Canadian firm Matador Technologies plans to buy 6,000 BTC by 2027, targeting 1% of supply as it accelerates its Bitcoin acquisition strategy.

In a significant acceleration of its Bitcoin purchasing strategy, publicly traded Bitcoin solutions company Matador Technologies intends to purchase up to 6,000 Bitcoin by 2027.

On Wednesday, the Canadian blockchain and Bitcoin technology company declared that purchasing 1,000 Bitcoin BTC is its short-term goal.

$118,304 by 2026 at the latest, and intends to create a Bitcoin treasury plan to amass 6,000 BTC by 2027.

At current market values, the company’s holdings of 77.4 BTC are valued at about $9 million.

Its long-term objective is to rank among the top 20 corporate Bitcoin holders worldwide and hold 1% of the total supply.

He went on to say that the new strategy incorporates “infrastructure and operational components” that align with the Bitcoin ecosystem and treasury management.

Two-Year Bitcoin Treasury Funding

Matador submitted a shelf prospectus for 900 million Canadian dollars ($656 million) on July 14 to offer financing flexibility over 25 months.

At-the-market equity offers, convertible financings, asset divestitures, Bitcoin-backed credit facilities, and strategic alliances or acquisitions are just a few fundraising strategies they intend to employ.

Early in July, the Canadian TSX Venture Exchange granted the company final authority to transition to a hybrid “technology/investment issuer,” paving the way for its Bitcoin treasury strategy.

Flywheel Compounding Strategy

Canadian blockchain and Bitcoin technology company has a four-part “compounding flywheel” approach that Bitcoin supports.

These include building real-world applications to generate revenue in Bitcoin, generating treasury yields through “volatility capture and synthetic mining,” strategically accumulating Bitcoin while optimizing its value per share, and bolstering the ecosystem through collaborations with DeFi projects and crypto infrastructure.

The company’s chief visionary officer, Mark Moss, stated, “Our plans to accumulate Bitcoin are designed to establish long-term stability on our balance sheet while reducing exposure to inflationary risk.”

Google Finance reports that Madador’s shares declined 4.65% on Wednesday, defying the usual upward reaction.

Since the start of the year, the company’s stock has increased by over 37%.

Bitcoin Treasuries Hold 6% Of Supply

This year has seen a surge in Bitcoin treasury firms as investors seek to follow in the footsteps of Michael Saylor’s Strategy, the largest corporate Bitcoin holder in the world with $71 billion in assets.

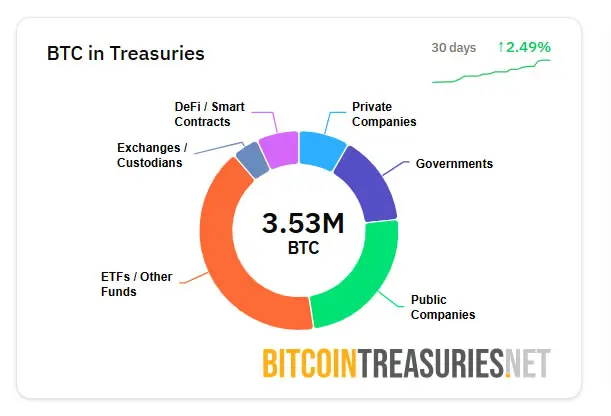

According to BitcoinTreasuries.NET, both public and private entities hold 1.15 million BTC.

With a current value of $136 billion, this cache accounts for over 6% of the whole quantity in circulation.