The cryptocurrency market set a new record of $2 billion in investment during May, a positive development for the sector.

The most recent CoinShares report indicates that inflows into crypto investment products totaled $185 million last week, marking the fourth consecutive week of growth. As a result, the cumulative inflows for May amounted to $2 billion, thereby elevating the overall inflows for 2024 to over $15 billion thus far.

One hundred million dollars in inflows originated from the United States last week, the largest region by far. A significant increase was observed in Switzerland, where the second-largest weekly inflow of the year totaled $36 million. In contrast, Canada underwent a substantial reversal, as evidenced by $25 million in inflows, which marked a distinct contrast to the net outflow of $39 million recorded in May.

Bitcoin alone experienced $148 million in inflows, while the short Bitcoin experienced an additional $3.5 million in outflows during the week. This indicates that investors in ETFs continue to hold a positive outlook.

Ethereum (ETH), the second-largest cryptocurrency in the world, has experienced a significant reversal over the past fortnight. Ethereum experienced its second consecutive week of inflows, accompanied by anticipations that spot Ethereum ETFs will become operational for trading by mid-July 2024.

Before these two weeks of inflows, Ethereum experienced over $200 million in ten consecutive outflows. This favorable development for Ethereum has additionally resulted in inflows of $5.8 million into Solana (SOL), an Ethereum Layer-1 competitor.

CoinShares reported that while direct investments in digital assets have experienced recent success, blockchain equities have encountered difficulties, with outflows tallying $7.2 million last week and $516 million this year.

Value of Bitcoin Transactions Achieves Annual High

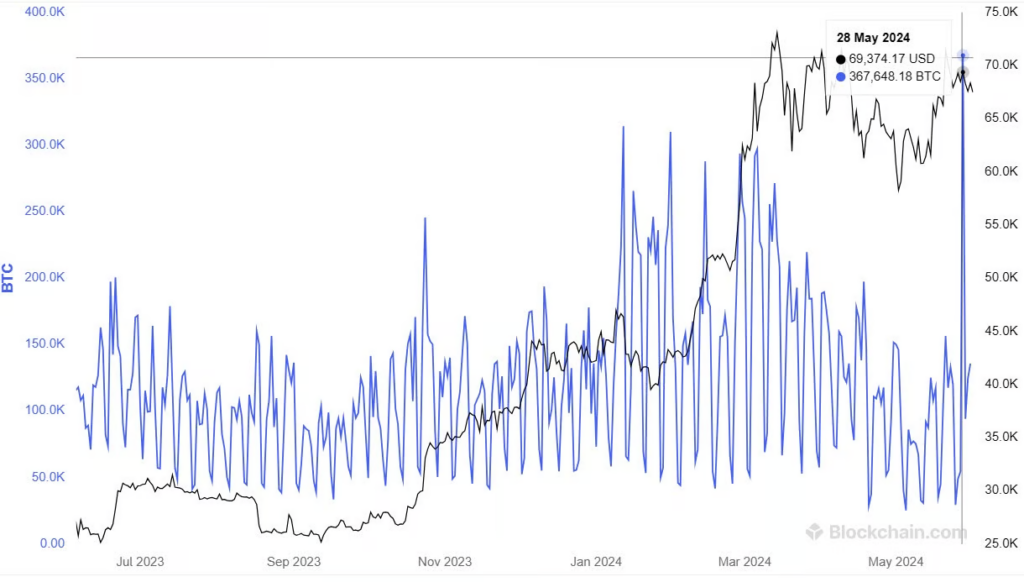

The value of Bitcoin transactions in US dollars reached a one-year peak of $25 billion on May 28. On May 28, approximately 367,000 BTC were transmitted on the blockchain, according to data from the Bitcoin explorer Blockchain.com. This represents the highest volume of BTC transactions since June 13, 2022, when over 519,000 BTC were exchanged.

Bitcoin was valued at approximately $26,500 per transaction at the time of the occurrences, for a cumulative transaction value of almost $14 billion. Notwithstanding the reduced volume of Bitcoin transactions on May 28, the value of BTC hovered around $69,374, substantially augmenting the overall transaction value to an estimated $25.5 billion.

Conversely, analysts in the cryptocurrency market maintain a bullish stance on Bitcoin moving forward. According to renowned trader Peter Brandt, the price of Bitcoin could reach $130,000 by the end of the year.

The asset has the potential to reach between $130,000 and $150,000 by August or September 2025 if its trajectory continues to resemble that of previous bullish runs, according to the cryptocurrency trader’s analysis.