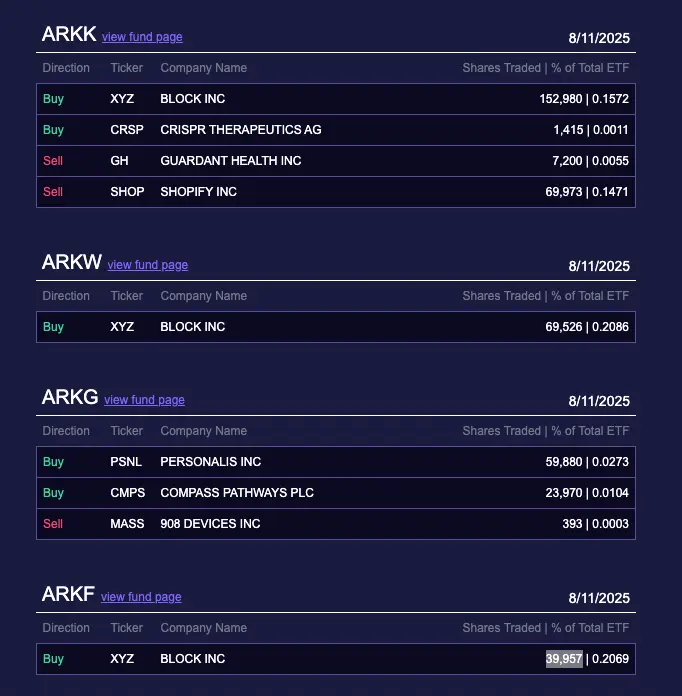

Cathie Wood’s Ark Invest snaps up 262,463 Block Inc. shares for $23.7M, fueling Jack Dorsey’s Bitcoin adoption push via Cash App and Bitkey.

Cathie Wood, renowned for her investments in crypto firms, recently acquired 262,463 shares of Block Inc. (NYSE: XYZ), which is owned by Jack Dorsey, across three of her Ark Invest funds on August 11. Dorsey has advocated for implementing Bitcoin through the company’s subsidiaries, including Square and Cash App. This development is consistent with his efforts. Wood’s most recent acquisition occurs amid a 15% decline in the XYZ share price from its weekly peak of $85.

According to the most recent data from Ark Invest, Cathie Wood acquired 262,463 shares of Jack Dorsey’s payments company. This acquisition was executed across three funds: the Ark Fintech Innovation ETF (ARKF), the ARK Next Generation Internet ETF (ARKW), and the Ark Fintech Innovation ETF (ARKF). Block Inc. disclosed robust Q2 earnings last week, which included an increase in Bitcoin holdings. This acquisition is the most recent.

Ark Invest’s official data indicates that the asset manager has a net investment value of $169 million in Block Inc. (NYSE: XYZ), which accounts for 1.62% of its total investments. The XYZ share price increased to $85 last week following the company’s announcement of a $1.5 billion profit in the second quarter, representing a 16% year-over-year increase. On the other hand, the XYZ stock entered the S&P 500 index last month, which could result in a substantial liquidity increase.

Cathie Wood has resumed her investment in cryptocurrency companies, providing compelling value opportunities. This is the most recent investment in a cryptocurrency company, following Wood’s acquisition of COIN equities in August.

Jack Dorsey to Increase Bitcoin Adoption

Block Inc., the payments firm founded by Jack Dorsey, is preparing to introduce a comprehensive Bitcoin banking suite designed to increase the adoption of Bitcoin treasury among small businesses. The integration of BTC is being driven by the company’s subsidiaries, including Cash App, Square, and Bitkey. Square enables merchants in the United States to accept Bitcoin payments. Cash App, which utilizes the Lightning Network, generated $10 billion in Bitcoin revenue in 2024. Bitkey offers self-custody hardware for everyday consumers.

In the second quarter of this year, the company increased its treasury by 108 BTC, bringing its total holdings to 8,692 BTC. These BTC were acquired at an average price of $30,405.