Crypto inflows reached $785M last week due to the Ethereum Pectra Upgrade, bringing YTD totals to $7.5B and recovering from recent outflows.

Ethereum was a standout among the positive flows into digital asset investment products. The sentiment transformed due to the Pectra upgrade and the network’s leadership changes.

The Pectra upgrade influenced the crypto inflows of the previous week

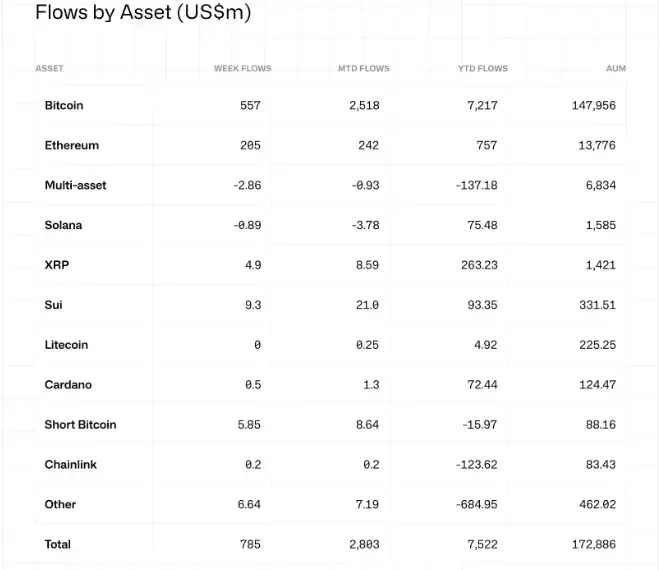

The most recent CoinShares report indicates that crypto inflows totaled $785 million for the week ending May 17. Despite the slight decrease from the $882 million of the previous week, this signals the fifth consecutive week of positive flows.

Markets continue to disregard Trump tariffs, resulting in favorable crypto inflows. Consequently, the United States dominated the positive flows. It outperformed Germany and Hong Kong with $681 million in inflows, as opposed to $86.3 million and $24.2 million, respectively.

Bitcoin (BTC) experienced a minor decline compared to the previous week. James Butterfill, the researcher at CoinShares, attributes the retraction to economic indicators in the United States.

“Bitcoin attracted $557 million in inflows, a decrease from the prior week, likely due to continued hawkish signals from the US Federal Reserve. Short-bitcoin products saw a fourth consecutive week of inflows, totaling $5.8 million, reflecting investor positioning amid recent price gains,” read an excerpt in the report.

Nevertheless, Ethereum was the most prominent beneficiary of last week’s crypto inflows. Ethereum received $205 million in crypto inflows, as indicated by the CoinShares report. This represented a substantial increase from the $1.5 million reported in the previous report.

Butterfill attributes the optimism to the Pectra Upgrade of Ethereum and the ensuing advancement of Tomasz Stańczak to the position of co-executive director.

“Ethereum was the standout performer, with US$205m in inflows last week and $575 million YTD, indicating renewed investor optimism following the successful Pectra upgrade and the appointment of new co-executive director Tomasz Stańczak,” Butterfill wrote.

On May 7, the Pectra Upgrade was implemented on the mainnet, which was the most significant alteration to the network since the 2022 Merge upgrade. On the one hand, EIP‑7251 increases the validator limit to 2,048 ETH. In the interim, EIP-7702 introduces smart-wallet functionality and significantly advances account abstraction.

Similarly, Tomasz Stanczak, recently appointed as co-executive Director of the Ethereum Foundation (EF), has a long history of involvement in the fundamental development of Ethereum. His objective is to minimize nodes’ storage requirements by emphasizing statelessness to improve Ethereum’s scalability and decentralization.

Nevertheless, the focus on rollups and the issue’s complexity resulted in the deprioritization of strong statelessness. Stanczak’s leadership can alter this focus.

“The Ethereum Foundation is thrilled to welcome Hsiao-Wei Wang and Tomasz Stanczak as co-Executive Directors. This new leadership structure marks an exciting new chapter in the Foundation’s evolution as we continue to support a growing Ethereum ecosystem,” the EF said in March.

Solana defied the trend, as Ethereum and other altcoins experienced positive flows. It disclosed crypto outflows of up to $0.89 million. This is consistent with a recent declining TVL (total value secured), which has plummeted by 64%.