Changpeng Zhao (CZ), the former CEO of Binance, a prominent cryptocurrency exchange, is incarcerated for four months for violating anti-money laundering regulations.

Binance Coin (BNB), the platform’s native token, remains under CZ’s control despite his imprisonment

According to a recent Forbes report, CZ controls approximately 94 million tokens, which is equivalent to 64% of BNB’s circulating supply. This substantial ownership raises concerns regarding BNB’s ability to withstand the regulatory obstacles surrounding Binance.

The Double-Edged Sword of Dominant Ownership

CZ’s substantial ownership of BNB is both advantageous and problematic. On the one hand, it emphasizes the token’s accomplishment. BNB is a critical component of the Binance ecosystem, as it facilitates transactions, provides access to token sales, and offers discounts.

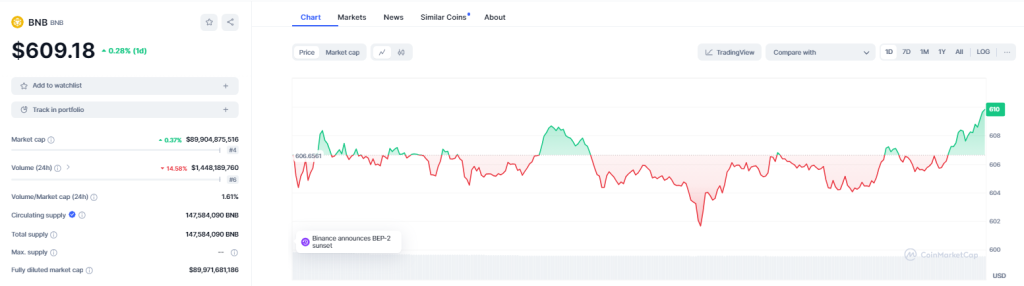

Its value has increased significantly, with a price that surged from $290 in January 2024 to a pinnacle of $724 in June. This increase is indicative of its robust utility and market demand. This performance has significantly increased Binance’s valuation, elevating CZ to the 24th richest individual in the world with an estimated net worth of $33 billion.

Nevertheless, Zhao’s dominant ownership also raises concerns regarding decentralization. Power distribution away from centralized entities is a foundational principle of cryptocurrency. There are persistent concerns regarding the token’s potential to function as an autonomous asset and its susceptibility to manipulation, as a substantial portion of BNB is held by a single individual.

In the Presence of Legal Issues

Binance’s future is clouded by Zhao’s legal troubles. The US Department of Justice (DOJ) allegedly indicted the exchange in 2023 for violating money laundering and sanctions laws. Binance’s reputational harm is substantial, even though CZ resigned as CEO and the company paid a substantial $4.3 billion fine.

The Consequences of Regulatory Scrutiny

This regulatory oversight may adversely affect Binance’s operations and user base. Investors apprehensive about the exchange’s legal issues may transfer their assets to alternative platforms. Additionally, implementing more stringent regulations could impede Binance’s expansion by limiting its capacity to provide specific products and services.

BNB’s Uncertain Future

The future of BNB is uncertain despite the recent price increase, which suggests resilience. However, the long-term consequences of Binance’s legal challenges are still uncertain. The changing regulatory landscape for cryptocurrencies will be crucial, as a more stringent regulatory approach could pose substantial challenges for Binance and BNB.

CZ continues to be a significant shareholder in Binance despite his prison sentence. His continued involvement, even from prison, could potentially harm investor confidence.

Additionally, Binance’s capacity to innovate and broaden its product line beyond BNB will be essential for navigating regulatory challenges. The company’s resilience and capacity to navigate the increasingly intricate landscape of cryptocurrency regulation will be determined by its success in diversifying its products and services.