Circle launches euro-backed EURC on Base, enabling layer-2 forex trades, and it is the first MiCA-compliant stablecoin for the network.

In a July 9 announcement, Circle, the stablecoin issuer, announced the launch of its euro-backed stablecoin, EURC, on the Base network. This move expands the network on which the coin can be natively issued and traded.

Previously, EURC was exclusively accessible in its native form on Avalanche, Ethereum, Solana, and Stellar. EURC is now accessible on an Ethereum layer-2 for the first time with the inclusion of Base. In the past, layer-2s were limited to utilizing a derivative form of EURC supported by versions present on other networks.

Circle asserted in its announcement that the new version will simplify the process of facilitating global trade for e-commerce applications.

“The first stablecoins on Base from a global issuer to be compliant with the new Markets in Crypto Assets (MiCA) regulation are the Base versions of EURC and the U.S.-dollar-backed USDC,” the announcement stated.

Bitstamp had previously declared that it would be delisting EURC’s competitor, Tether Euro (EURT) because it was purportedly noncompliant with the Markets in Crypto-Assets (MiCA) framework.

Base users who desire to exchange euros for dollars or vice versa may find the announcement a source of comfort. According to 2023 research, forex trades executed on a blockchain can reduce costs by up to 80%.

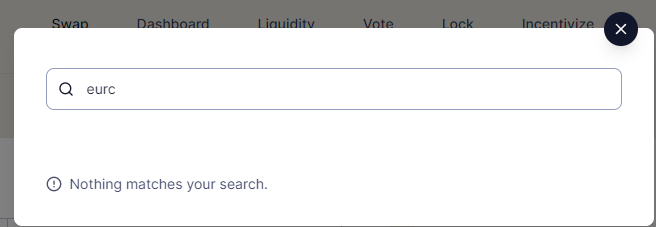

Nevertheless, Base users may need to wait a bit longer before conducting these trades on their favored decentralized exchanges, as some exchanges still need to include the new coin. At the time of publication, no results were obtained from a search for “EURC” in the Base versions of Aerodrome, Uniswap, and BaseSwap.

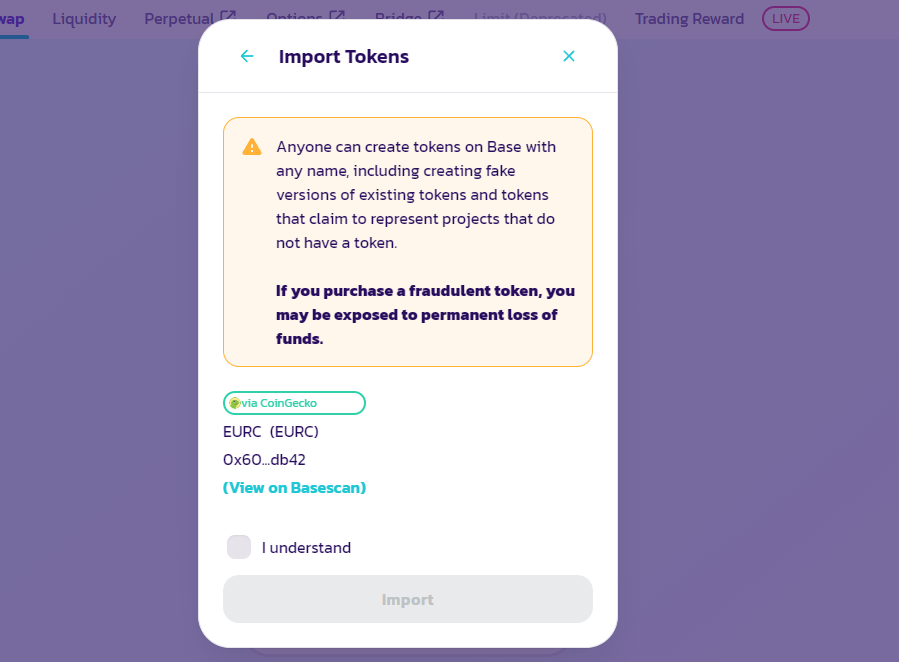

The “import” feature of PancakeSwap permits token trading; however, the user is issued a strongly worded warning before doing so.

As per the announcement, the exact token address for EURC on the Base mainnet is 0x60a3e35cc302bfa44cb288bc5a4f316fdb1adb42.