Circle, the issuer of USDC stablecoin, files for IPO to list CRCL stock on NYSE, aiming for a $5B valuation amid growing stablecoin adoption.

Circle, the issuer of USDC stablecoins, has applied the Initial Public Offering (IPO) to list “CRCL” stock on the New York Stock Exchange (NYSE). This announcement coincides with the organization’s decision to dispel speculation regarding potential acquisitions by Ripple or Coinbase. The announcement coincides with the GENIUS Act, also known as the stablecoin measure, being only one step away from becoming law.

Circle Files for IPO and NYSE Listing

Circle Internet, the company responsible for the USDC stablecoin, has disclosed its intention to conduct a US initial public offering (IPO) to achieve a valuation of up to $5.65 billion. The company intends to sell approximately 9.6 million shares, while existing shareholders plan to dispose of an additional 14.4 million shares.

Upon receipt of all regulatory approvals, the company’s stock will be listed on the New York Stock Exchange (NYSE) under the ticker “CRCL.” The offering is anticipated to raise to $624 million, with each CRCL stock priced between $24 and $26, as stated in the official press release. Goldman Sachs, Citigroup, JPMorgan, and other prominent finance institutions will be bookrunners for this initial public offering.

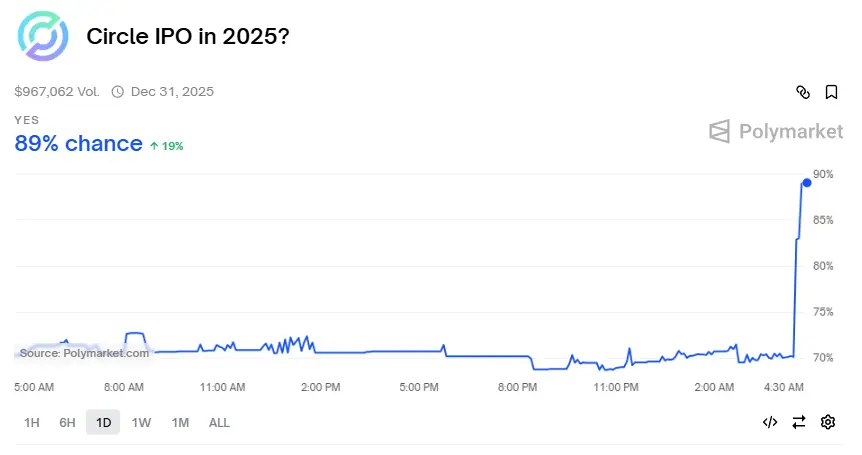

The Circle IPO announcement is imminent following the company’s denial of previous speculations regarding a potential Ripple acquisition. Additionally, the transaction was unsuccessful because Ripple’s proposal was either extremely low or insufficient for the stablecoin company. Polymarket, a decentralized prediction market, has increased the likelihood of approval from 70% to 90% in the past 24 hours.

Competition in the stablecoin market is expected to intensify

In recent weeks, US legislators have been diligently working to pass the GENIUS Act, also known as the stablecoin bill, to establish official legislation for digital assets pegged to the US dollar. Coinbase and Ripple, among other prominent cryptocurrency companies, are actively seeking to increase their market share. Citigroup’s most recent survey indicated that the stablecoin market could expand to $1.6 trillion by 2030.

Circle is presently the second largest player in this sector, following Tether, with USDC. Nevertheless, Ripple, a well-established player, has recently introduced their RLUSD stablecoin, which has already amassed a market capitalization of over $300 million. In contrast, Arthur Hayes reports that major Wall Street institutions are investigating the possibility of a joint stablecoin collaboration, which could pose a risk to existing players.