since its inception. IBIT is one of the quickest ETFs to reach this milestone, with a 54% market share in the BTC ETF market. This development occurred at a time when Donald Trump’s Truth Social was attempting to access the ETF market.

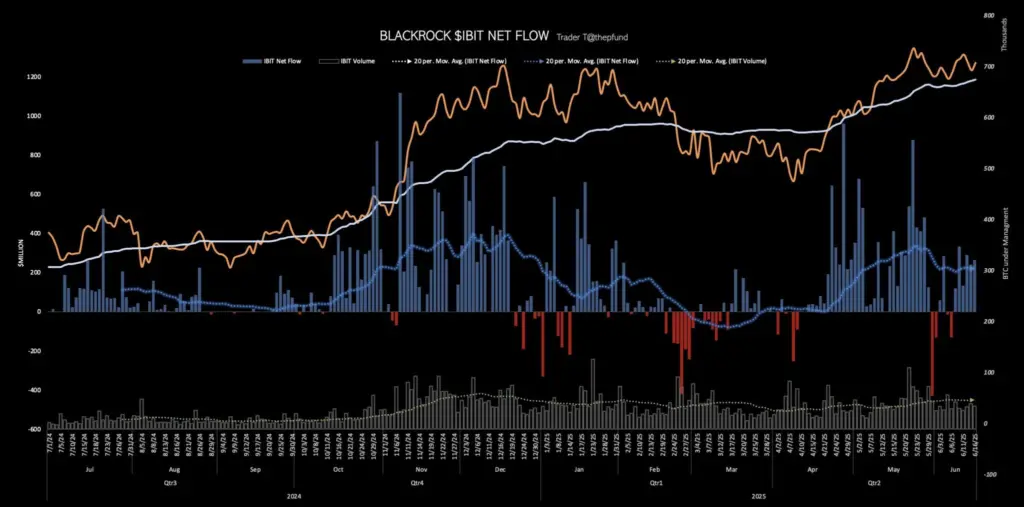

BlackRock’s iShares Bitcoin Trust (IBIT) has been utterly dominant in the Bitcoin ETF space, surpassing $50 billion in inflows for the first time since its inception, as Trump Media’s Truth Social platform endeavors to enter the market. BlackRock’s IBIT, as indicated by the data from Trader T, acquired a total of 2,464 Bitcoins, which are valued at $264 million. Additionally, it recorded a daily trading volume of $2.3 billion during yesterday’s trading sessions.

BlackRock’s iShares Bitcoin Trust manages $72 billion in total assets, accounting for a significant 54% market share of the $131 billion total Bitcoin ETF AUM.

In addition to the BlackRock Bitcoin ETF, Fidelity FBTC, and Ark Invest’s ARK experienced inflows of $83 million and $41 million, respectively. According to Farside Investors data, this brings the total inflows across all issuers to over $408 million. The data also demonstrates that BlackRock has entirely decimated its competition, with Fidelity’s FBTC, its immediate competitor, receiving only $11.6 billion in inflows since its inception.

Spot Bitcoin ETFs have discreetly gained momentum, igniting a new inflow streak. In the last six trading days, these funds have attracted $1.8 billion in new investments, bringing the total inflows for the year to approximately $11 billion.

Consequently, the IBIT share price experienced a 3.5% increase on Monday, surpassing the critical resistance level of $60. IBIT has experienced robust trading activity in recent weeks. The stock has increased by over 40% since its April lows of $44, surpassing $60.

Nevertheless, the IBIT share price may continue to increase if the BlackRock Bitcoin ETF inflows persist. Bitcoin is currently trading at $107,368, representing a 1% increase. The ETFs may experience a surge in institutional inflows if they reach their all-time highs.