Dan Romero posits that in light of the increased fees implemented by Venmo, 1099 laborers may find solace in stablecoins

After learning of the increase in transaction fees for the mobile payment service Venmo, Dan Romero, co-founder of Farcaster, proposed “a stablecoin payments app” for freelancers based in the United States. The new fee structure of the mobile payment service owned by PayPal has elicited opposition from the community.

In his statement, Romero suggested stablecoins as a remedy for “1099s.” This pertains to individuals subject to the Form 1099 issued by the U.S. Internal Revenue Service. This includes freelancers and independent contractors.

In an X post dated May 23, financial analyst Ross Hendricks commented on Venmo’s increased transaction fees, stating, “[PayPal] has just activated Venmo’s monetization switch.”

With three words, one X user replied to Hendricks’ post, initiating the narrative shift to cryptocurrencies:

“Crypto fixes this.”

Shortly thereafter, Hendricks refuted this assertion by raising doubts regarding the present condition of cryptocurrency transfers. The co-founder of the decentralized social network Farcaster inquired:

“What is the consumer app with hundreds of millions of users that enables seamless, instant crypto transfers free of charge?”

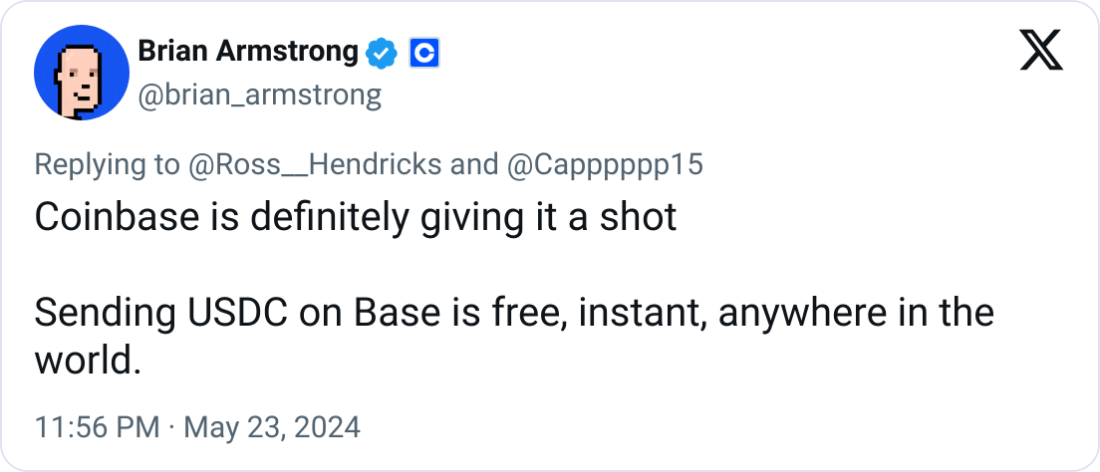

Coinbase’s co-founder and chief executive officer, Brian Armstrong, responded swiftly that the stablecoin Circle USD USDC$1.00 is “trying it out” on Base.

Romero, who was formerly a senior executive at Coinbase, declared Armstrong’s reply to the discussion in a single word:

“Based”

Hendricks posited that “possibly things could change” but conveyed skepticism regarding using Coinbase to transfer USDC “for routine transactions.”

A further X user expressed skepticism in the following manner:

“You just described a great business opportunity. Yeah sending money on Venmo to be robbed by PayPal or sending on Coinbase. Why pay 2.99% when you can pay nothing?”

Following the May 23 announcement by Coinbase Chief Legal Officer Paul Grewal that XRP XRP$0.53 was again trading on Coinbase in New York, the discussion ensued.

Following a lawsuit against Ripple by the United States Securities and Exchange Commission (SEC) in 2020, numerous centralized exchanges, including Coinbase, delisted XRP. Due to the SEC’s allegations that Ripple Labs sold unregistered securities, the company was delisted.

In the wake of the 2023 ruling by Judge Analisa Torres that secondary sales of XRP do not meet the criteria to be classified as securities transactions, centralized exchanges initiated a reversal of position and reinstated the contentious digital asset.