A group of JENNER memecoin buyers filed a lawsuit against Caitlyn Jenner, claiming she made false statements about the token.

Memecoin customers have accused former Olympian Caitlyn Jenner of peddling the celebrity token as an unregistered investment in a planned class-action lawsuit.

In a Nov. 13 complaint, U.K. and Romanian citizens Naeem Azad and Mihai Caluseru accused Jenner and her manager Sophia Hutchins of “fraudulently soliciting financially unsophisticated investors throughout the United States and abroad to purchase the unregistered securities.”

They stated that they would not have done so “had it not been for the false and misleading statements and omissions made by Jenner,” claiming to have lost more than $56,000 when purchasing JENNER on Ethereum and Solana.

Jenner “willfully failed” to register the token with the Securities and Exchange Commission, according to the lawsuit, and customers “suffered significant damages” because they were unable to assess the risk of investing without the information that would have been disclosed had JENNER been registered.

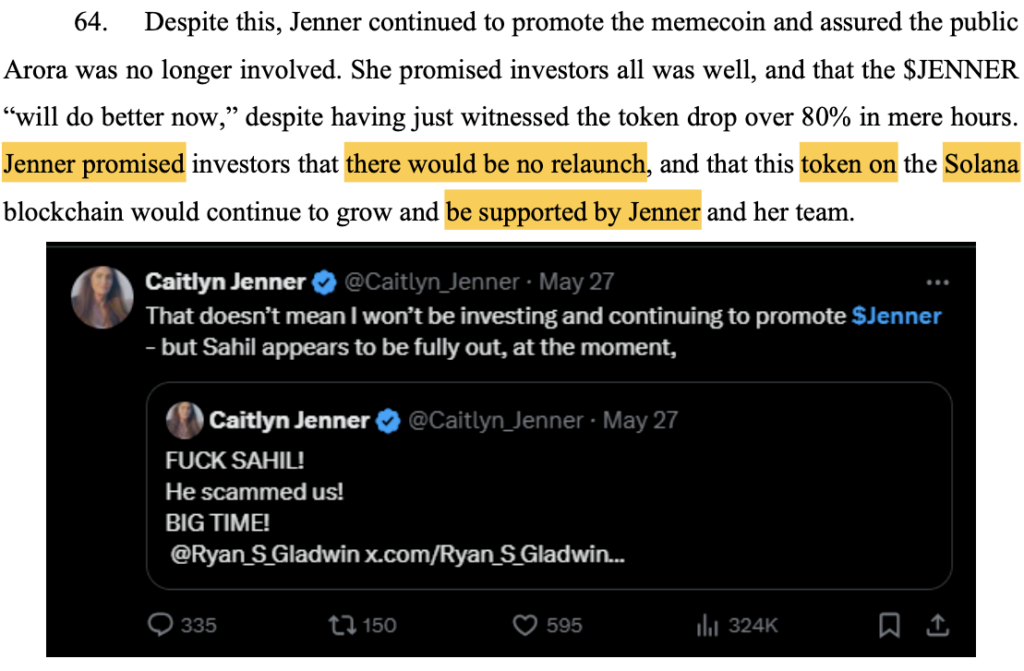

In May, JENNER was initially introduced on Solana via the memecoin creator Pump.fun. She and other well-known individuals stated that partner Sahil Arora “scammed” them, which quickly sparked controversy. The token was later reissued on Ethereum by her.

With its price falling to an all-time low on November 13 and its value collapsing to $170,000 from a height of nearly $7.5 million, the Ethereum token has lost all of its value since its debut. Additionally, CoinGecko reports that its trading volume over the last day was only $1.80.

According to the complaint, Jenner has “left holders on the hook for serious losses, no longer actively promotes the memecoin, and appears to have all but abandoned the project.” “It is doubtful that these losses will ever be recouped.”

Jenner allegedly started “touting price and market capitalization targets” for the Solana coin shortly after its launch, according to the lawsuit.

Following Arora’s sale of a significant amount of his token, which the lawsuit claimed was “the exact risk that Jenner had a duty to warn investors of when she was soliciting their purchases, which she willfully failed to do for her financial benefit,” it crashed.

Arora was not named as a defendant in the lawsuit.

After that, Jenner relaunched the token on Ethereum, which Azad and Caluseru said destroyed the value of the original Solana token but “instituted a 3% ‘tax'” on each transaction. They said she “has never properly disclosed” this information, but it has “enriched Jenner tremendously.”

They claimed that Jenner violated securities laws by promising token buybacks and using token revenues to pay to list the token on exchanges, both of which the lawsuit claims never occurred and caused additional losses.

In addition, the lawsuit claimed that Jenner “willfully omitted information” about her interactions with Arora and the value of her and other insiders’ JENNER holdings, which she allegedly benefited by acquiring “earlier and cheaper than the general public.”

In addition, Azad and Caluseru’s lawsuit accuses Hutchins of aiding and abetting fraud, securities law breaches, and common law fraud against Jenner.

Jenner’s attorneys were not immediately identifiable. A request for comment via Jenner’s website was not immediately answered. Hutchins was unavailable for comment.