Cybercrime losses continue to climb each year, and while experts acknowledge that blockchain technology may not completely eliminate the problem, they believe its widespread adoption could significantly help reduce it

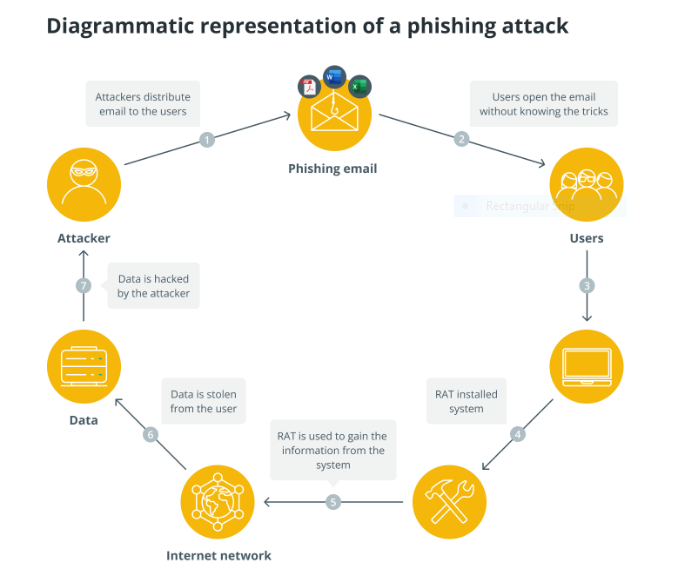

Phishing campaigns, ransomware attacks, identity deception, and data theft are all types of cybercrime.

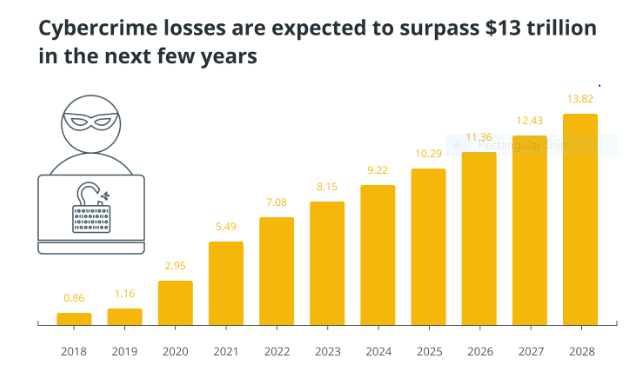

Cybersecurity Ventures, a firm that conducts research on cybersecurity, projects that annual cybercrime losses will increase to $10.5 trillion by 2025.

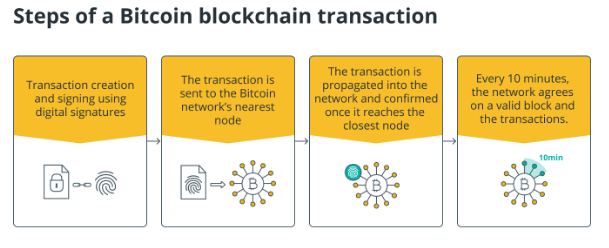

Bitcoin, the inaugural decentralized blockchain, was introduced in January 2009 alongside the digital currency it accompanied.

The technology incorporates security measures, including cryptography, decentralization, and consensus.

Co-founder of blockchain security firm CertiK and co-founder of blockchain tech, Ronghui Gu, said blockchain technology is “at its core, a security technology” and that its use could increase the level of security in “mainstream industries that rely heavily on data integrity,” such as finance and healthcare.

He stated, “By storing patient records on a blockchain, for instance, the risks of data breaches and unauthorized access to sensitive information could be reduced, and patients would have greater control over when and with whom their data is shared.”

Some businesses are already conducting blockchain-based medical record storage and management experiments.

Even a COVID-19 medical certificate was published on the blockchain by one organization.

According to Gu, standard data storage systems may be appealing targets for cyber attackers due to their centralized character.

Furthermore, many existing systems need to incorporate adequate mechanisms that enable users to ascertain the location and manner in which their data is utilized.

Blockchain and Web3 technologies mitigate a number of these concerns through the decentralization of data storage and the elimination of centralized points of failure and unauthorized access.

“By being built on distributed ledger technology, which eliminates single points of failure, it is more resistant to conventional cyberattacks like data tampering and network penetration,” Gu explained.

“Unlike centralized systems, blockchains distribute data across a network of computers, making it incredibly difficult for attackers to gain control of the entire system.”

Blockchain’s security is above average

According to the annual “Hack3d: The Web3 Security Report” for 2023 published by CertiK, 751 Web3 security incidents resulted in losing digital assets worth more than $1.8 billion.

Although blockchain technology is not impervious to cyberattacks, its decentralized nature provides more robust security, according to Gu.

To manipulate a distributed ledger, an assailant would require authority over 50% of all machines; furthermore, “once data is entered, it becomes exceedingly difficult to modify.”

He added, “Strong cryptography is used to secure each transaction, ensuring that only authorized parties with the corresponding keys can act on behalf of an address.”

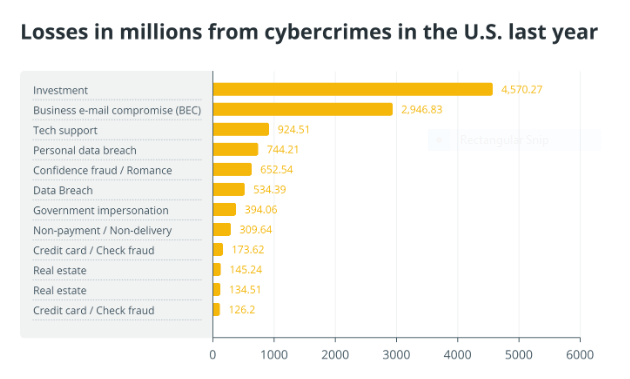

According to the online data aggregator Statista, the United States experienced the most significant losses from investment schemes in the previous year.

The business email compromise came in second, with fraudulent tech support correspondence following suit.

#

Each of these categories of assaults may solicit funds transfer to fraudulent individuals, leading to financial losses and the compromise of sensitive personnel and economic data.

Gu believes that the implementation of smart contracts could aid in reducing the success rate of these prevalent intrusions.

A smart contract is a transaction protocol designed to execute actions by the parameters of the agreement automatically.

“Smart contracts can automate numerous laborious compliance tasks and reduce the risk of fraud in the financial sector by requiring specific conditions to be fulfilled before transaction execution,” Gu explained.

Although blockchain technology is not a panacea for preventing cybercrime, it may still be of assistance.

In light of the dynamic nature of the cybersecurity industry, Gu maintains that the practical goal of entirely eradicating cybercrime is unattainable. As novel technologies emerge, additional attack vectors and vulnerabilities also surface.

A substantial proportion of cybercrime is predicated on human fallibility, including phishing schemes, social engineering attacks, and insecure passwords.

“Although education can mitigate these dangers, expecting each user to be flawless is impractical,” he continued.

Cybercrime also encompasses a socioeconomic dimension. Criminal behavior is likely to persist if monetary or non-monetary incentives are present.

By 2028, these incentives, specifically the funds plundered from victims, are projected to have amassed an astounding sum of more than $13 trillion, according to data from Statista.

Gu argues that rather than striving for the complete eradication of cybercrime, the objective should be to reduce its occurrence and alleviate its consequences using robust infrastructures and knowledgeable users.

He stated, “This strategy safeguards against the inherent dangers of decentralized technologies while preserving their freedom and benefits.”

Gu further stated, “Attaining a state devoid of cybercrime would almost certainly necessitate drastic actions that may encroach upon individual liberties and privacy, contrary to the principles that blockchain technology was designed to safeguard.”

Johann Polecsak, co-founder and chief technology officer of hybrid blockchain platform QANplatform, said while “blockchain is not a silver bullet against all types of cyberattacks,” it could assist in bolstering security in particular industries.

“It can effectively reduce the point of failure to key-management issues, which can be mitigated with hardware-based signing tools,” he said, “if implemented properly.”

Fear has long surrounded quantum computing as a potential tipping point in the cryptocurrency industry.

The possession of a computer with the ability to breach blockchain encryption could lead to the misappropriation of user funds on a significant scale.

Vitalik Buterin argues that a “simple” hard fork could thwart a quantum attack on Ethereum.

Co-founder of the security service network GoPlus and decentralized security data, Eskil Tsu, told Cointelegraph that he believes “blockchain is the only thing that can help” reduce cybercrime.

“The inherent properties of blockchain—decentralization, transparency, and immutability—can reduce the surface area for online attacks and significantly mitigate risks,” he said.

“However, to build a truly future-proof system, it is unquestionably important to choose a blockchain designed to withstand quantum computing attacks.”

Blockchain technology may provide an answer to AI cyberattacks

Fraser Edwards, co-founder and chief executive officer of decentralized data infrastructure provider Cheqd, believes blockchain technology has numerous applications in preventing cyberattacks, particularly phishing and impersonation schemes.

Phishing remains the prevailing email attack method, constituting 43.3% of all email threats, according to a report published in 2024 by secure provider Hornetsecurity.

Edwards stated, “Decentralized identity and credentials, which frequently employ blockchain technology under the hood, will have a tremendous impact on reducing cyberattacks.”

“A huge proportion of cyberattacks are through phishing or social engineering, where people are either impersonated or their security details gained.”

Edwards opined that blockchain technology might even remedy emergent cyber threats and scams, including those employing artificial intelligence.

Aspects of AI-generated content have become an exponential source of concern over the past few years. In the 2024 iteration of its “Global Risks Report,” the World Economic Forum detailed every conceivable negative consequence of AI tech.

Deepfakes have been identified as an especially worrisome phenomenon. Computer-generated audio and images produced by AI video technology are frequently indistinguishable from the originals.

A Hong Kong company was recently duped out of $25 million in a deepfake scheme in which fraudsters posed as senior executives during an online video conference. The police in Hong Kong stated that it was among the very first incidents of this nature that they had encountered.

SumSub data indicates that the prevalence of deepfakes multiplied by ten in all industries worldwide between 2022 and 2023.

Edwards stated that it is currently feasible to produce counterfeit driver’s licenses and passports, which can be utilized to circumvent Know Your Customer (KYC) procedures.

Additionally, he asserted that it is generally straightforward to assume the identity of another individual via their applications or websites once one obtains their login credentials.

Identity verification and Know Your Customer (KYC) tests are required when initiating an online account with a cryptocurrency exchange.

Edwards argued that a decentralized identifier (DID), a globally unique identifier similar to a URL whose address is distinct, resolvable with high availability, and cryptographically verifiable, could be a potential solution to combating these cybercrimes.

“DID and credentials implement two-factor authentication (two-FA) in the sense of automation,” he explained. “Accounts are authenticated not only with passwords but also with the correct signature from the wallet or device that stores the credentials.”

“DID and credentials can also prevent AI from generating document images, which would be easily detectable as fraudulent if not signed by the appropriate issuer.” “Content credentials can similarly prevent the use of generated videos,” Edwards continued.