Chainlink jumps 27% in a day as news of an EU tokenized asset service integration sparks a surge in value and a sharp rise in user activity.

On December 3, Chainlink’s LINK$24.24 price beat the cryptocurrency market, registering a 27% daily gain after partnering with an EU-based company to introduce a tokenized asset settlement method.

LINK’s price has increased by 125% in the last 30 days and 50% in the previous week.

According to TradingView and Cointelegraph Markets Pro data, LINK painted a “god candle” on December 3, going from a low of $18.58 to a 2-year high of $26.92, a 45% increase.

Alongside the price increase for LINK, trading activity has also changed. On December 3, LINK’s spot trading volumes exceeded $8.6 billion, a 271% increase from the previous day. With a market valuation of $15.52 billion, it is firmly established as the fifteenth largest cryptocurrency globally.

The first EU-regulated market for tokenized securities in Europe

The community’s excitement at Chainlink’s strategic partnership with 21X, a platform specializing in tokenized money and securities, to launch Europe’s first EU-regulated tokenized securities market is reflected in the price surge of LINK.

To assist 21X in settling assets from other chains, Chainlink will provide its cross-chain interoperability protocol (CCIP). Stablecoin tokenized assets that will be onboarded from other chains and made available to clients are considered by 21X.

21X can conduct asset transfers between several blockchains and include real-time market data with this technology.

Max Heinzle, the founder and CEO of 21X, stated, “We are excited to collaborate with Chainlink as we get ready to introduce Europe’s first tokenized securities market infrastructure.”

“By leveraging Chainlink’s technology, we will offer a secure and efficient platform for trading and settlement on a public permissionless blockchain.”

Activity on the Chainlink network surges

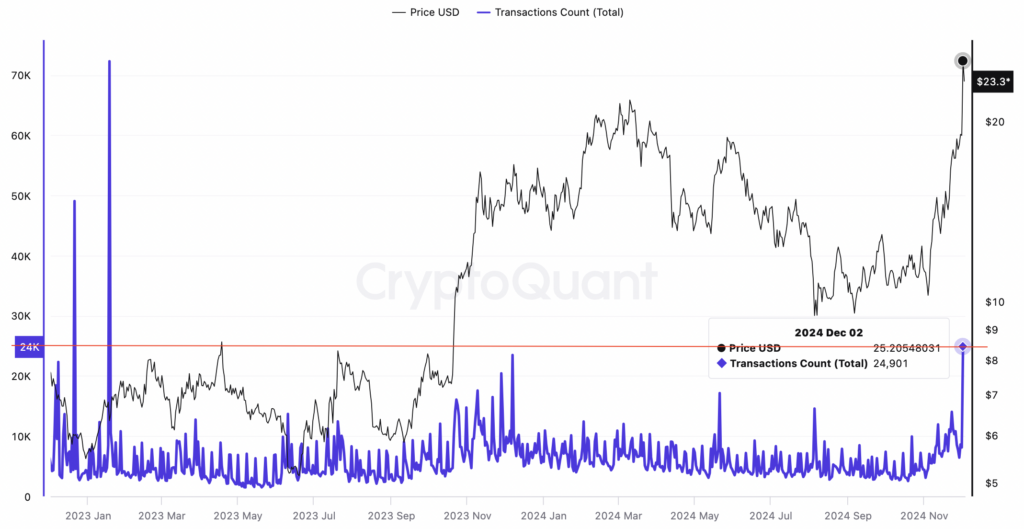

According to information from market research company CryptoQuant, Chainlink’s network activity is rising with the price.

There was a 286% increase in daily transactions from 6,437 on November 29 to a 2-year high of 24,901 on November 2.

Additionally, the number of active addresses has increased by 179% throughout the same period. This suggests that the Chainlink ecosystem is becoming more widely used, which raises the demand for LINK.

A Chainlink trader targets a price of $50.

At 79, the relative strength index is in the overbought area and slopes downward, indicating that the rising momentum is ending.

On the daily chart, a “golden cross” could support the rally’s continuation.

When a shorter-term moving average, generally the 50-day MA, crosses above a longer-term moving average, usually the 200-day MA, a bullish technical pattern known as a “golden cross” is created.

The price of LINK made a clear advance over the neckline of a U-shaped recovery pattern at $19 on November 30, the day this bullish signal was formed.

A substantial advance that closes over $25 will act as a springboard for the present pattern’s bullish target, which is $30, or 21% higher than the current price.

However, other industry analysts are even more optimistic about 2025. For instance, the price is now on track to reach regions beyond $50 after breaking above the barrier at $22, according to trader Satoshi Flipper, who goes by a pseudonym.

“It’s $LINK SEASON, now we do $22 –> $52”