Several publicly traded Bitcoin mining companies have acknowledged a slowdown in production due to declining profitability or ‘hash price’

As of May 6 May 6, one of the largest cryptocurrency mining corporations in the United States, Hut 8, disclosed a significant decline in proprietary production for April.

The firm reported a 36% decline in BTC mined in April compared to March. Nevertheless, this was predominantly attributable to transferring more than 25,000 mining devices from Marathon Digital Holdings-acquired facilities in Nebraska and Texas.

Due to a decrease in its deployed hash rate from 5.4 EH/s to 4.5 EH/s, Hut 8 produced 148 BTC in April as opposed to 231 BTC in March.

Asher Genoot, CEO of Hut 8, stated,

“Amid the halving, our team’s operational capabilities enabled us to maximize deployed hash rate while completing the relocation of our fleet from hosted to owned facilities and bringing new capacity online.”

Reductions in Mining Output

Not only Hut 8 but also other significant Bitcoin mining companies disclosed a decrease in production.

Industry publication The Miner Mag reports that additional public mining companies, including Bitfarms, Cipher, CleanSpark, Core Scientific, Riot, and Terawulf, also documented reductions in production ranging from 6% to 12% in April.

April 20 and April 20, the halving event reduced the block reward by half, from 900 BTC to 3.125 BTC, and the daily mining output by half, from 900 BTC to approximately 450 BTC.

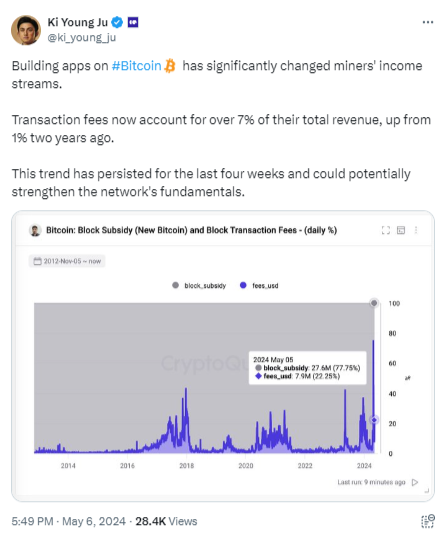

With the introduction of Bitcoin Runes, however, the BTC fee market momentarily nullified the effect of the halving by increasing demand for block space.

However, with the waning prevalence of the most recent meme asset fad, it is anticipated that Bitcoin (BTC) production rates will further decrease and miner selling will increase.

Riot Blockchain released its April production updates on May 6 and May 6. The company’s Bitcoin (BTC) production decreased by 12% in April, from 425 BTC in March to 375 BTC.

Riot anticipates that its total self-mining hash rate capacity will increase over twofold to 31 EH/s by the conclusion of 2024.

A decline in profits

Concurrent with the decrease in output has been a decline in profitability, or “hash price.” The Hash Rate Index calculates the hash price as just $0.05 per terahash per second per day.

Since its peak around the time of the halving, it has decreased by 72% to $0.182/TH/s/day and by an enormous 87.5% since its peak around $0.400/TH/s/day in 2021.