Macroeconomic data is once again a major driver of crypto ETPs. Thus, the post-US election honeymoon is over, according to James Butterfill of CoinShares.

Last week, cryptocurrency exchange-traded products (ETP) saw a small influx of $47 million following a significant sell-off in Bitcoin investment products.

According to a January 13 study by cryptocurrency investment firm CoinShares, investors invested almost $1 billion in crypto ETPs during the second trading week of 2025, which was mostly offset by $940 million in weekly outflows.

According to James Butterfill, research director at CoinShares, the release of fresh macroeconomic data and minutes from the US Federal Reserve, which indicated a more hawkish Fed and a stronger US economy, was the catalyst for the enormous outflows.

“This implies that the honeymoon period following the US election is over, and macroeconomic data is once again a major factor influencing asset prices,” he said.

Crypto ETPs receive $213 million every week.

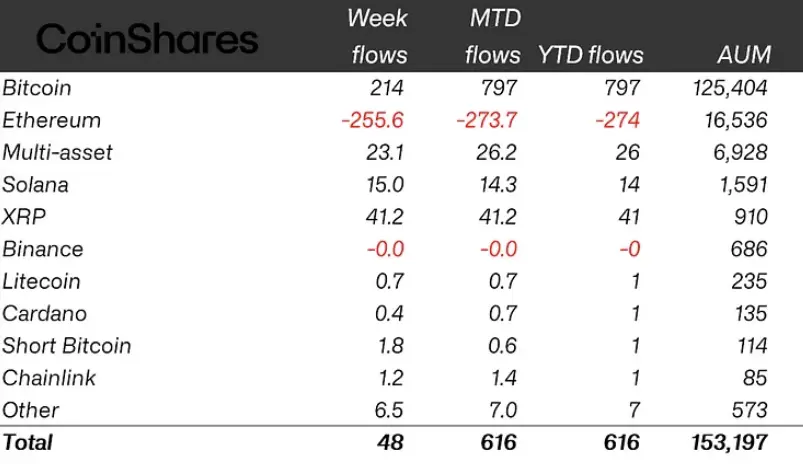

Despite experiencing the most significant withdrawals compared to other digital assets later in the week, Bitcoin (BTC) investment products saw inflows of $213 million from January 6–January 10.

With $799 million in inflows this year, Bitcoin remains the best-performing asset in 2025, according to the research.

The total assets under management (AUM) in Bitcoin ETPs fell 3.5% after the sell-off, from $130 billion to $125.4 billion the week before.

While XRP gains traction, Ethereum experiences the most significant outflows.

With $256 million in outflows, Ether ETH$3,067.29 investment products saw the most outflows last week.

According to Butterfill, Ethereum outflows should not be ascribed to any particular problem with the asset but rather to a larger tech sell-off.

The third-largest cryptocurrency by market capitalization, XRP XRP$2.37, had significant crypto ETP inflows of $41 million last week.

Political and legal concerns remain the main drivers of the jump, with inflows indicating increased optimism ahead of the US Securities and Exchange Commission’s appeal deadline on January 15.

Despite their subpar price performance, altcoins such as Aave, Stellar, and Polkadot still drew significant investments, with inflows of $2.9 million, $2.7 million, and $1.6 million, respectively.

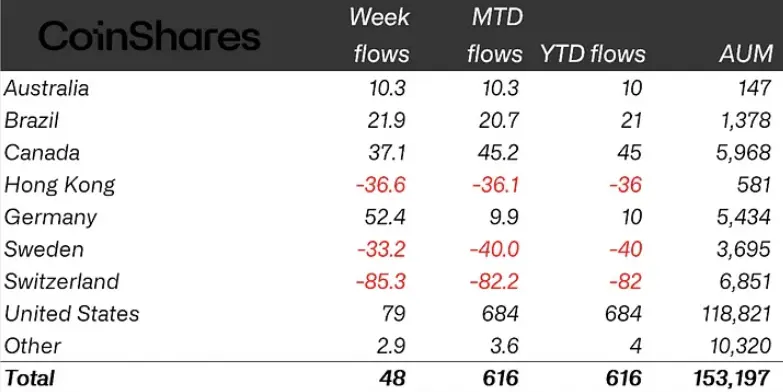

With $85 million, Switzerland leads outflows.

Switzerland led the withdrawals last week with $85 million, but the US remained the largest contributor to crypto ETPs with $79 million in inflows.

Canada and Germany also contributed significant inflows, with $37 million and $52 million, respectively.

In addition to Switzerland, Hong Kong and Sweden also saw significant outflows of about $37 million and $33 million, respectively.