As investor interest in digital assets grows, crypto investment funds saw $1 billion in inflows, bringing total net assets to new all-time highs.

According to CoinShares, Bitcoin ETPs attracted $790 million in inflows last week, less than the $1.5 billion three-week average. The dynamics shifted in favor of Ether.

Despite ongoing volatility in key digital assets like Bitcoin and Ether, cryptocurrency investment products saw another week of inflows last week.

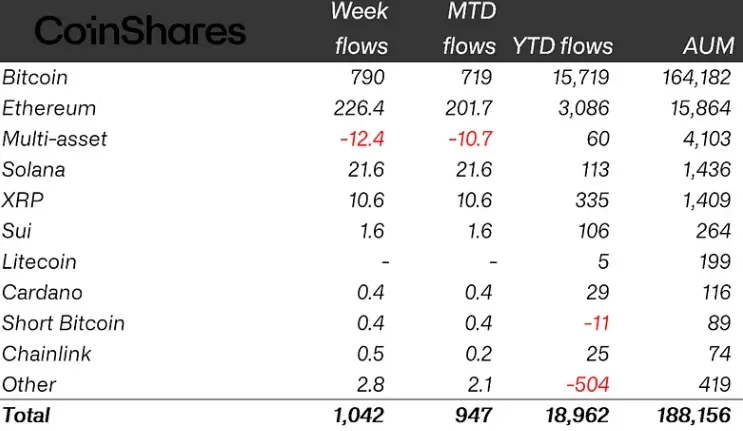

CoinShares stated on Monday that global crypto exchange-traded products (ETPs) had inflows of $1.04 billion during the trading week that concluded on Friday.

According to James Butterfill, head of research at CoinShares, the new inflows caused crypto ETPs to continue shattering year-to-date (YTD) inflow records, reaching a new all-time high of slightly under $19 billion.

Crypto ETP assets under management (AUM) hit a new high of $188 billion, up from $184.4 billion the previous week.

With $790 million, Bitcoin is the top inflow.

Last week, Bitcoin BTC$108,695 ETPs saw the most significant inflows, with $790 million, or 76% of all crypto ETP inflows.

According to Butterfill, BTC ETP inflows decreased from the previous three weeks, when they averaged $1.5 billion each week.

As Bitcoin gets closer to its all-time high price levels, “the moderation in inflows suggests that investors are becoming more cautious,” he noted.

Change to ETFs for Ether?

Following $225 million in inflows, Ether (ETH) $2,562 ETPs saw their 11th straight week of inflows.

“During this run, weekly inflows have averaged 1.6% of AUM on a proportional basis, which is significantly higher than Bitcoin’s 0.8%,” Butterfill noted, implying that there has been a “notable shift in investor sentiment in favor of Ethereum.”

BlackRock’s cryptocurrency funds handled most of last week’s inflows, receiving $436 million, or 42% of total issuer inflows.

Despite the July 4 holiday, the US leads in inflows.

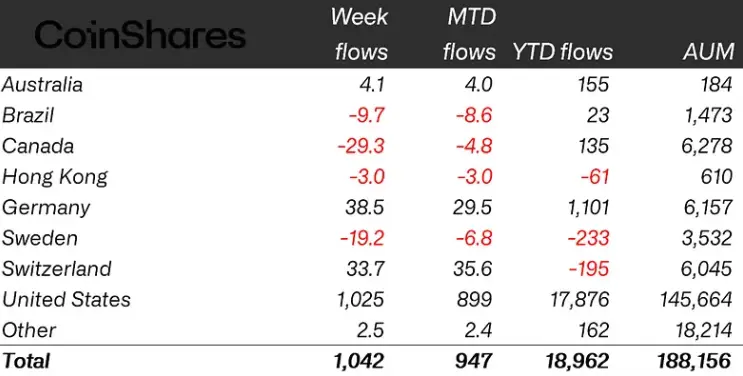

Even though US stock markets were closed on Friday in honor of the July 4th Independence Day holiday, regionally, crypto ETP inflows were still mostly centered in the US.

According to CoinShares, the US led in inflows with $1 billion, followed by Germany and Switzerland with $38.5 million and $33.7 million, respectively.

However, sentiment remained sluggish in nations like Canada and Brazil, where outflows were $29.3 million and $9.7 million, respectively.

Even though Canadian issuer 3iQ introduced the spot XRP exchange-traded fund at $2.28 on the Toronto Stock Exchange in mid-June, the country’s sentiment remained lackluster.

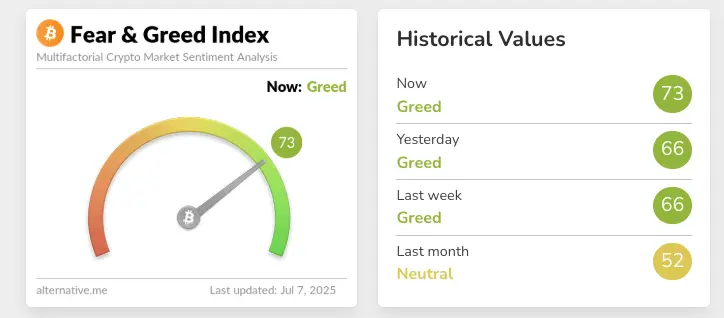

The “greed” feeling is strong during an increase in volatility.

Even though inflows into Bitcoin ETPs slowed last week, market sentiment remained generally positive.

With a score of 66 last week, the Cryptocurrency Fear & Greed Index was solidly in “Greed,” per statistics from Alternative.me.

Despite massive volatility in Bitcoin, which saw its price plummet to as low as $105,400 last Tuesday and then soar beyond $110,000 last Thursday, according to CoinGecko data, the sentiment was upbeat.

The price of Ether likewise temporarily dropped below $2,400 last Tuesday before rising above $2,620 on July 3, following the pattern of Bitcoin.