For two years in a row, Canadians have shown a strong preference for cash and card payments for day-to-day purchases over crypto.

Fewer than 3% of Canadians have employed Bitcoin or other cryptocurrencies for daily transactions for two consecutive years.

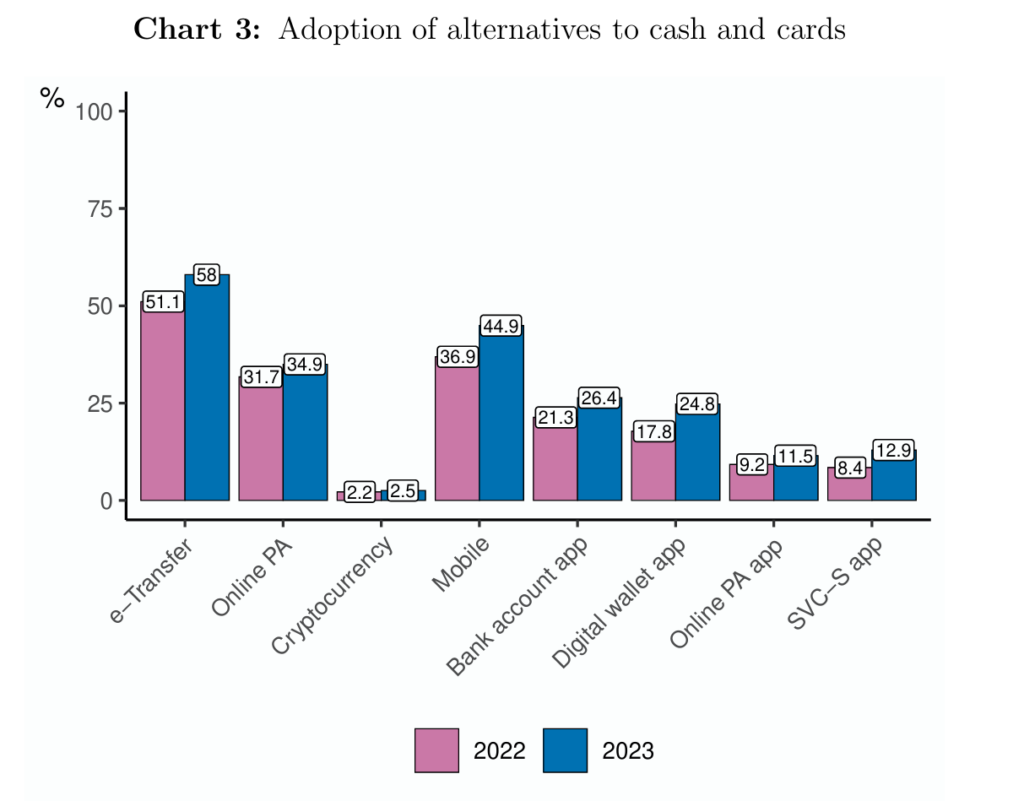

In 2022 and 2023, the nation’s long-standing preference for currency and bank cards for payment purposes was revealed in a yearly survey conducted by the Bank of Canada. Nevertheless, the utilization of these payment alternatives has generally increased over the past decade.

The prevalence of cash and credit cards in Canada

Most Canadian respondents preferred e-transfer, a method of transmitting money using email addresses or phone numbers, over the numerous other alternatives to cash and cards.

On the other hand, cryptocurrency continues to be the least preferred method of payment in Canada. As illustrated in the graph above, only 2.2% of respondents utilized cryptocurrencies for payment in 2022, which increased to 2.5% in 2023.

Reluctance to adopt a cashless future

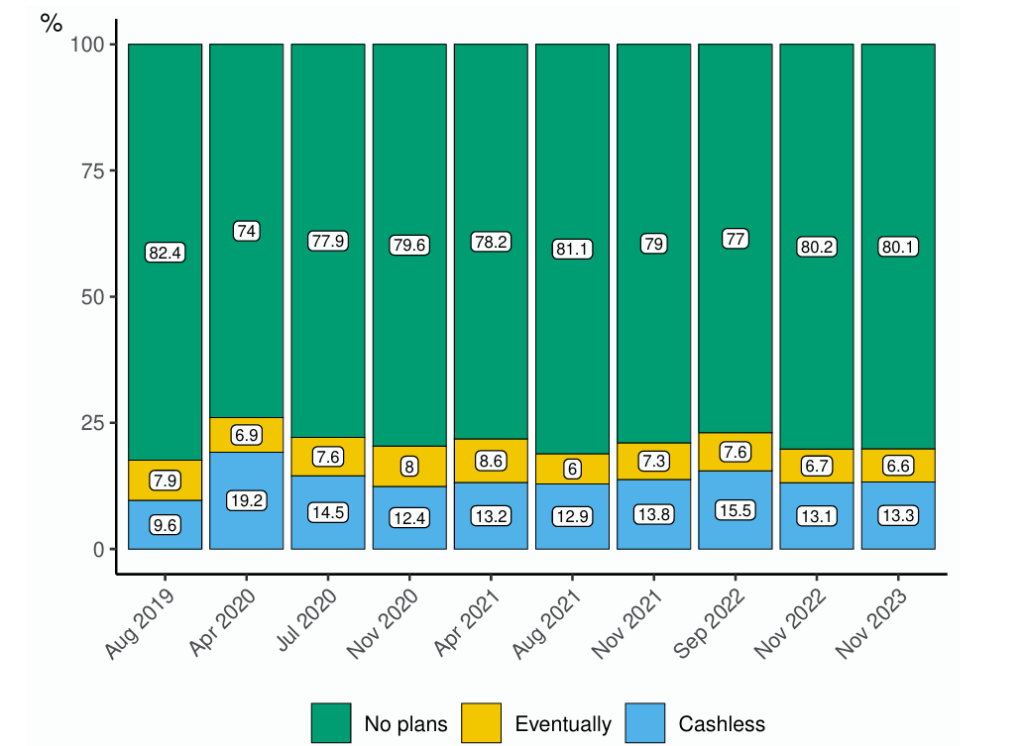

The pervasive reluctance to transition to a cashless economy is the primary factor contributing to Canada’s slow cryptocurrency adoption. A consistent trend since 2019, more than 80% of respondents stated that they have no “plans to stop using cash in the future.”

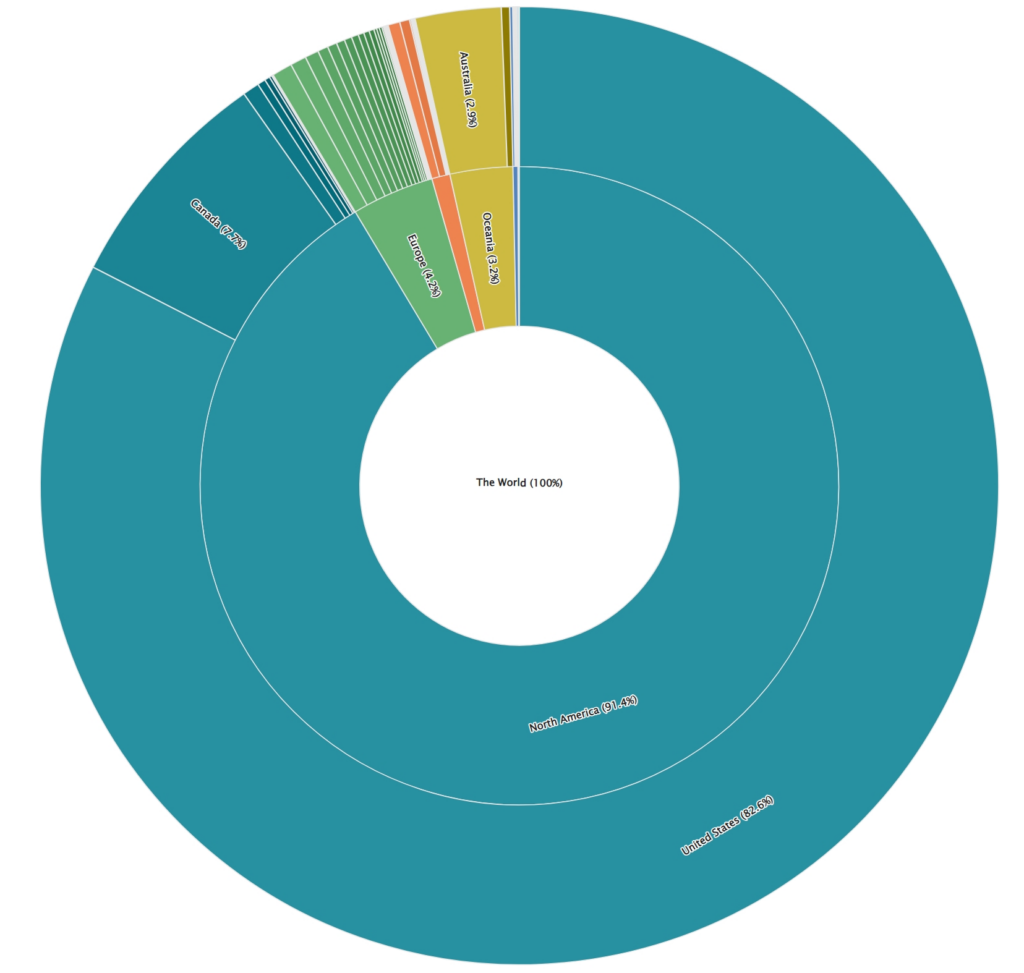

The Bitcoin ATM ecosystem in Canada continues to flourish despite the stagnation of crypto adoption. The nation is home to the world’s second-largest network of crypto ATMs, following the United States.

As illustrated below, Canada has 2,941 active Bitcoin ATMs, which account for 7.7% of the total.

Conversely, the Bank of Canada persists in its pursuit of financial innovation. In conjunction with the Bank of International Settlements (BIS), the central bank has recently established the BIS Toronto Innovation Centre, an innovation center.

Canada’s financial innovation

The announcement emphasized that the new center will operate in the Caribbean, Latin America, and Canada. Tiff Macklem, the Governor of the Bank of Canada, highlighted the significance of the partnership in promoting innovation in the region.

“As the financial sector continues to evolve, we need to innovate in different areas and apply skills that aren’t traditionally associated with central banking. By doing so, Canadians can share in the benefits of innovation.”

The center will concentrate on three of the six priority themes of the BIS: central bank digital currencies (CBDCs), next-generation financial market infrastructures, and open finance.