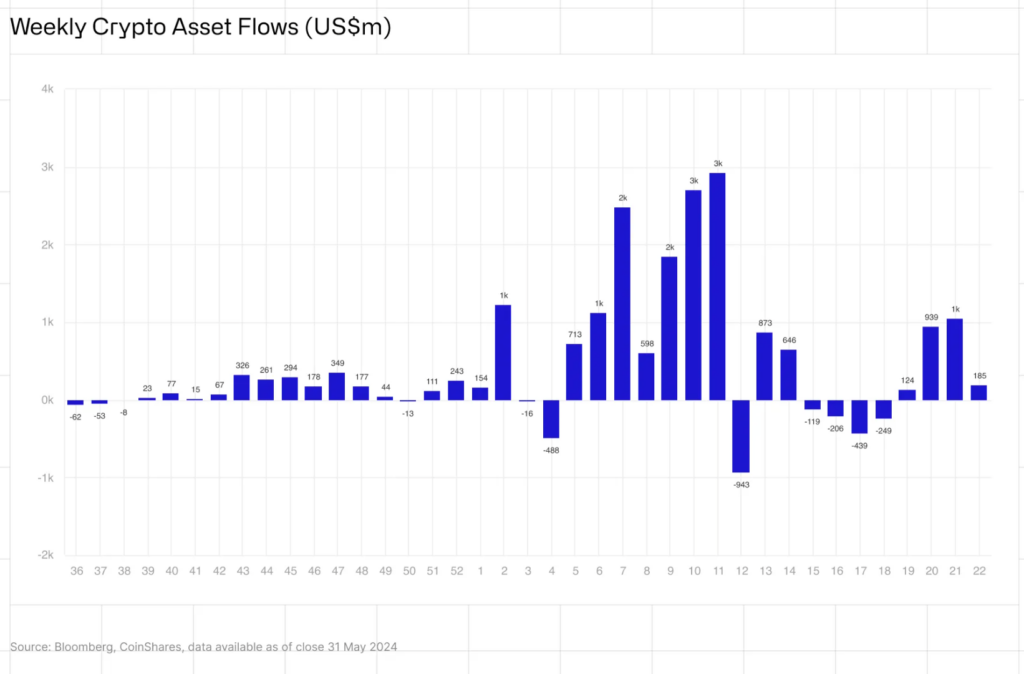

BTC dominates the crypto fund inflows as weekly inflows into crypto funds summed at $185 million for the last week in May with monthly inflows reaching $2 billion.

Digital asset funds witnessed inflows for the fourth consecutive week, according to the most recent “Digital Asset Fund Flows” report from CoinShares, published on June 3.

The report indicates that digital asset funds received $185 million in weekly inflows during the last week of May, for a total of $2 billion in monthly inflows; this brings the year-to-date capital inflow to over $15 billion.

The United States generated the majority of weekly inflows, contributing $130 million to the total inflows for the previous week. However, according to the report, incumbent issuer outflows in the United States amounted to $260 million.

Bitcoin, a decentralized cryptocurrency, accounted for most weekly inflows, totaling $148 million in investment transfers. In addition, short Bitcoin funds experienced weekly outflows of $3.5 million, for a monthly total of $12.5 million. This may indicate that Bitcoin investors continue to hold a favorable sentiment.

The final week of May witnessed $33.5 million in weekly Ether inflows and $21.6 million month-to-date. This signifies a shift in investor sentiment, possibly influenced by the United States’ regulatory approval of Ether exchange-traded funds (ETFs).

In prior weeks, institutional investors experienced a decline in sentiment, as evidenced by the outflow of $200 million from exchange-traded ETH products.

Additionally, inflows to Solana’s SOL funds were favorable; for the week ending May 31, inflows amounted to $5.8 million, bringing the monthly total to $24.8 million.

Nevertheless, multi-asset funds demonstrated unfavorable performance during May. Specifically, monthly outflows from multi-asset funds and products amounted to $12.2 million, with weekly outflows amounting to $2.7 million during the final week of May.

Approval of Ether ETF in the United States

The U.S. Securities and Exchange Commission approved Ether ETFs in the United States on May 23, 2024. However, it is worth noting that Ether exchange-traded products have been accessible in other jurisdictions since that time.

Since then, over $3 billion worth of ETH has been transferred from centralized exchanges, indicating that exchange balances will fall to their lowest levels in years, which could cause supply disruption issues for the digital asset in the coming weeks and months.