The Blockchain Group plans to raise $340 million to expand its Bitcoin treasury, aiming to strengthen its crypto holdings and long-term digital asset strategy.

The Paris-based cryptocurrency startup claims to be the first BTC treasury company in Europe and currently has $154 million worth of Bitcoin.

The Blockchain Group, a cryptocurrency startup in Paris, intends to raise more than $340 million for its Bitcoin treasury, indicating that European institutions still embrace cryptocurrencies.

According to a news release on Monday, The Blockchain Group, which bills itself as Europe’s first Bitcoin Treasury firm with a total value of $105,889, intends to raise $300 million ($342 million) to finance additional BTC purchases.

The “At the Market” (ATM) offers practice in the US and served as the model for the $340 million round’s structure. Subject to a predetermined volume, shares will be sold at market circumstances set by the company’s counterparty.

According to the release, the increase would be implemented in phases, with pricing determined by the “higher of the previous day’s closing price or the volume-weighted average price,” with a cap of 21% of that day’s trading volume.

A week prior, the corporation announced that it had purchased $68 million worth of Bitcoin, increasing its total holdings to 1,471, or more than $154 million.

Other institutional holders are also starting fundraising campaigns to accumulate additional Bitcoin.

Michael Saylor’s Strategy said on Friday that it would quadruple its previously stated $250 million raise by holding a stock offering to raise about $1 billion for its upcoming Bitcoin purchases.

According to Bitcoin records, Strategy is the biggest corporate Bitcoin holder in the world, holding approximately $61 billion in Bitcoin, or 2.76% of the total supply.

“Strategic treasury” moves are driving the momentum of Bitcoin.

After breaking through the $112,000 all-time high on May 22, Bitcoin has entered a period of price consolidation.

According to Nexo dispatch editor Stella Zlatareva, institutional adoption and calculated treasury actions “anchor the bullish long-term narrative” despite the disadvantages.

“Strategic buys, treasury allocations and infrastructure investment paint a picture of long-term confidence — regardless of short-term price action.”

Resilience is demonstrated by Bitcoin’s robust recovery from the $103,000 support, with “no signs of mass deleveraging or forced selling,” Zlatareva continued.

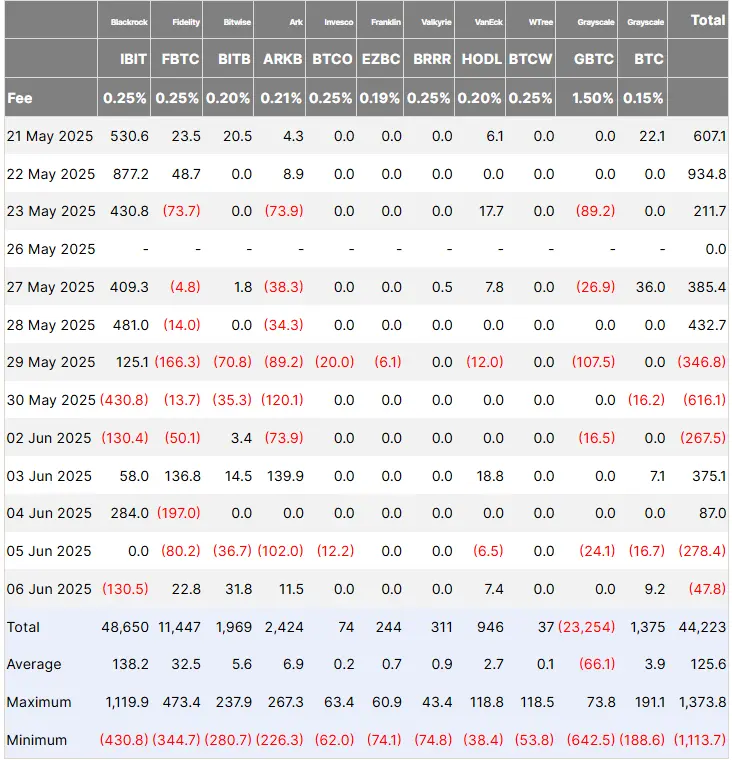

US-listed spot Bitcoin exchange-traded funds have had difficulty sustaining inflows despite the favorable atmosphere surrounding treasury-based accumulation.

According to Farside Investors, the ETFs had more than $47 million in withdrawals on Friday, marking the second straight day of selling following net outflows of $278 million on Thursday.