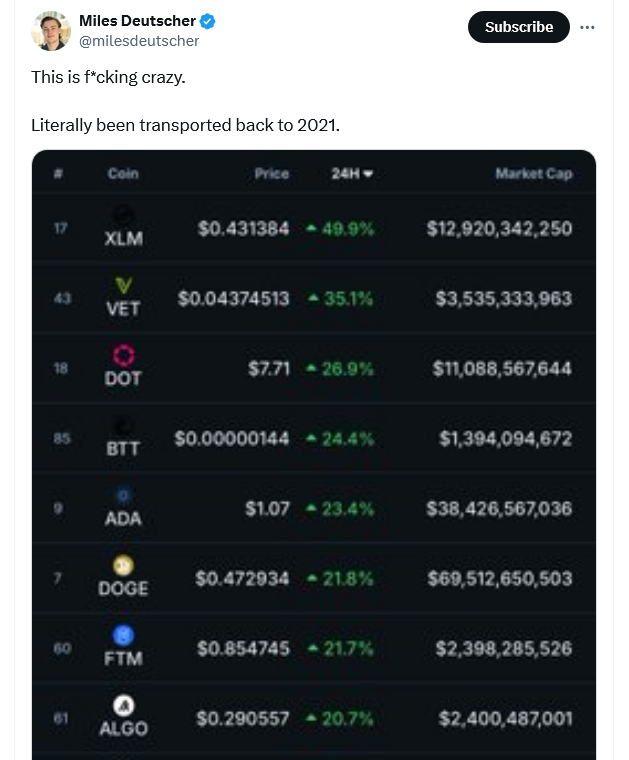

More people sold Dogecoin, XRP, Stellar, and Sandbox than normal because the prices of some of the best altcoins from the 2020-2021 cycle went up as much as 50%

Bitcoin fell after failing to break the $100,000 mark on November 24. This was one of the biggest weekend crypto sell-offs in over six months.

In the past 24 hours, crypto contracts worth more than $470 million have been closed. Long liquidations made up $352.6 million, and short liquidations made up $119.9 million. Altcoins made up the great majority of positions that were wiped, according to CoinGlass data.

Together, Bitcoin and Ether were liquidated for a total of $108.9 million. Dogecoin, XRP, and Stellar were the last three on the list, sold for $33.1 million, $27.6 million, and $21.6 million, respectively.

Next in terms of the number of liquidations were Solana, Sandbox, Polkadot, and Cardano.

Miles Deutscher, an analyst in the crypto industry, thinks that more traders from the last cycle are opening their crypto wallets again for the first time in a while and investing in coins they already know.

Others said these utility tokens were selling below their true worth in a bear market where Bitcoin and memecoins have done better.

Bitcoin will reach $1,000,000, but how much will it cost? — Michaël van de Poppe

Bitcoin is worth $97,790 right now, 2% less than its all-time high of $99,645 on November 22. At that price, it was almost close to breaking $100,000.

Bitcoin’s value has increased almost 44% since November 5, when Donald Trump won the US presidential election.

56.2% of the entire crypto market cap, or $3.46 trillion, comprises bitcoin.