Crypto market sentiment turns cautious as the Trump tariff pause ends July 9, with $15B Bitcoin options expiry looming Friday.

The crypto market is currently experiencing selling pressure, precisely when the 90-day moratorium on Trump tariffs is expected to conclude on July 9, 13 days from now. As of press time, the price of Bitcoin remains at $107,500, with $17 billion in options expiring on Friday. In contrast, altcoins such as Ethereum (ETH), XRP, Solana (SOL), and Dogecoin (DOGE) have experienced a 2-5% decline.

Crypto investors are on edge before Trump tariffs start up again

Crypto market investors are now concentrating on the conclusion of the 90-day Trump tariff hiatus, as the geopolitical tensions associated with the Iran-Israel conflict appear to have been resolved. Arthur Hayes anticipates that Bitcoin will soon reach an all-time high, citing macro developments such as the GENIUS Stablecoin Act and the SLR Exemption as key catalysts for digital assets.

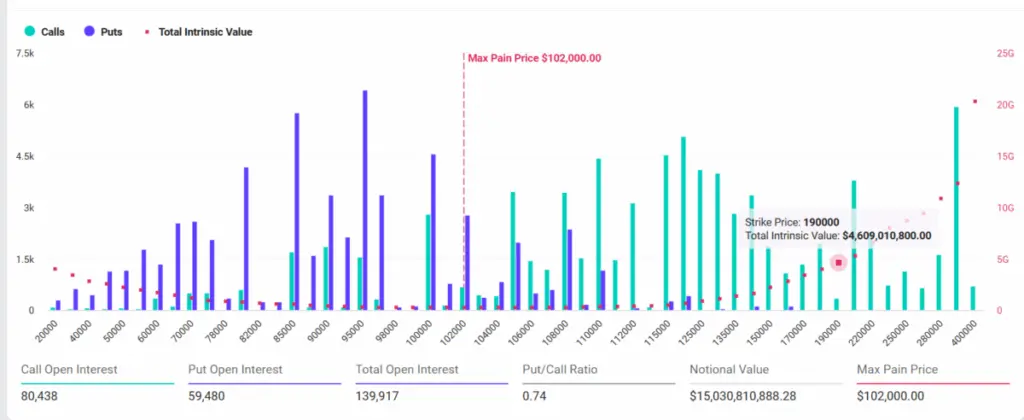

A total of 139,392 Bitcoin option contracts, with a notional value of $14.9 billion, are scheduled to expire on Friday, according to Deribit data. The bulls are still in control, as evidenced by the put-call ratio of 0.74. The maximal pain point is at $102,000.

Recent commentary from the Greek language.Live also indicates that Bitcoin is experiencing “mixed sentiment,” with traders experiencing neutral or break-even results despite market momentum. A significant level of resistance at 110k has been noted as a barrier that may be difficult to overcome.

Conversely, the corporate scramble for BTC reserves has already begun, as evidenced by the substantial inflows of Bitcoin ETFs, underscoring the robust institutional demand. As of Thursday, the net inflows have already exceeded $1.7 billion, with BlackRock’s IBIT being the most significant contributor.

Trump’s tariffs are once again in the spotlight, and a deal with China has been reached

The broader crypto market sentiment indicates that investors are taking a cautious approach, as President Trump’s 90-day tariff suspension is scheduled to expire in just 13 days, on July 9. Investors are anticipating the implementation of any forthcoming trade agreements. Some of the significant modifications that are expected to occur as a result of the Trump tariff include:

- The reinstatement of “reciprocal tariffs” that are specific to each country.

- Imports from the European Union are subject to tariffs of up to 50%.

- The preservation of a global baseline tariff rate of 10%.

Despite the tariff hiatus, the crypto market, along with the global markets, has experienced a rally, with the S&P 500 gaining approximately 1,200 points since April 9th. Additionally, US President Donald Trump and US Commerce Secretary Lutnick signed the US-China trade agreement two days ago. President Trump stated the following in his address on Thursday:

“We’re going to open up India. In the China deal, we’re starting to open up China. Things that never really could have happened. We just signed [a trade deal] with China. We’re not going to make deals with everybody… But we’re having some great deals. We have one coming up, maybe with India — a very big one.”

Investors remain passive despite the renewed optimism regarding Federal Reserve rate reductions in July.