Two Celsius creditors have submitted a motion to request a second distribution, alleging that they have experienced diminished payments due to their ownership of corporate accounts

A motion has been filed by a married couple who owned Celsius corporate accounts to receive a second disbursement from the bankruptcy. The couple and other creditors allegedly received a 35% reduction in payment compared to non-corporate accounts.

It is reported that a hearing will be conducted on June 27 to address the motion submitted on June 3.

The motion was initiated in response to the numerous complaints from corporate creditors who have complained that the Celsius debtors have delayed payments to corporate accounts and have paid currency instead of crypto, resulting in losses for these creditors.

The “Faller Creditors,” which are four companies, BFaller RD, BFaller ROTH RD, SFaller TRD RD, and SFaller RD, together, are seeking an order sanctioning further distribution under the Celsius bankruptcy plan, according to the filing. According to business records in California, the four entities are Individual Retirement Accounts (IRAs) owned by Sheri Anne Faller and Bernard Jacob Faller.

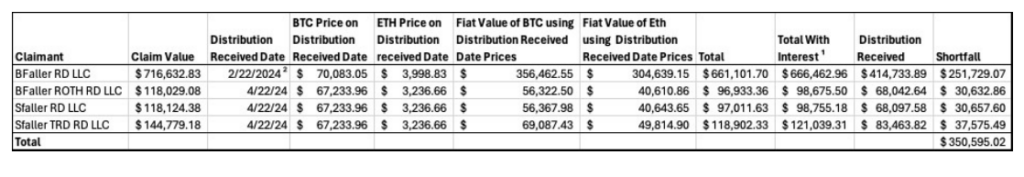

The document stated that these four IRAs had over $1 million in cryptocurrency in their Celsius accounts before the platform’s bankruptcy petition date. Under the negotiated bankruptcy plan, the claim was reduced to $634,337.93 in Bitcoin and Ether, which will be distributed on January 16. The two individuals were owed approximately 7.38 BTC and 123 ETH.

Nevertheless, the Celsius creditors purportedly neglected to fulfill the payment obligations by the January 16 deadline. On January 19, a Celsius representative informed the two individuals that their accounts did not meet the criteria for the first 100 corporate Celsius accounts in terms of the value of their assets.

As a result, they would not be eligible to receive cryptocurrency payments. Alternatively, the cryptocurrency would require conversion to cash and distribution through the banking system.

The couple initially consented to receiving the cash value of their cryptocurrency on January 19. Nevertheless, they assert that debtors have yet to pay them. The two creditors requested payment in cryptocurrency on February 13, citing the delay as the reason.

The debtors reportedly informed them once more that they were not included in the top 100 list of corporate creditors and, therefore, could not be paid in cryptocurrency.

A wire transfer of $414,733 was ultimately received by the two creditors on February 22. Nevertheless, they assert they were prohibited from withdrawing these funds until March 8. On April 22, they received an additional payment of approximately $219,602, totaling $634,335.

The couple asserts that the cash value of these remittances is significantly less than the value of the BTC and ETH they were owed, as determined by the prices that were in effect at the time of receipt.

According to their calculations, they were entitled to receive $973,955, the equivalent value of the BTC and ETH they were assured. Consequently, they are requesting an additional $338,611 in addition to interest payments of $11,984 for the delay in distributing their cryptocurrency beyond the required date, for a total of $350,596.

Unlike the most prominent corporate accounts or individuals, the Faller creditors are not the sole businesses that have expressed dissatisfaction with Celsius’s treatment of them. In March, the director of a corporate creditor contacted Cointelegraph to assert that he had received 30% less than he had agreed to under the plan.

Celsius Estate responded to the assertion above and similar ones by announcing that it had already sold users’ cryptocurrency on January 16. Consequently, it determined that it could not compensate creditors with cryptocurrency it no longer possessed. Furthermore, the estate contended that it was obligated to dispose of the cryptocurrency by the bankruptcy plan on that date.

Additionally, it asserted that corporate accounts’ compliance and onboarding processes are “significantly more demanding,” making it impossible for most corporate creditors to acquire accounts.

These assertions are refuted by the most recent filing. It is asserted that the estate did not make commensurate efforts to provide corporate creditors with accounts: “[T]he Debtors did not make commercially reasonable efforts to make distributions as provided in Article 4, subsection K of the Plan, because they only sought to use Coinbase and PayPal as the cryptocurrency distribution agents when others were available.”

The document alleges that Kraken and Bitgo, cryptocurrency exchanges, could have been employed instead of Coinbase and PayPal to facilitate “widespread distribution to a large group of creditors.” It refers to the selection of Coinbase and PayPal as an “arbitrary choice.”

The document also critiques the three-month delay between converting the crypto in these accounts to fiat and the corresponding disbursements.

“The Plan specifies that the Plan Administrator would conduct the conversion “as close to the anticipated date of distribution as reasonably practical under the circumstances” when distributing fiat currency in place of cryptocurrency. It also asserts that three months is “not a reasonable period” to elapse following the conversion.

The Celsius estate previously rejected these arguments, asserting that it had made reasonable efforts to secure corporate accounts for creditors and promptly pay them cash if they could not receive cryptocurrency.

An omnibus hearing is scheduled for June 27 at 10 am EDT (2 pm UTC), and the motion will be considered at this hearing, according to Wesley Chang, another Celsius corporate creditor who claims to have suffered losses due to payment delays.

In June 2022, Celsius, a crypto financing platform established in 2017, ceased processing withdrawals. Consequently, the platform could not release an estimated $2.8 billion in cryptocurrency for users. Alex Mashinsky, the platform’s founder and former CEO, was indicted on seven counts of fraud for his alleged involvement in the platform’s collapse. September is the date of his prosecution.

Celsius settled over $2 billion in creditor claims after its bankruptcy filing in July 2022. According to a court filing from the platform’s estate on February 15, most creditors have received cryptocurrency payments “without any security or operational issues.”