Cardano climbs to third in Grayscale’s top 10 crypto list with a 6.3% weekly gain, as the SEC nears an ADA ETF decision by August 2025.

Cardano has achieved a substantial position in Grayscale’s most recent crypto rankings, surpassing numerous competitors. This coincides with the increasing likelihood that the U.S. Securities and Exchange Commission (SEC) will issue its decision regarding a proposed ADA exchange-traded fund (ETF) this month.

Cardano Secures the Third Position in Grayscale’s Weekly Performance Rankings

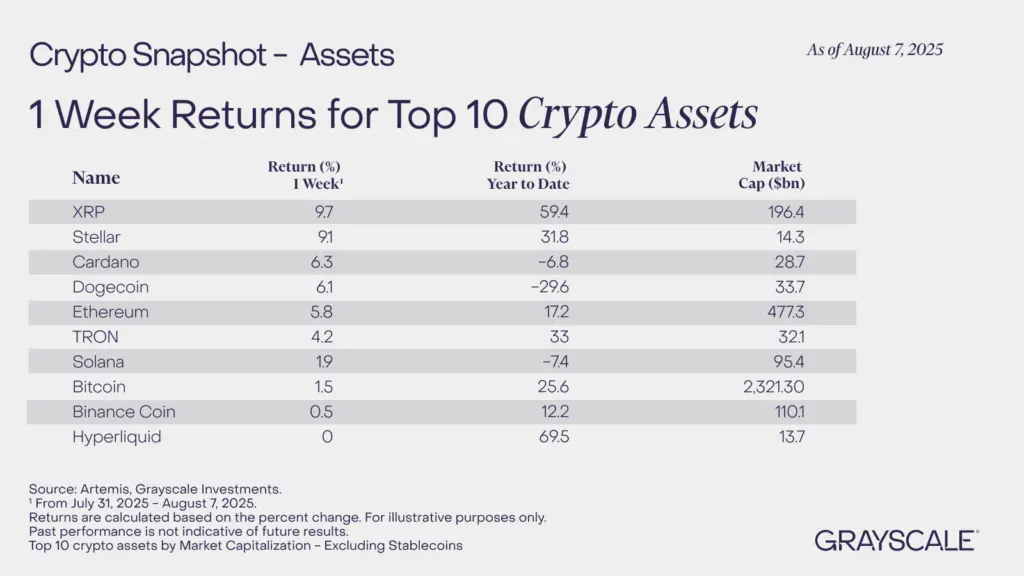

Cardano was ranked third in Grayscale’s most recent “Top 10 Crypto Assets by Weekly Returns” assessment. This occurred after a 6.3% increase between July 31 and August 7, 2025. This represents a significant improvement from the previous week, when ADA was ranked ninth following an 8.1% decline.

Despite the weekly increase, ADA’s market capitalization has increased to $28.7 billion, as its year-to-date gains have slowed to 6.8%. The price of Cardano has decreased by 3.48% in the past day, which is less than the 1.78% decline in the overall cryptocurrency market.

The auspicious launch of Midnight coincided with the momentum. This protocol on the Cardano network is privacy-oriented and has attracted significant community interest.

Stellar was ranked second, with a 9.7% weekly gain, while XRP topped the list in the same classification. Dogecoin, Ethereum, Tron, and Solana occupied the fourth through seventh positions, with gains ranging from 4.2% to 6.1%. Bitcoin’s performance was more subdued, with a weekly increase of only 1.5%, placing it eighth. Hyperliquid and BNB completed the top 10.

The ADA ETF is anticipated to be updated by the end of August

The anticipated approval of the ADA ETF has sparked speculation within the community. Analysts anticipate the U.S. Securities and Exchange Commission (SEC) will respond to Grayscale’s application for the Cardano ADA ETF by the end of August. Optimism regarding approval has been enhanced by recent regulatory clarifications that indicate that specific staking activities are not securities.

Currently, the ADA ETF has a 75% likelihood of obtaining the green light, according to Polymarket data. Nevertheless, the SEC may postpone its ultimate decision until October 23. The application was submitted earlier this year, and reports suggest that the SEC has formally acknowledged its review.

The SEC approved Grayscale’s proposal to convert its Bitcoin, Ethereum, XRP, and ADA large-cap fund into ETFs last month. Ethereum accounts for 11% of the GDLC Fund’s portfolio, with over 80% dominated by Bitcoin. Solana (2.8%), XRP (4.8%), and Cardano (0.8%) comprise the smaller allocations.

These indicators suggest that an ADA ETF may be imminent. ADA may enhance its institutional exposure and market momentum if the SEC grants approval.

In other August news, Charles Hoskinson, the founder of Cardano, is scheduled to disclose an audit report later this month. The evaluation concentrates on managing ADA tokens in 2021 by Input Output Global (IOG).

The audit was conducted three months after Hoskinson was accused of obtaining ADA tokens. He has suggested that a defamation litigation may still be pursued after the report is made public to clarify the situation before significant network and market events, such as approving a Spot ETF.