Crypto market and stocks plummet as Russia’s President Putin signs a nuclear decree following Joe Biden’s unsuccessful continuation of Trump’s peace efforts.

The crypto market, including Bitcoin, Ethereum, Solana, XRP, and the broader market, experienced a precipitous decline on Tuesday as a result of the signing of a decree by Russian President Vladimir Putin, which authorizes the expanded use of nuclear weapons.

The allegations also resulted in a significant decline in stock markets worldwide.

The action is in response to the authorization granted by US President Joe Biden to Ukraine to attack Russia with US missiles.

Nuclear Decree Approved By Putin Leads To Stock, Crypto Market Plunge

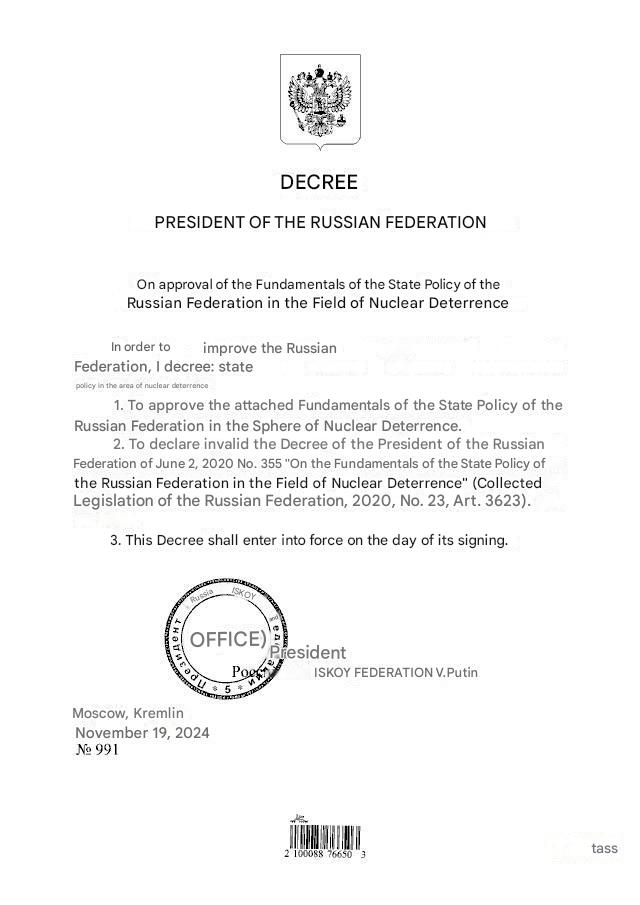

On November 19, Russian President Vladimir Putin signed a decree that authorizes Moscow to employ nuclear weapons against a non-nuclear state if it is backed by nuclear powers.

According to the reports, “any attack by a nation in a military bloc will be considered an attack by the entire bloc.”

The stock markets worldwide experienced an abrupt decline, which resulted in a panic selling spree and reversed recent gains.

President-elect Donald Trump’s efforts to establish peace between the nations have been undermined by Joe Biden’s authorization for Ukraine to deploy missiles within Russia.

According to Coinglass data, the crypto market experienced a selloff in the past few hours as longs were liquidated. XRP, Dogecoin (DOGE), Cardano (ADA), and other altcoins experienced a drop of over 1% in an hour, while Bitcoin (BTC) and Ethereum (ETH) experienced a nearly 0.50% decline.

The leading losers in the past few hours were PNUT, RAY, XTZ, AKT, and other recent gainers. The price of PNUT decreased by 5% to $1.68.

Will Price Of Bitcoin Plummet To $82K As Result of Additional panic?

In response to European equity markets, US stock futures that are linked to the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite also experienced a decline.

CoinGape stated that Bitcoin on-chain metrics and market sentiment indicated a 10% correction, with a potential decline to $80,000. Next, the critical Bitcoin support zones are located at $85,800-$83,250 and $75,520-$72,880).

Additionally, it is anticipated that profit bookings will occur, as the Crypto market dread and greed index suggest that there is a high level of greed, which could lead to profit booking.

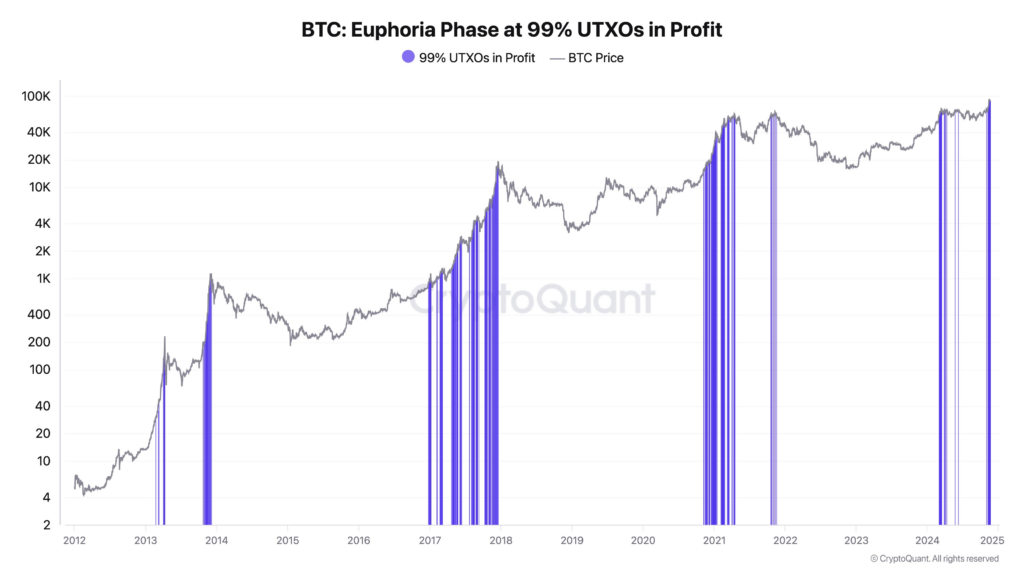

Ki Young Ju, the CEO of CryptoQuant, disclosed that 99.3% of UTXOs are currently profitable. “Everyone is content.” The duration of this euphoric phase is typically 3–12 months, with the exception of the November ’21 bull trap.

The price of Bitcoin (BTC) has decreased by 0.86% over the past 24 hours, and it is currently trading at $91,274. The 24-hour low and high are $89,393 and $92,596, respectively.