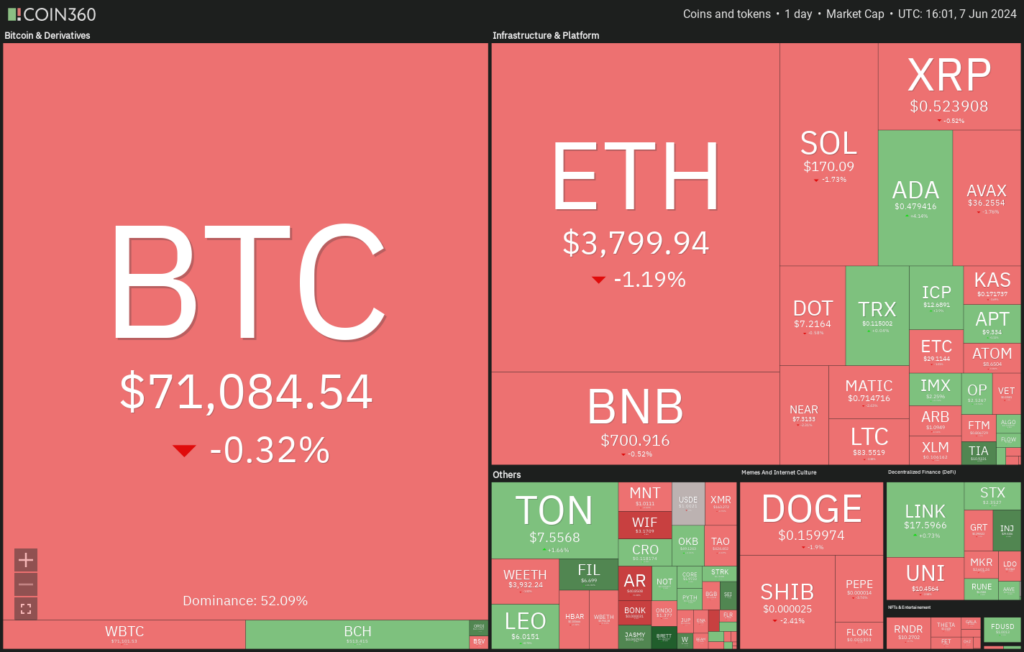

Strong point of purchase: According to Bitcoin ETFs, crypto traders should expect an upside breakout in the upcoming days.

Though it hasn’t happened yet, traders have anxiously awaited for Bitcoin BTC$71,023 to break out of the current range. The force required for the breakout increases when the price stays inside the range. The fact that there have been net inflows into spot Bitcoin exchange-traded funds for 19 straight days is encouraging. This indicates strong purchasing ahead of the uptrend’s potential resume.

Businesses are directly investing in Bitcoin in addition to Bitcoin ETFs. The Nasdaq-listed medical producer Semler Scientific bought its first batch of 581 Bitcoin on May 28 and now owns 828 Bitcoin, according to a June 6 S-3 filing. The company stated that it is still open to raising an additional $150 million in debt securities, primarily for use in general corporate operations, which may include buying Bitcoin.

Apart from the increasing need for Bitcoin ETFs, there appears to be a growing appetite among institutions to invest in alternative currencies. The Information reported on June 6 that Franklin Templeton, an asset manager, is considering launching a private fund to introduce institutional investors to cryptocurrencies.

Could purchasers keep up the pace and raise the price of Bitcoin to a record high? Will that increase the purchase of certain altcoins? Let’s examine the charts of the top ten cryptocurrencies to find out.

- 1 Analysis of the price of bitcoin

- 2 Analysis of ether prices

- 3 Analysis of BNB prices

- 4 Crypto Coin Solana pricing evaluation

- 5 Analysis of the XRP pricing

- 6 Analysis of Dogecoin’s pricing

- 7 Analysis of Toncoin prices

- 8 Analysis of Shiba Inu prices

- 9 Analysis of the Cardano price

- 10 Analysis of avalanche prices

Analysis of the price of bitcoin

On June 6, the bears attempted to push Bitcoin again below the psychological threshold of $70,000, but the bulls held firm. Based on this indication, the buyers may be trying to turn the $70,000 level into support.

The relative strength index (RSI) and the upsloping 20-day exponential moving average ($68,609) are positive, suggesting that the bulls are in control. The BTC/USDT combination may increase to $73,777, which is the solid overhead resistance.

The price will likely support the 20-day EMA if it declines from $73,777. A break over $73,777 is more likely if this level is bounced off. After that, the two might increase to $80,000 and then $88,000.

On the other hand, a break below the 20-day moving average will indicate that the range-bound movement might continue for a few more days.

Analysis of ether prices

Ether ETH$ 3,784 has been finding it challenging to launch a robust comeback from the $3,730 support level, suggesting that demand peters out at higher prices.

The 20-day EMA ($3,684) is upsloping, and the RSI is in the positive zone, indicating that the bulls are in charge. The ETH/USDT pair may increase to $3,977 and ultimately $4,094 if the price rises from its current position above $3,900.

However, if the price keeps falling and closes below the 20-day moving average, it will indicate that the bulls have given up and are taking profits. The pair can drop to the 50-day simple moving average ($3,342).

Analysis of BNB prices

Although BNB$697 is rising, the rise is encountering resistance at $722, indicating that short-term traders may be booking profits.

The $635 breakout barrier is where the bears will attempt to drive the stock lower. The BNB/USDT pair will indicate that the bulls have turned $635 into support if it rises strongly from this level. This will increase the likelihood of a rise towards the $775 pattern goal.

A break and closing below the $635 support level will be the first indication of weakness. The selling can get more intense once the bears push the price below the uptrend line. That might initiate a decline to $536.

Crypto Coin Solana pricing evaluation

On June 6, Solana SOL$169 again found support at the 20-day EMA ($167), suggesting that bulls see the dips as a chance to purchase.

To hold onto their edge, buyers will try to raise the price to $189. Although it might be a barrier, this level will probably be overcome. After that, the SOL/USDT pair can try to rise to the strong resistance level of $205.

Bears must move swiftly to pull the price below the 50-day SMA ($156) to stop the upward trend. Should they take such action, the pair might fall to $140 and the crucial support level of $116.

Analysis of the XRP pricing

XRP 0.52 is still trading close to the moving averages, suggesting that traders must act more aggressively when buying or selling.

The RSI is close to the midpoint, and the flattish moving averages indicate that the drab price activity might last for some time. The bulls will attempt a resurgence if the price breaks and closes above $0.54. The USDT/XRP pair may increase to the $0.57 overhead resistance level.

On the other hand, the bullish ascending triangle pattern will be invalidated if the price declines and breaks below the support line. The pair can drop to the support level of $0.46.

Analysis of Dogecoin’s pricing

Dogecoin DOGE$0.16 has been trapped between $0.18 and the 50-day SMA ($0.15) for the previous few days.

The RSI is close to the halfway point, and the flat moving averages imply that the range-bound behavior might last a little longer. Bulls will try to push the DOGE/USDT pair above $0.18 if the price breaks above the moving averages.

A break and closing below the 50-day SMA on the downside will indicate that the bulls have given up. That can trigger a decline to $0.14 and then to the crucial $0.12 support level. It is anticipated that the bulls will vigorously defend this level.

Analysis of Toncoin prices

On June 7, Toncoin (TON) marginally moved above the overhead resistance level of $7.67, suggesting that bulls are attempting to restart the rise.

The 20-day EMA ($6.77) slows upward, and the RSI is close to the overbought area, indicating that the upside is the likely direction of least resistance. Should purchasers propel and sustain the price above $8, the TON/USDT combination may increase to $10.

The 20-day EMA is the critical support level to monitor if prices decline. If the price breaks below this support, it will indicate that the buyers are losing ground, but a bounce-off will imply that the bulls are in charge. After that, the pair can drop to the 50-day SMA ($6.25).

Analysis of Shiba Inu prices

On June 5, the bulls pushed Shiba Inu SHIB$0.000025 above the moving averages but could not sustain their gains.

The bears are pulling the price below the support line and the moving averages. If they succeed, the rising triangle pattern will be deemed invalid, perhaps initiating a downward trend to $0.000018.

Alternatively, a price move above the present level will indicate that the bulls are firmly guarding the support line. The SHIB/USDT pair may increase to the $0.000030 overhead resistance level.

Analysis of the Cardano price

CardanoADA $0.48 has been moving in a symmetrical triangular formation for many days, indicating a struggle between bulls and bears.

On June 7, traders finally forced the price above the moving averages after a few days of hesitation. The ADA/USDT pair might reach the triangle’s resistance line, where the bears are likely to put up a fierce fight. Should buyers break through the barrier, the pair may rise as high as $0.62. At $0.57, there is a minor resistance level, but it will probably be crossed.

On the other hand, a significant decline in price from the resistance line will signal that the bulls are taking profits. That can prolong the couple’s confinement within the triangle.

Analysis of avalanche prices

For the past few days, Avalanche AVAX$35.84 has been trading near the moving averages, indicating that supply and demand are in balance.

Neither the bulls nor the bears have a distinct advantage due to the flattish moving averages and the RSI close to the midway point. The AVAX/USDT combination may reach $42 if the price rises above the moving averages.

Alternatively, it will indicate that the bears attempt to seize control if the price declines and breaks below $34. When the pair drops to $29, buyers will probably intervene. The subsequent direction should start above $42 or below $29.