Bybit targets Muslim investors looking for investment choices by Islamic finance standards by launching a cryptocurrency account that complies with Shariah.

Bybit, a cryptocurrency exchange, has announced the release of new products tailored to Muslim investors’ demands that comply with Shariah, or Islamic law.

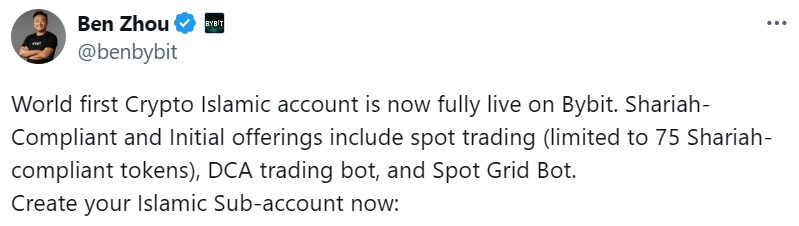

Ben Zhou, co-founder and CEO of Bybit, revealed on X on September 24 that the trading platform had introduced a Crypto Islamic account. This includes having access to a dollar-cost averaging (DCA) bot, a spot grid bot, and spot trading of tokens that comply with Shariah.

Bybit claims that because their Islamic account upholds the tenets of the faith, investors can trade “without compromising” their beliefs. According to the exchange, the products are created in collaboration with Zico Shariah, a Malaysian advising firm specializing in Islamic law.

How digital assets can abide by Islamic law

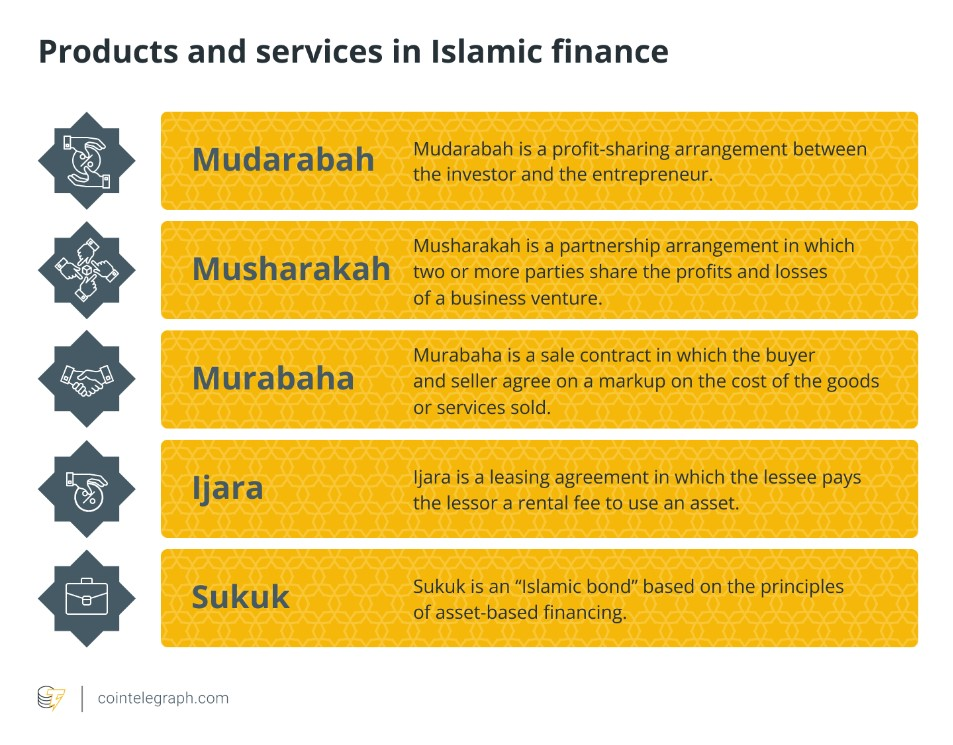

The foundation of the Islamic banking system is “Shariah,” or Islamic law. One of its regulations, which emphasizes fair and moral financial transactions, forbids collecting or charging interest on loans.

Islamic finance is based on profit-and-loss-sharing arrangements between lenders and borrowers rather than interest. Investors and borrowers share investment risks, gains, and losses in this case.

Investments in physical assets such as stocks, bonds, and cryptocurrency are permitted by law. Nevertheless, this cryptocurrency must adhere to the tenets of Islamic finance.

To comply, cryptocurrency assets must be built on a profit-and-loss sharing model. This implies that rather than getting a set rate of return on investment, investors will instead participate in the gains and losses made by the company.

Before Muslim investors may begin purchasing the tokens, a supervisory board must examine and approve them after they are issued. The certification procedure frequently thoroughly examines the tokens’ functionality and appearance.

Bybit obtains a license in Dubai.

At the same time that Bybit launched the new Shariah-compliant product, the country of the United Arab Emirates, where Islam is the state religion, granted Bybit a license.

The exchange obtained a temporary license in Dubai, one of the United Arab Emirates’ emirates, on September 16. Two years after Bybit established its headquarters in the emirate, the Virtual Asset Regulatory Authority (VARA), Dubai’s cryptocurrency regulator, granted Bybit a non-operational license.

Such a provisional license will take effect after the cryptocurrency exchange satisfies specific conditions established by VARA.

According to Helen Liu, chief operating officer of Bybit, Dubai’s location, regulations, and atmosphere present a plethora of chances for cryptocurrency ventures and investors.