Bitcoin falls to $108K, down 13%, after hot PCE inflation data (2.9%) and Schiff’s “Game Over” call spark crypto market correction.

The crypto market correction has been further exacerbated by the US PCE data, which indicated a high level of inflation. Bitcoin (BTC) has fallen to $108,000. Ethereum (ETH), XRP, and Solana (SOL) are the most prominent altcoins experiencing even more severe corrections. The market-wide liquidations have increased to $580 million, as Fed Chair Jerome Powell is at a juncture regarding interest rate cuts. Peter Schiff, a Bitcoin critic, asserts that the game is over.

The crypto market crash precipitates major liquidations

The US PCE data has surged to 2.6%, which has reignited inflationary concerns. This has resulted in a further crypto market correction, as BTC has fallen to $108K. Fed Chair Jerome Powell is the focal point of attention, as the potential for no rate decreases during the September FOMC, which has resulted in a decline in risk-on assets.

Investors are concerned that Bitcoin may once again plummet to $100K levels, as it has extended its weekly losses to 6.5% and is currently trading at $108,456. A prominent crypto analyst, Ali Martinez, observed that BTC resembles the 2021 chart pattern. Therefore, Bitcoin supporters must maintain a price above $108,700. This could result in an additional 15% decrease to $94,000.

Ethereum’s selling has also persisted as the general market sentiment has shifted to a “cautious” stance, following a week of optimism. This is despite the ongoing inflows of institutional and Ether ETF funds.

Ethereum has been the dominant player in the broader altcoin market thus far. Consequently, the crypto market is reverberating with the correction that occurred today. Solana (SOL) is again testing the critical support at $200, while Ripple’s XRP has extended further losses to $2.81 after losing $3 support. The current long liquidations in the crypto market are $480 million, according to the Coinglass data, while the overall liquidations are $589 million.

Peter Schiff declares that the situation is “game over”

Bitcoin critic Peter Schiff declared that the Trump administration is “game over” in response to the macro shift. Schiff has criticized former U.S. President Donald Trump’s call for the Federal Reserve to reduce interest rates, contending that such an action would erode the confidence of creditors.

Schiff posits that the government could reduce financing costs by lowering rates; however, this approach could discourage lenders. “If interest rates are not sufficiently elevated to generate returns that surpass inflation or dollar depreciation, creditors will decline to extend additional loans to the United States government,” he cautioned.

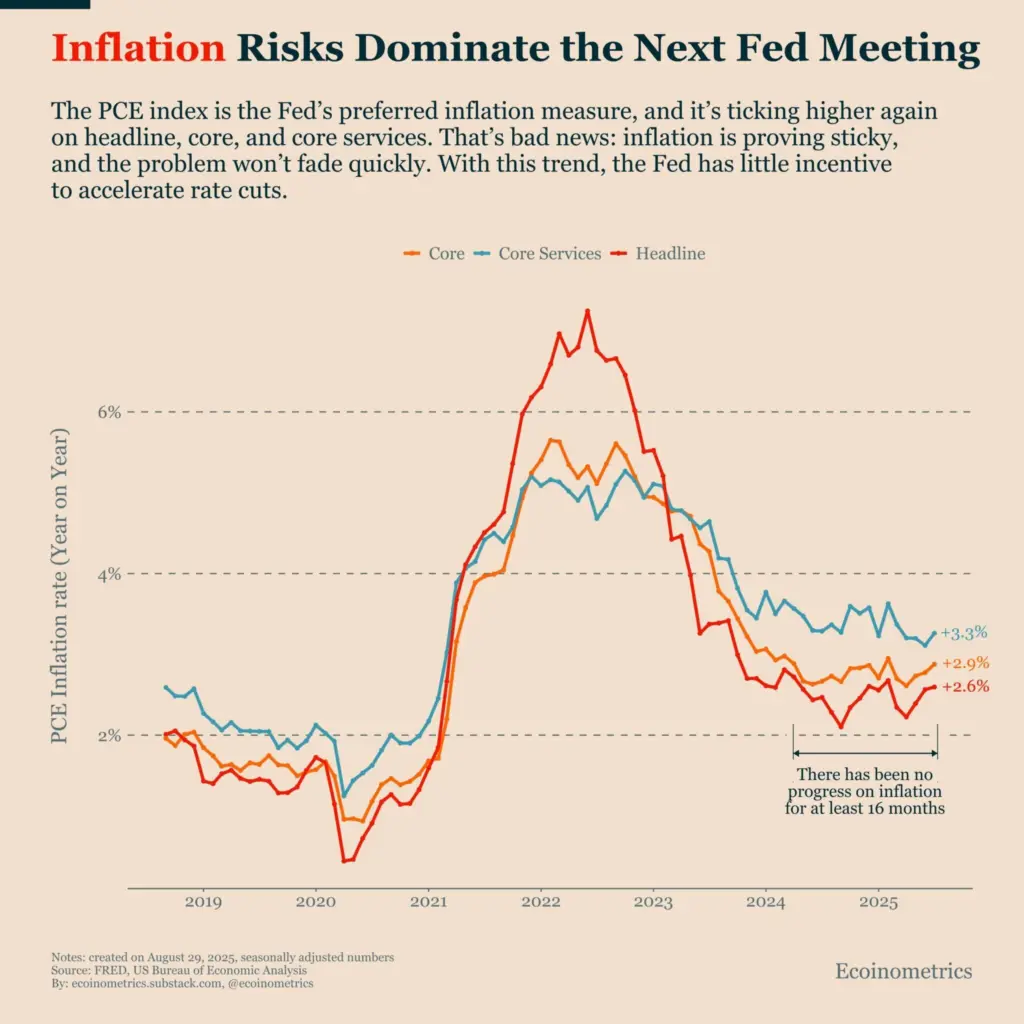

Additionally, the Bitcoin macro strategy platform ecoinometrics has indicated that inflation concerns are expected to be the primary focus of the upcoming Federal Reserve meeting. “The Federal Reserve has minimal motivation to expedite rate cuts due to inflation’s persistence.” It was noted that risk assets will not appreciate this, and in the short term, it will hinder Bitcoin.

As demonstrated above, the most recent PCE data suggest that headline, core, and core services measures have experienced growth. Inflation has not made substantial progress over the past 16 months, as evidenced by a more comprehensive perspective.