OKX introduces free conversions between Circle’s USDC stablecoin and the US dollar as part of a new collaboration with Circle.

Circle, the stablecoin issuer, has teamed up with OKX, a prominent cryptocurrency exchange, to increase liquidity for USDC stablecoin conversions to the US dollar.

In a joint statement on Wednesday, OKX and Circle announced that they are launching zero-fee USDC ($0.9998) conversions with USD as part of a new relationship.

Circle’s chief business officer, Kash Razzaghi, said that “the most important update is that users can now convert USD to USDC and back within the OKX platform, offering a seamless and transparent on- and off-ramping experience.”

Jason Lau, chief innovation officer at OKX, claims that the enhanced USDC liquidity expands on OKX’s extensive bank relationships and compliance strategy, which enable users to exchange USD and stablecoins “for the first time, without any friction or fees.”

Interaction between USD and stablecoins

Ashley Lannquist, a former digital finance specialist at the International Monetary Fund, claims that despite the growing popularity of stablecoins, there are still many obstacles, like network transaction costs and bank-to-exchange intermediation.

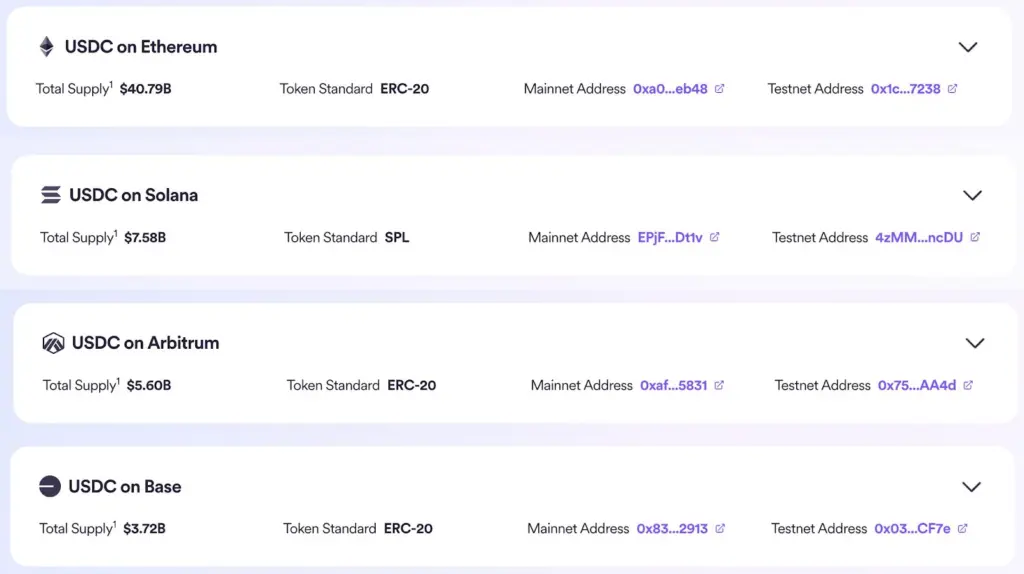

The 12 networks that OKX offers are Ethereum, X Layer, Aptos, Arbitrum One, Avalanche C-Chain, Base, Optimism, Polygon, Polygon (USDC.e), Solana, Sui, and OKT Chain, out of the 23 networks that USDC supports in total.

The agreement between Circle and OKX intends to eliminate some infrastructure difficulties without influencing network prices.

“There was always some friction when switching between stablecoins and USD before this partnership with Circle,” Lau stated.

He raised concerns about product design, trading fees, and order book depth. “Like any other asset swap, users would see a swap between USD and stablecoins,” he said. “With this partnership with Circle, we’ve integrated with banking partners to streamline fiat on- and off-ramps and enabled 1:1 USD-to-USDC conversions so that both retail and institutional users can better benefit,” Lau stated.

OKX’s banking alliances

OKX has been collaborating with several partners across banking and payment networks to provide its 60 million global users with deeper USDC liquidity.

Lau stated, “OKX’s main on-ramp solutions currently revolve around global payment solutions like Apple Pay and PayPal and important partners like Standard Chartered Bank, DBS, and Bank Frick.”

Lau stated that “any user with access to USD and USDC” on their OKX account could access the enhanced USDC liquidity.

Razzaghi of Circle stated that the new conversion features, which include trading, sending, and keeping USDC, will be accessible across various OKX products and services.

OKX supports deep liquidity for Tether USDt.

While increasing USDC liquidity, OKX does not ignore scaling competing stablecoins, such as Tether USD. The biggest stablecoin by market capitalization is USDT at $1.00.

A representative for OKX said that “OKX has long supported deep liquidity and access for stablecoins, especially USDT, which remains the most used and traded stablecoin on the platform, as evidenced by over $330 million in daily volume for pairs like ETH/USDT.”

According to the spokesman, OKX is still collaborating with several stablecoin issuers to enhance liquidity outside of USDT.