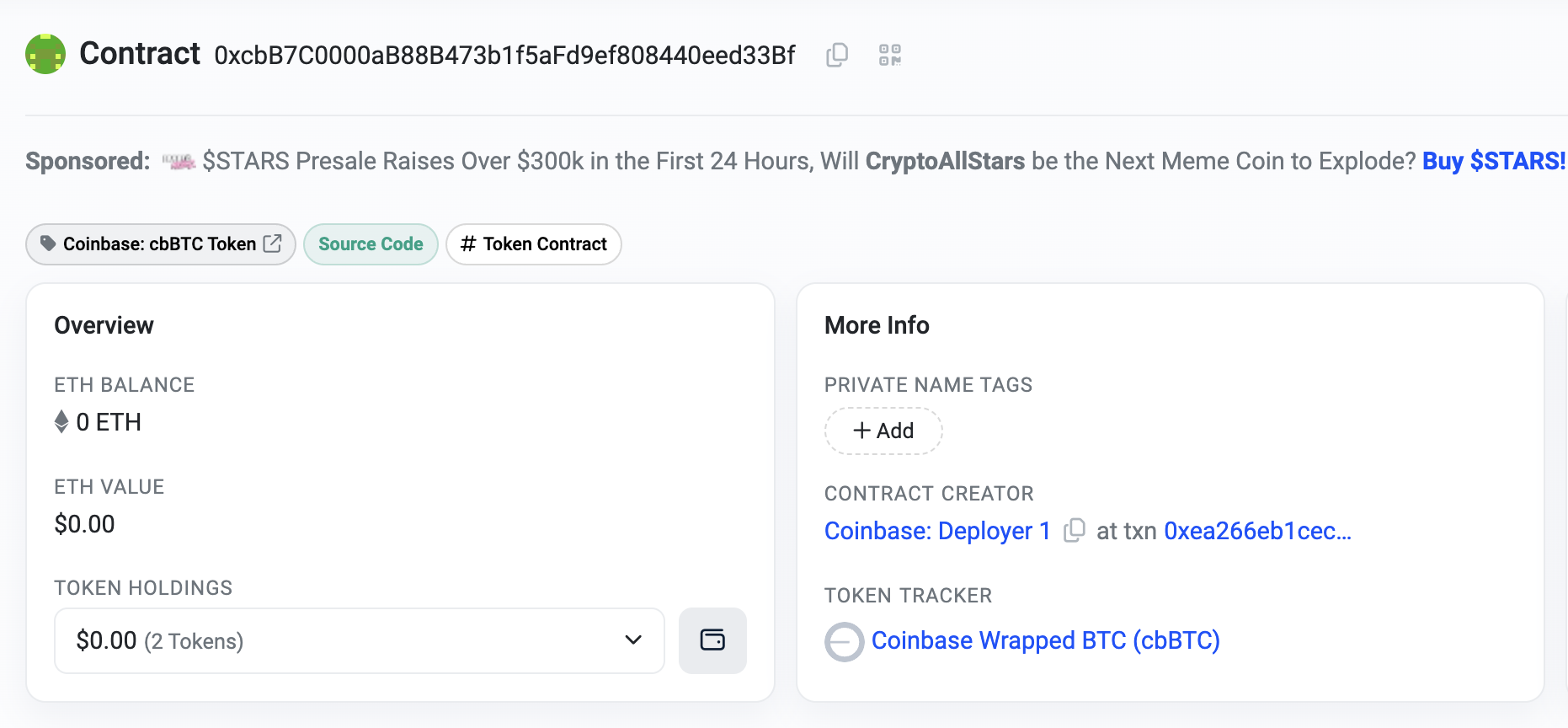

Exchange of crypto Launched by Coinbase, the cbBTC token is a Bitcoin version wrapped up on the Ethereum network and its layer-2 scaling network Base

The exchange said people can now use cbBTC in the UK, Australia, Singapore, and all US states except New York.

On September 12, Coinbase said that cbBTC would be launched. It is backed 1:1 with Bitcoin, owned by Coinbase, and does not have its own order book or trading pairs on the exchange’s platform.

When a user sends Bitcoin to a Base or Ethereum address, Coinbase instantly mints cbBTC at a 1:1 ratio. This is how wrapped Bitcoin works. It works the other way, too: if a user sends cbBTC to a Coinbase address, the tokenized Bitcoin will change into regular Bitcoin instantly.

The exchange also said they wanted to bring cbBTC to other blockchain networks and ecosystems in the future, but they didn’t say how they planned to do that.

Why would you use cbBTC?

Some tokenized forms of Bitcoin can be used to add decentralized finance features to the valuable digital asset. The Bitcoin ledger is mostly a list of transaction results that have not yet been spent.

Each Bitcoin wallet comprises transaction results that haven’t been spent yet and are linked to a specific Bitcoin address. In short, the Bitcoin record doesn’t have any real coins on it.

Bitcoin hasn’t been used much in decentralized finance applications, mainly in the Ethereum environment, because of its structure and the problems of moving digital assets between blockchain networks.

With cbBTC and other Bitcoin tokens from Coinbase, users can use their Bitcoin as collateral to get loans or as an asset that can be lent and earn interest. When it first comes out, cbBTC will work on Aave, Compound Finance, Morpho, Spark, Moonwell, and more.

The BitGo Wrapped Bitcoin scandal

Coinbase revealed plans to launch cbBTC a few days after BitGo faced criticism for its plans to change the custodial structure of its Wrapped Bitcoin (WBTC) product to one that works in more than one jurisdiction.

With this new arrangement, BitGo’s custodial centers are now in Hong Kong and Singapore, among other places. However, some industry experts were worried about the project because it involved Justin Sun, the founder of Tron.

When it was revealed that Sun would be involved, the risk management company Block Analytica suggested limiting all WBTC positions. They did this because Sun’s involvement in the diversified jurisdiction plan posed an “unacceptable level of risk.”