To establish itself as the “Everything Exchange,” Coinbase has acquired Deribit, a crypto options platform, in a stock and cash transaction.

Exchange of cryptocurrency Deribit, a crypto options platform, has been incorporated into Coinbase due to the acquisition agreement reached between the two parties in May. This occurs in the organization’s endeavor to establish itself as the “Everything Exchange.”

Coinbase acquires Deribit for $2.9 billion

The crypto exchange announced in a blog post that it had completed its acquisition of Deribit. This move, the exchange claimed, would render it the “most comprehensive global crypto derivatives platform.”

Coinbase observed that the transaction occurred when Deribit experienced a record-breaking month in July, with trading volumes surpassing $185 billion. Additionally, the company controls nearly $60 billion of the platform’s open interest.

As previously reported, Deribit was to be acquired by the foremost exchange for $2.9 billion in a stock and cash transaction. The exchange provided $700 million in cash and 11 million shares of Class A stock as part of the agreement.

Coinbase acknowledged that this acquisition takes it closer to providing a comprehensive range of trading products on a single platform, such as options, futures, perpetuals, and spot. The organization further stated that this action will facilitate their expansion on a global scale, resulting in increased liquidity and broader participation.

Goal to become the premier exchange for all things

Brian Armstrong, CEO of Coinbase, expressed his enthusiasm for the agreement, asserting that the Deribit team’s expertise will be instrumental in their endeavor to establish themselves as the Everything Exchange. Additionally, he stated that this would allow them to provide industry-leading derivative products on a global scale.

The crypto exchange’s ambition to become the “Everything Exchange” was reported. The organization disclosed its intention to provide prediction markets and tokenized equities in the United States to accomplish this.

Coinbase has recently implemented DEX trading for U.S. users, allowing them to trade base tokens effortlessly. Additionally, there are plans to include support for Solana tokens. Based on the fact that Base and Solana have the highest number of daily token launches, this is anticipated to increase the exchange’s trading volume substantially.

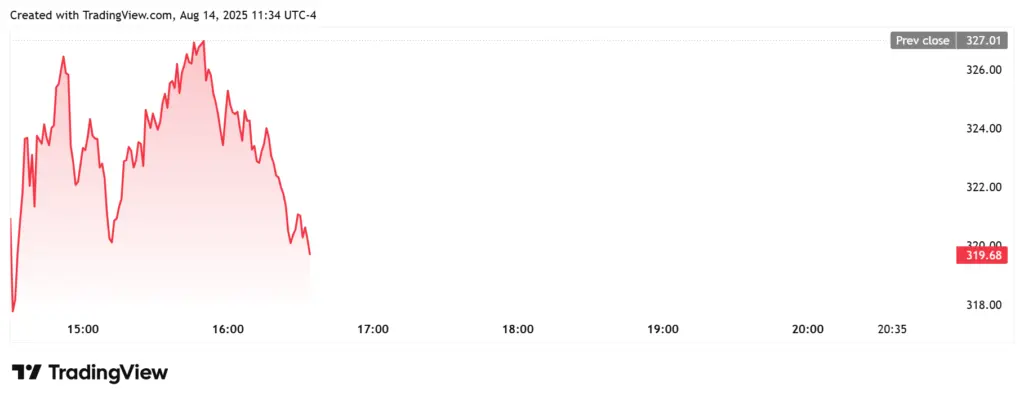

The Deribit announcement has resulted in a decline in the COIN stock. The stock price is currently trading at approximately $320, a decrease of more than 2% in the current trading session, according to TradingView data. Since the stock reached a new all-time high (ATH) of $436, it has been in a downward trend since July.