Cathie Wood’s ARK Invest sold its first batch of Circle shares for $52 million, marking a significant move ahead of the stablecoin firm’s potential IPO.

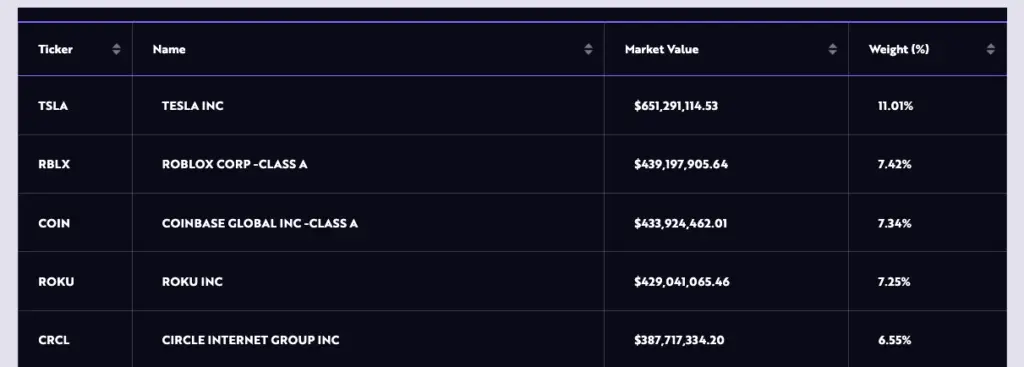

Circle is among the top company holdings, weighing up to 6.7% across three funds.

Eleven days after going public, ARK Invest, the cryptocurrency-friendly asset manager started by well-known Bitcoin bull Cathie Wood, is already reaping the benefits of its exposure to stablecoin issuer Circle.

A trade notification shows that the company sold 342,658 Circle (CRCL) shares from its three funds on Monday for $51.7 million.

Since Circle began trading publicly on the New York Stock Exchange (NYSE) on June 5, this sale represents the first disposal of the company’s CRCL shares.

On the first day of trading, the company purchased about 4.49 million Circle common stock shares worth $373.4 million at the closing price.

Circle is among the top assets.

Circle is still among the company’s top holdings across all three funds—ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF)—even after the transaction.

With assets under management (AuM) of $5.6 billion, ARKK is the largest fund. At $387.7 million, or about 6.6% of its total assets, it has the largest CRCL holding.

With $124 million worth of CRLC shares, or 6.7% of its total assets, ARKW is second only to Coinbase, which has a 6.8% weight. With 72 million CRCL shares, or 6.7% of its total assets, ARKF is the smallest fund out of the three in AUM.

Before Circle’s NYSE debut, the company was among the first investors to express interest in purchasing up to $150 million worth of Circle stock. Following many IPO upsizings in response to overwhelming investor demand, the company expanded the volume of purchases it made.

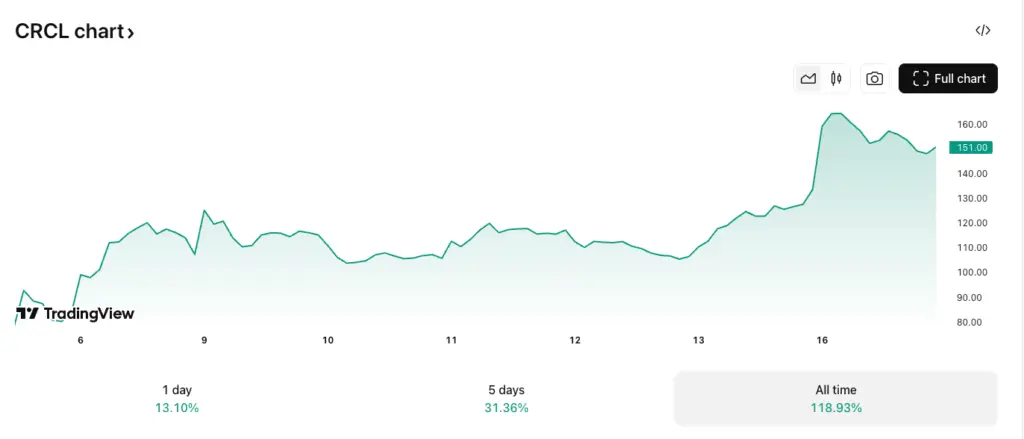

According to TradingView, Circle shares have sharply increased, breaking through $164 on June 16 after making their NYSE debut on June 5 at $69 per share. The stock closed yesterday at $151, up over 118% since inception.

The success of Circle’s IPO demonstrated that stablecoins had witnessed a change in the public’s image of the cryptocurrency business, according to research associates at the company on June 9.

According to the experts’ use of Hernando de Soto’s theory, stablecoins are carrying on the property rights revolution that Bitcoin started.

“Bitcoin made financial property rights possible with smartphones. Stablecoins are advancing the cause with a less volatile asset and more utility across blockchains and financial platforms.”

Cathie Wood is regarded as a significant Bitcoin BTC $106,392 bull. She predicted in February 2025 that, due to growing institutional use and demand for Bitcoin as an asset class, it may reach $1.5 million by 2030.