The British Columbia Securities Commission found the ezBtc founder took millions of canadian dollars from client for personal use, leading to investor losses.

Customers of the Canadian cryptocurrency trading website ezBtc were duped by the platform’s founder, David Smillie, who stole almost 13 million Canadian dollars ($9.5 million) from their cryptocurrency investments and used the money for gambling.

A panel appointed by the Canadian province regulator British Columbia Securities Commission (BCSC) concluded that ezBt had embezzled client money “for their own purposes.”

The ezBtc platform claimed to hold all its users’ cryptocurrency money in cold storage until going offline entirely in September 2019 or thereabouts. The platform was shut down in 2022.

Between 2016 and 2019, when it existed, ezBtc collected about 2,300 Bitcoin BTC ($59,136) and over 600 Ether ETH ($2,645) from cryptocurrency investors.

935.46 EzBtc diverted Bitcoin and 159 Ether for gambling and personal usage.

The BCSC panel claimed that Smillie misappropriated over one-third of customer payments for gaming and private use:

“We find that in aggregate, 935.46 Bitcoin and 159 Ether were transferred by ezBtc to Smillie’s exchange accounts and/or to CloudBet and FortuneJack. The transfers to the two gambling websites were sometimes direct from ezBtc, and sometimes indirect from ezBtc to Smillie’s exchange accounts and then to the gambling websites.”

The panel went on to say that because clients were unable to withdraw their assets, the “deceit” carried out by Smillie and ezBtc “led to actual loss.”

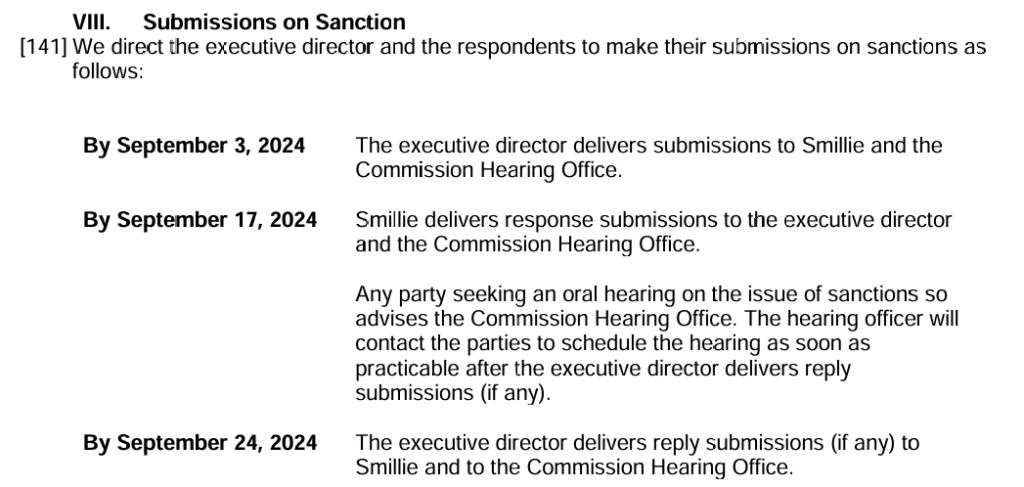

The court petition states that penalties will be applied by September 24 and may include fines or prohibitions on participating in the market.

Legal counsel represented the founder, although neither Smillie nor ezBtc representatives attended the hearing.

Canada’s slow acceptance of cryptocurrencies

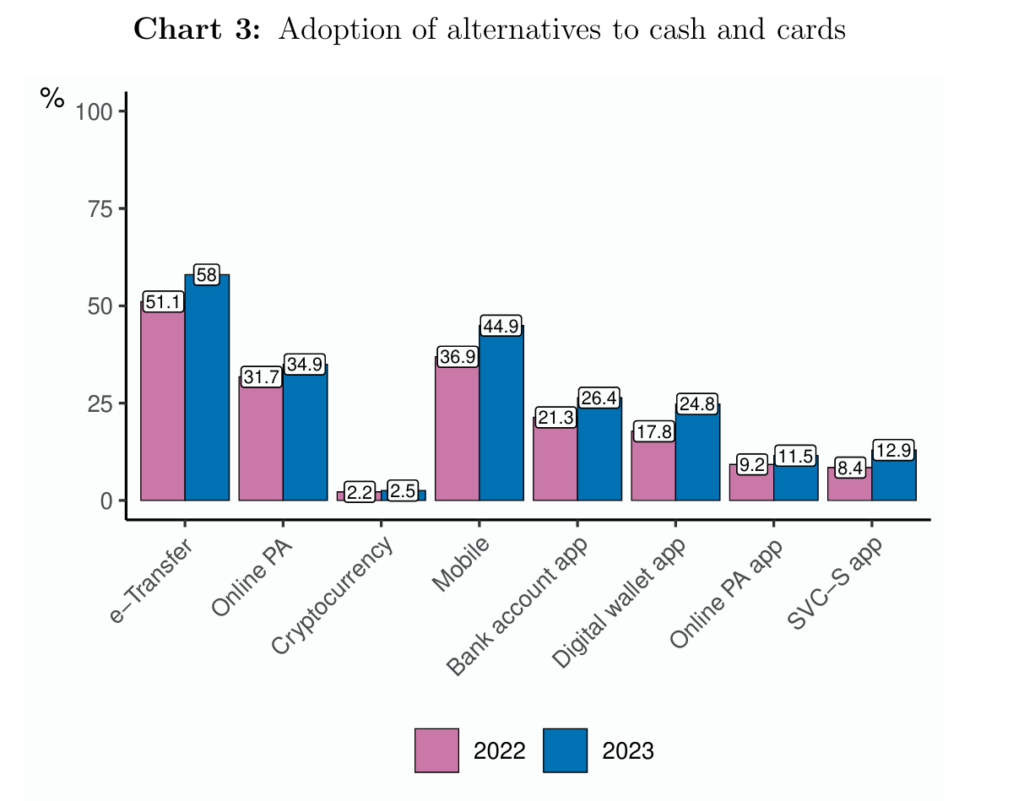

Only 3% of Canadians use Bitcoin or other cryptocurrencies for daily payments, and the country’s adoption of cryptocurrencies has stagnated for more than two years. On the other hand, Canadians have demonstrated a strong preference for using cards and cash.

Most Canadian respondents favored using e-transfer, a way to transfer money using phone numbers or email addresses, over the many other options available to them in place of cash and credit cards.

The reluctance of people in Canada to give up cash is the leading cause of the sluggish acceptance of cryptocurrencies.