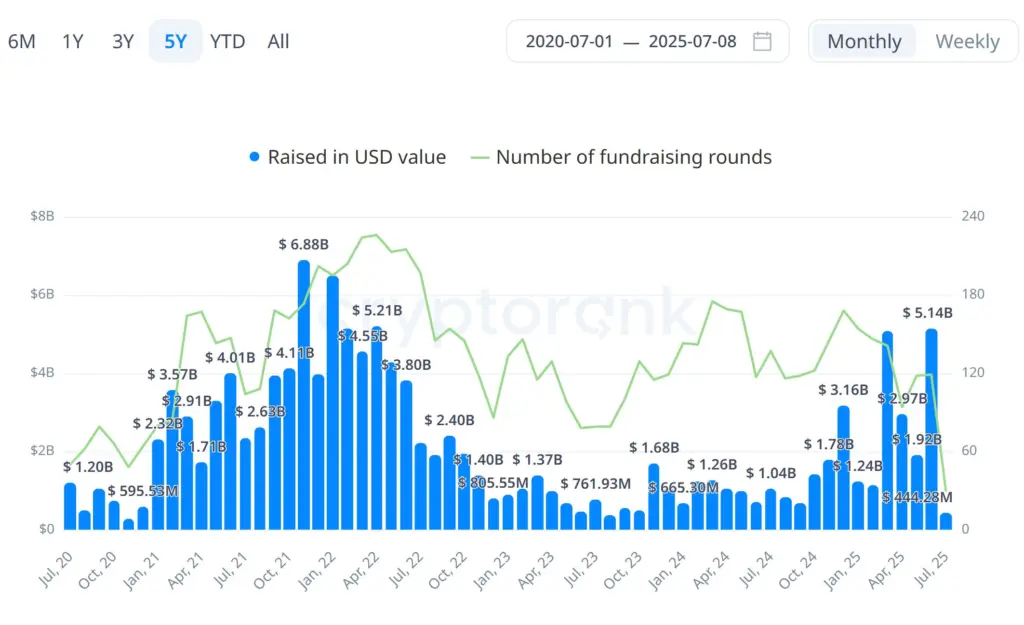

With $5.14 billion raised in June alone, cryptocurrency venture capital reached $10.03 billion in Q2 2025, its highest level since early 2022.

The second quarter of 2025 saw a resurgence in venture capital investment in cryptocurrency, with startups raising $10.03 billion for the three months ending in June. At $16.64 billion, it was the best quarter since Q1 2022.

According to data from CryptoRank, June took the most significant percentage, bringing in $5.14 billion, the highest monthly total since January 2022. The spike indicates that interest in cryptocurrencies is reviving after months of comparatively flat growth.

Strive Funds, an asset management firm led by American politician and businessman Vivek Ramaswamy, raised $750 million in May to develop “alpha-generating” methods through purchases connected to Bitcoin BTC$108,442.

TwentyOneCapital raised $585 million in April, the second-largest amount of money raised during the quarter. With a $400 million raise, Securitize ranked third in Q2 2025. Other noteworthy companies that followed were Digital Asset ($135 million), Auradine ($153 million), ZenMEV ($140 million), and Kalshi ($185 million).

Coinbase Ventures dominated Q2’s investments.

5 acquisitions between April and June, Coinbase Ventures topped the list of active investors and drove Q2 activity. Andreessen Horowitz (a16z), Pantera Capital, and Animoca Brands all had strong rankings, contributing to the quarter’s spike in deal volume.

With ten investments in June, Coinbase Ventures once again topped the list. Pantera Capital came in second with eight, Galaxy with five, and Paradigm with the most lead investments with four. GSR, a16z, Cyber Fund, and Animoca Brands were active companies.

While fundraising efforts were dispersed across several industries, blockchain technology and DeFi attracted much attention. While financing for memecoin remained subdued despite sporadic jumps, CeFi, NFT, and GameFi categories also experienced moderate activity.

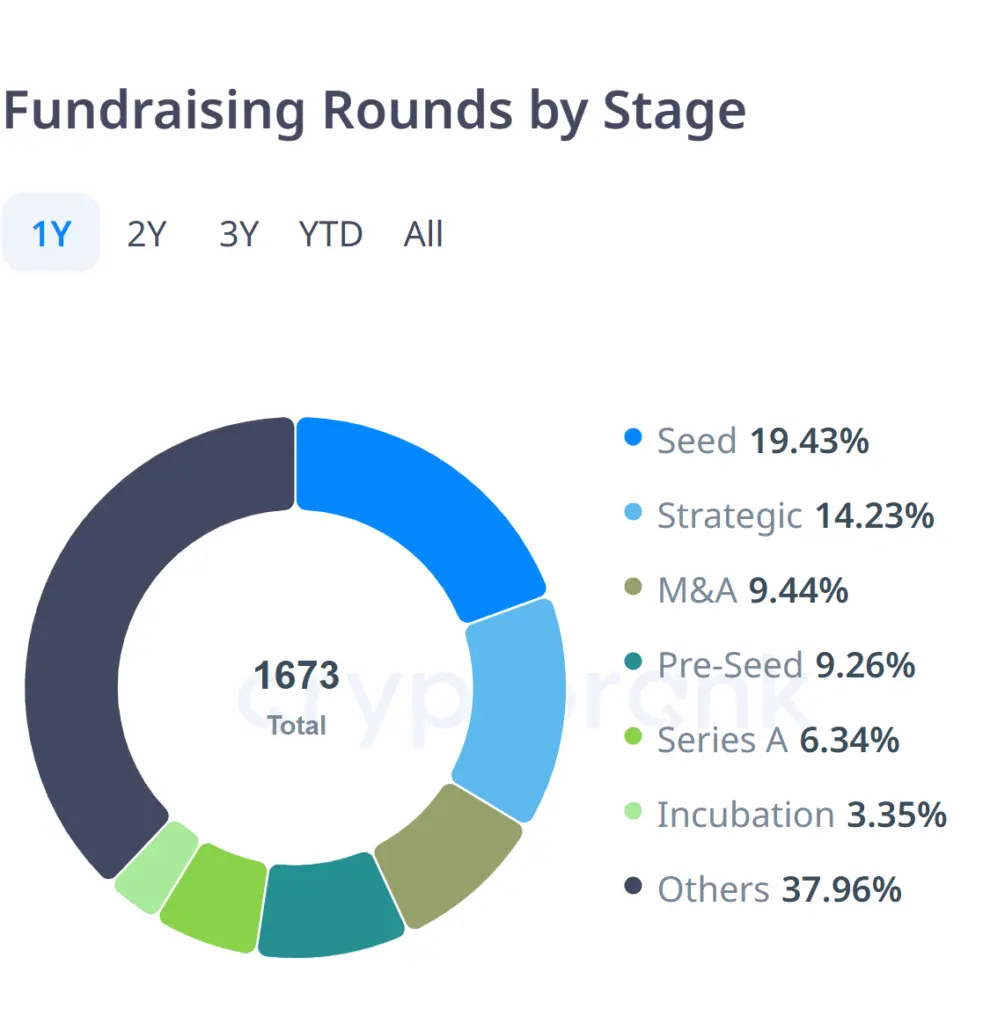

With 19.43% of the 1,673 tracked agreements over the past year, seed-stage deals comprised the highest portion of cryptocurrency funding rounds. At 14.23%, strategic rounds came next, indicating a continued focus on long-term ecosystem plays.

Pre-seed and M&A activity were also noteworthy, which accounted for 9.26% and 9.44% of total activity, respectively. According to data from CryptoRank, incubation deals accounted for only 3.35% of the total, whereas Series A rounds made up 6.34%.

Galaxy Digital’s first external fund raises $175 million.

Galaxy Digital raised $175 million at the closing of its first external venture fund last month, exceeding its original goal of $150 million. The fund will concentrate on high-growth cryptocurrency industries such as tokenization, payments, stablecoins, and the infrastructure that supports them.

Theta Capital Management, located in Amsterdam, also secured more than $175 million in May for its most recent fund-of-funds, which is intended to assist blockchain businesses in their early stages.