In a post on X, Bybit CEO denies insolvency rumors, clarifying that none of the rumors have any real facts supporting them.

Ben Zhou, the chief executive officer of the cryptocurrency exchange Bybit, responded in a post shared on X to the rumors that the platform had been compromised and declared insolvent.

On May 22, X was rife with allegations regarding an insolvent exchange. As the rumor circulated, it was exacerbated by an onslaught of parodies that replicated a widely shared FTX-related post on X. This time. However, the posts referred to Bybit.

On May 22, X was rife with allegations regarding an insolvent exchange. The dissemination of the rumor was accelerated by a deluge of parodies that replicated a widely circulated FTX-related post on X. However, the posts this time referred to Bybit.

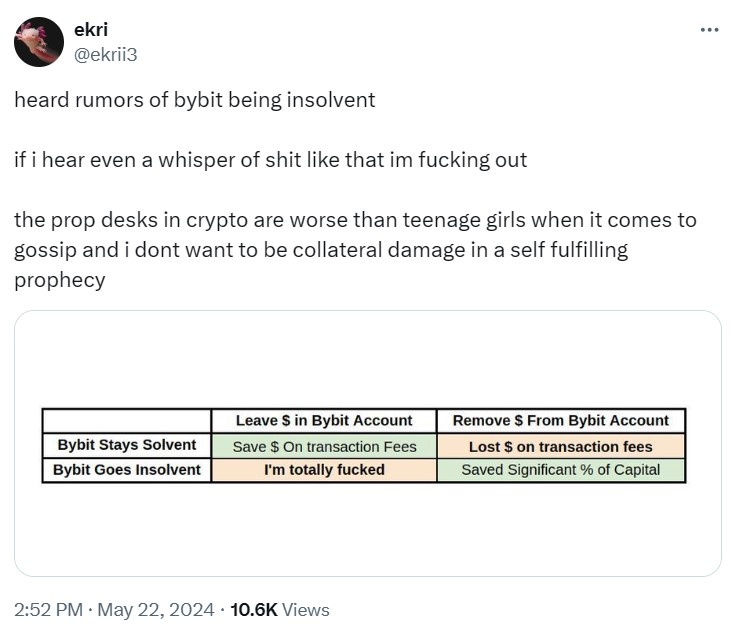

Some individuals attempted to understand the situation better while commenting about withdrawing their funds from the exchange.

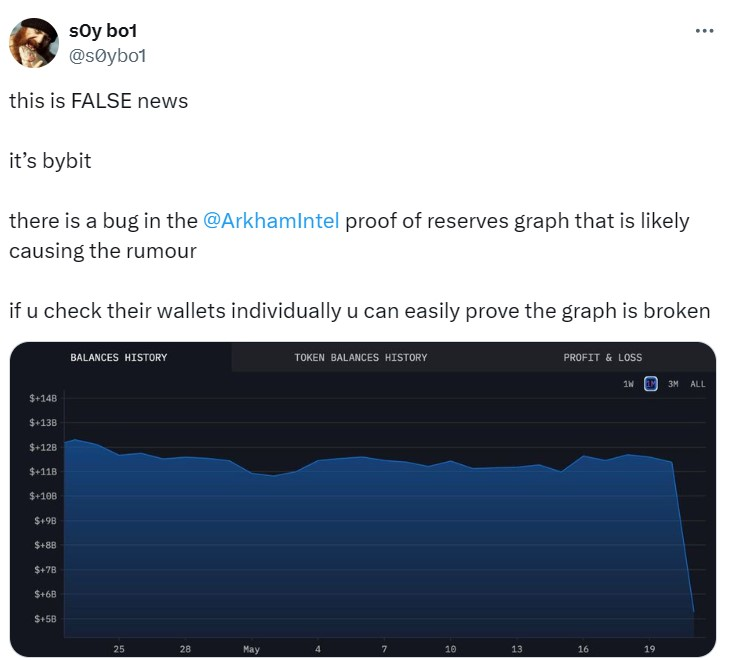

A cryptocurrency user hypothesized that an Arkham Intelligence proof-of-reserves graph error may have caused the disinformation.

The graph showed that Bybit’s wallets were being depleted, which could cause users to question whether the exchange was insolvent or compromised. Nonetheless, upon closer inspection, the trading platform accounts continued to indicate the presence of funds.

Bybit clarified the following day that none of the allegations were accurate. Zhou declared categorically on X on May 23 that the allegations were unfounded. His writing was:

“None of the rumours that I have see so far have any real facts supporting it, please be aware.”

Zhou also provided a link to Bybit’s proof-of-reserves (PoR) and a Nansen dashboard that details the number of assets held by each Bybit wallet.

The PoR indicates that the trading platform maintains a position where it retains an excess of 100% of user assets. This guarantees that the exchange will always have a complete inventory if users desire to extract their assets.

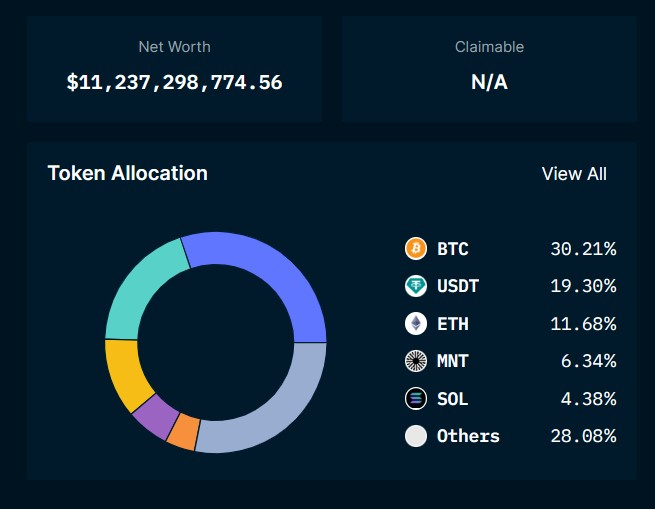

Additionally, the Nansen dashboard data revealed that Bybit’s wallets contain more than $11 billion in cryptocurrency. As per Nansen’s assertion, the net worth reflects the aggregate value of the tokens stored in the Bybit-provided addresses.

Nevertheless, the analytics platform explicitly stated that this information was not intended to be all-encompassing regarding Bybit’s actual assets or reserves.

In addition to rumors of insolvency, Bybit encountered regulatory obstacles earlier this month. The Autorité des Marchés Financiers, France’s securities regulator, reaffirmed a warning to investors on May 16 that the cryptocurrency exchange is not registered as a provider of digital assets in the country.

The regulator asserted that it had the jurisdiction to impede access to the “illicitly providing its services” trading platform within the nation.