Canary Capital CEO Steven McClurg predicts XRP ETF will outshine ETH and SOL ETFs, driven by regulatory clarity and rising adoption.

The CEO of Canary Capital has predicted that the XRP ETF has the potential to outperform both the ETH ETF and the SOL ETF products. This follows the rumors that an XRP ETF will be authorized shortly.

Will the XRP ETF outperform the SOL ETF and ETH ETF?

Steven McLurg, the CEO of Canary Capital, contended in a recent interview posted by Paul Barron that an XRP ETF has the potential to outperform its competitors.

“There’s now a clear court precedent that XRP isn’t a security. It can easily move into a 33 Act fund. Out of all pending products, I think the XRP ETF will gain the most traction.”

At a time when crypto investors are closely monitoring the progress of the ETH ETF and SOL ETF proposals, both considered critical next steps following the introduction of Bitcoin ETFs, his comments are particularly noteworthy.

During the interview, Paul Barron also emphasized the cumulative impact of Fedwire’s adoption of ISO 20022. The Fedwire payment network of the Federal Reserve announced the formal adoption of ISO 20022 on July 14. This adoption will facilitate same-day settlement for trillions of daily transactions, including Treasury securities and central bank reserves.

XRP is one of the few assets specifically designed for real-time, cross-border settlement at scale, as noted by industry observers, as a result of Ripple’s infrastructure. The Canary Capital CEO’s perspective is further supported by the fact that neither the ETH ETF nor the SOL ETF filings can demonstrate a comparable real-world payment use case.

What is the anticipated approval date for the XRP ETF by the Securities and Exchange Commission (SEC)?

As previously reported, the XRP ETF was assigned a 95% likelihood of approval in 2025 by Bloomberg analysts James Seyffart and Eric Balchunas. SOL ETF, Litecoin, and Cardano are also included in these forecasts, with similar probabilities of 90–95%.

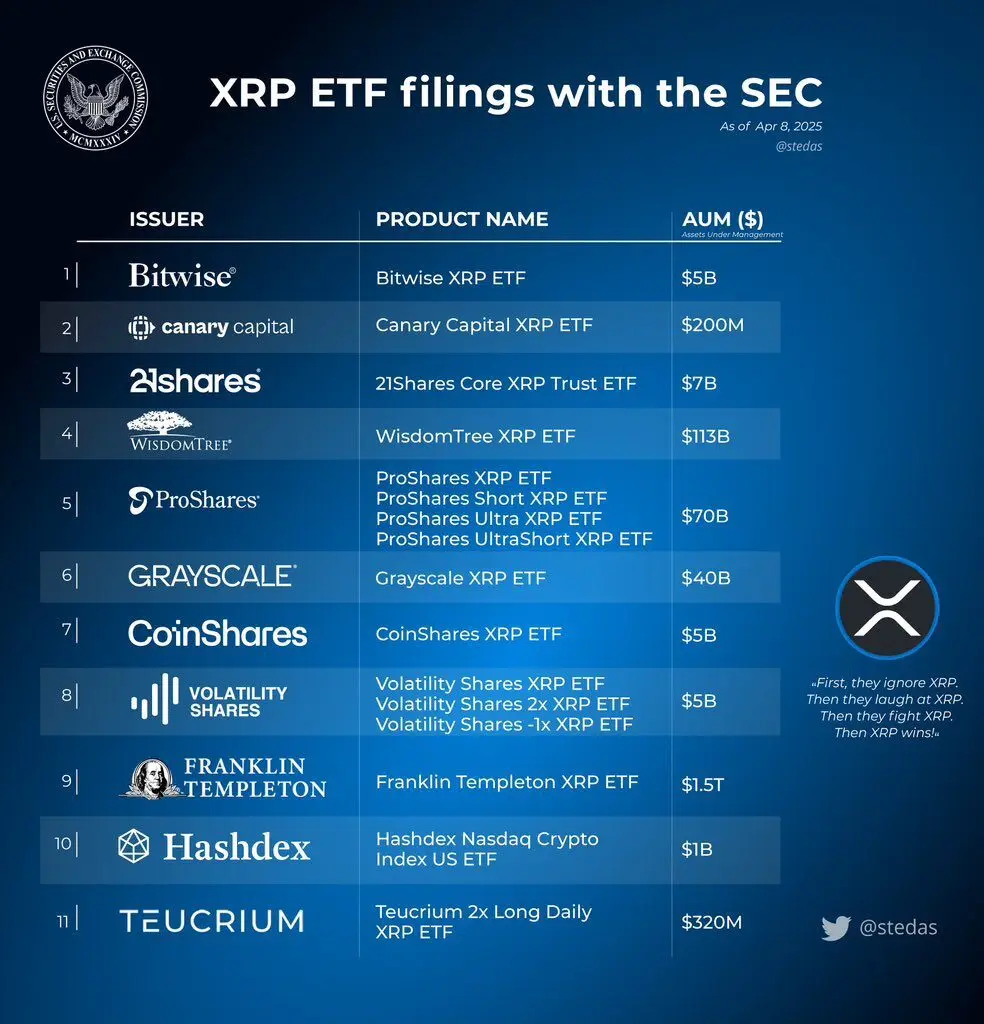

Nevertheless, the XRP ETFs have been subject to delays in approval, which has prompted speculation regarding the potential timing of a decision. The SEC announced in June that it would delay its review of Franklin Templeton’s SOL ETF and XRP ETF filings until the autumn of 2025. The review concentrates on structural issues, market protection, and compliance. This is another addition to the expanding list of XRP ETFs awaiting approval from the SEC.

Despite this, other filings are progressing. ProShares, an asset manager, has amended its XRP ETF under Rule 485(b)(1)(iii) to make July 18, 2025, the effective date. Furthermore, Teucrium’s double-leverage XRP ETF (XXRP) encountered a substantial increase in demand following its launch, with daily trading volume exceeding $120 million, which is exceeding four times its average turnover.

The XRP price has risen above $3 following a robust trading week, contributing to traders’ optimism. This price increase demonstrates their confidence in the potential for an ETF approval and the strong market fundamentals.