The report was released five days after Howard Lutnick, Cantor Fitzgerald’s CEO, was appointed Secretary of Commerce under President-Elect Donald Trump.

In the past year, Cantor Fitzgerald, a financial services firm, reportedly acquired a 5% stake in Tether, a stablecoin issuer. This acquisition could position the company to receive increased political support from the incoming Trump administration.

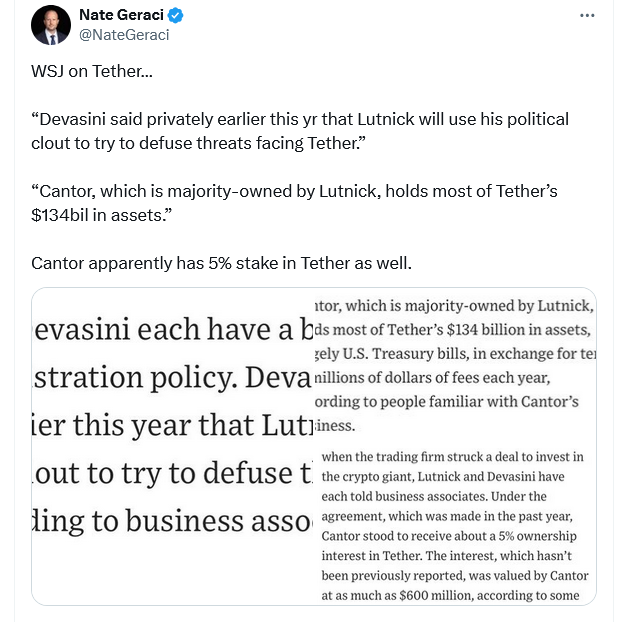

The WSJ reported on November 24, citing information from business associates familiar with the matter, that the 5% stake was reportedly valued at up to $600 million at the time of the agreement.

Howard Lutnick, Cantor Fitzgerald’s CEO, was appointed Secretary of Commerce for the United States President-elect Donald Trump on November 19. This could result in Tether receiving increased political support.

According to the Wall Street Journal, Giancarlo Devasini, who is believed to be the largest shareholder of Tether, allegedly stated, “Lutnick will attempt to mitigate the threats that Tether faces by leveraging his political influence.”

As one of Trump’s transition advisers, Lutnick is already in close collaboration with him. WSJ reported that he has been evaluating candidates for other high-level government positions that may involve overseeing Tether.

Upon receiving confirmation from the Senate, Lutnick declared that he would relinquish his position as CEO of Cantor Fitzgerald.

According to reports, the US Attorney’s Office for the Southern District of New York has been investigating the potential use of Tether by third parties for illicit purposes, including the financing of terrorism.

Even though numerous banks worldwide have prohibited Tether from conducting business, Cantor Fitzgerald has remained one of the stablecoin issuer’s most significant banking partners.

The majority of Tether’s $134 billion reserves are held by the Lutnick-led firm, with most of the funds being invested in US Treasury bills.

Several times, Lutnick has publicly expressed his confidence in the financial stability of Tether and emphasized the significant role that a US dollar-backed stablecoin can play for individuals in high-inflation countries such as Argentina, Turkey, and Venezuela.

In July, he also disclosed the new Bitcoin lending program of Cantor Fitzgerald at the Bitcoin 2024 conference.

“We will provide leverage to Bitcoin owners.” At that time, Lutnick declared, “We will commence operations with $2 billion in lending.”

Fintel data indicates that Cantor Fitzgerald maintains assets valued at approximately $3.5 billion.

Lutnick declared on Wednesday that he will relinquish his role at Cantor.