A crypto analyst said a “flash crash” is possible; however, they perceive it as a purchasing opportunity, suggesting they are optimistic about the long term.

After the broader crypto market experienced substantial gains over the past month, a crypto analyst cautioned that a “flash crash” was highly probable.

MN Capital founder and crypto analyst Michael van de Poppe stated in a Nov. 3 X post that “if corrections occur, and they will, a flash crash is likely to occur, inducing a massive liquidation crash across Altcoins.”

According To Crypto Analysts, There Is Opportunity To purchase

“Do not become alarmed.” Utilize these as an opportunity to enter the markets. Van de Poppe further stated, “They are a blessing.”

The escalating number of crypto market positions implies that even a minor decline could result in a substantial number of liquidations.

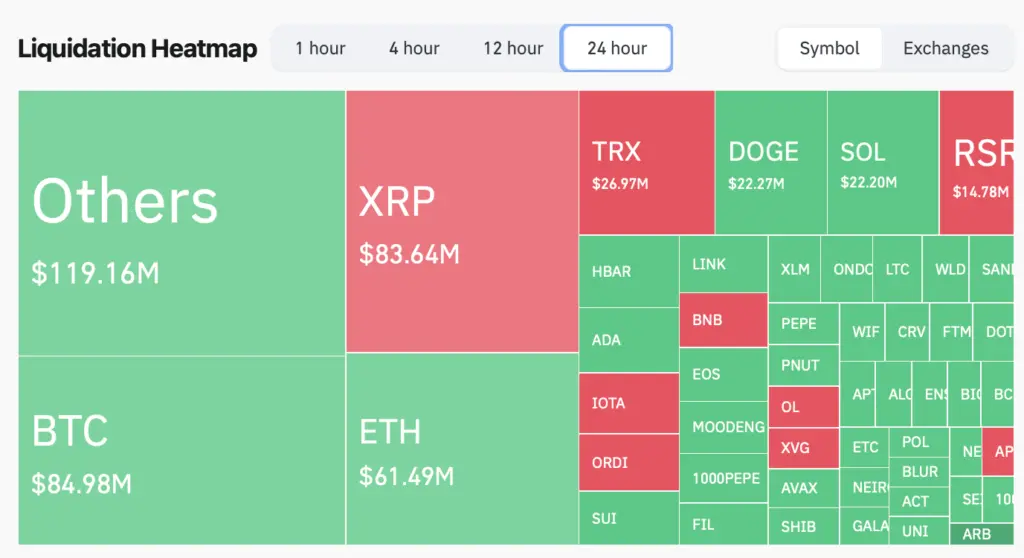

South Korean President Yoon Suk-yeol’s declaration of martial law and subsequent swift reversal resulted in the liquidation of approximately $618.7 million from the entire crypto market within the last 24 hours.

According to CoinGlass data, $85.8 million in Bitcoin positions and $61.5 million in Ether positions were liquidated out of the total.

The emergency declaration resulted in a decline in the prices of Bitcoin, Ether, XRP, and other cryptocurrencies.

However, according to CoinMarketCap, they have since recovered some of their losses, with a 2.4%, 3.3%, and 9.2% recovery, respectively.

South Korea Has Experienced Recent Increase In Trading Of Cryptocurrency

It occurred only one day after 10x Research announced on December 3 that retail trading volumes for crypto assets in South Korea had increased to $18 billion in the previous 24 hours, surpassing the country’s stock market by 22%.

In the interim, it was recently reported that Bitcoin whales were watching from the margins with their holdings as BTC continued to retrace and tease, hovering just below $100,000.

In a Nov. 2 analyst note, CryptoQuant contributor Onat Tütüncüler stated, “Although there is currently no immediate selling pressure, the rising inflow of Bitcoin into exchanges highlights a potential risk of future sell-offs.”