Bolivia’s crypto transactions soar 530% as locals use Tether’s USDT to hedge inflation and access dollars amid economic crisis.

Cryptocurrency adoption is skyrocketing as Bolivia grapples with soaring inflation and a depreciating Boliviano. Residents increasingly turn to digital assets to protect their wealth and conduct transactions in the face of economic instability.

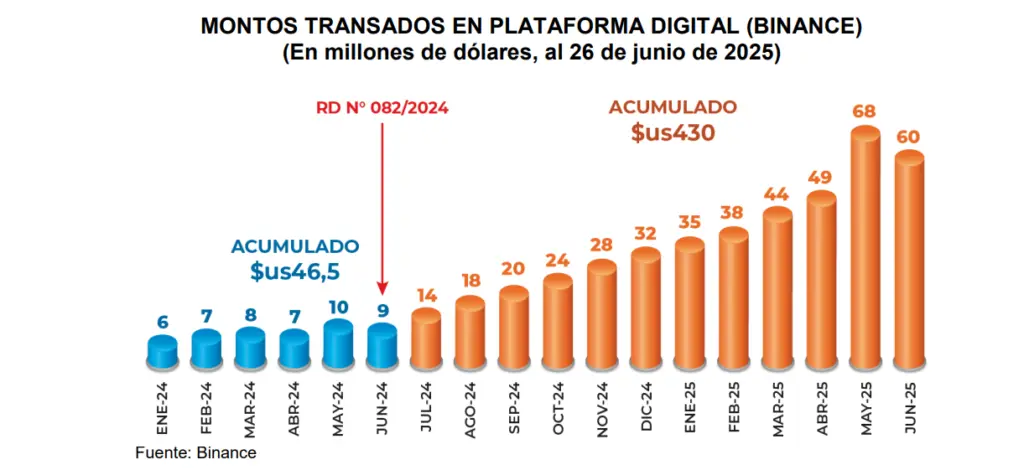

Crypto Transactions Soar by Over 530%

According to a Central Bank of Bolivia report, cryptocurrency transactions surged from $46 million in the first half of 2024 to $294 million in 2025, marking a 530% increase. This dramatic rise follows the government’s decision in June 2024 to lift a ban on Electronic Payment Channels and Instruments for Virtual Assets (VA), enabling regulated use of digital currencies.

The report highlights the growing role of cryptocurrencies in facilitating transactions, particularly for small businesses and families, by providing access to foreign currency for remittances, purchases, and payments. Earlier reports noted significant adoption of Tether’s USDT, with merchants increasingly pricing goods in U.S. dollars rather than Boliviano due to the decline in local currency. A Reuters article reported that Bolivians flock to platforms like Binance and stablecoins like USDT to hedge against Bolivian depreciation.

Crypto as a Lifeline in Bolivia’s Economic Crisis

Beyond serving as an inflation hedge, cryptocurrencies like Bitcoin and USDT are gaining traction for everyday transactions. Reuters reported the emergence of Bitcoin ATMs, such as those linked to the Blink wallet developed in El Salvador, allowing users to exchange cash for crypto. In Cochabamba, some beauty salons offer discounts for Bitcoin payments, while Binance accounts are used for routine purchases like meals.

The country’s economic challenges are driving this shift.

The country faces a severe crisis, with inflation reaching 14.6% as of March 2025 and the Boliviano losing over half its value on the black market since the start of the year. Foreign exchange reserves have plummeted from $15 billion in 2014 to under $2 billion by late 2024, exacerbating fuel and consumer goods shortages. Dollar-pegged stablecoins like USDT offer a stable alternative to the volatile Boliviano, with daily USDT transaction volumes estimated at $600,000. However, this remains a fraction of the $12–$14 million black market and $18–$22 million formal financial sector.

The Bolivian government is developing a regulatory framework for fintech companies, aligning with Latin America’s Financial Action Task Force (FATF) standards. Additionally, state energy firms are exploring cryptocurrency for fuel import payments due to dollar shortages, signaling broader institutional acceptance.

However, former Central Bank head Jose Gabriel Espinoza cautioned that the crypto surge reflects declining household purchasing power rather than economic stability. He noted that while cryptocurrencies are growing, they remain a nascent market. Economists warn of risks, including volatility and regulatory uncertainties, despite crypto’s appeal as a hedge against the nation’s 40-year-high inflation and near-depleted dollar reserves.