Crypto prices rebound as the US-Israel-Iran war impact fades, signaling a market bottom and renewed upward momentum despite global tensions.

Economic events and geopolitical tension significantly influence the price of cryptocurrency.

The digital asset was substantially affected by the US-Israel-Iran war this month, as the escalation and de-escalation of the conflict affected investors’ trading sentiments and activities.

It is important to note that the crypto market has experienced gains today, which represents a departure from its previous impact.

Is it likely to erupt again? Let us deliberate on that matter.

Crypto Price Plummet In Response To US-Israel-Iran Conflict

The escalation of Middle East tension and the subsequent decline in crypto prices commenced on June 13.

On that day, Israel initiated the “Operation Rising Lion” and conducted air strikes against Iranian nuclear facilities.

Iran began a counterattack and threatened to close the Strait of Hormuz, which sparked concerns about an oil market upheaval.

Consequently, the crypto market experienced a significant decline, resulting in over one billion dollars in liquidity loss in a single day.

The digital asset’s collapse was further exacerbated by the US’s involvement in the Israel-Iran war.

Iran responded to the US airstrike on Iran’s nuclear site with a missile strike on Al-Udeid Air Base in Qatar on June 22.

The bull case of this weekend’s events:

While the Israel-Iran war has undeniably escalated with US involvement, it’s not all bad news.

In fact, there may be a situation where this weekend’s events lead to a faster conclusion of this conflict.

This situation would be one where… https://t.co/qnzbrBB7zE

— The Kobeissi Letter (@KobeissiLetter) June 22, 2025

The cease-fire agreement followed these events, which resulted in the cryptocurrency market’s growth.

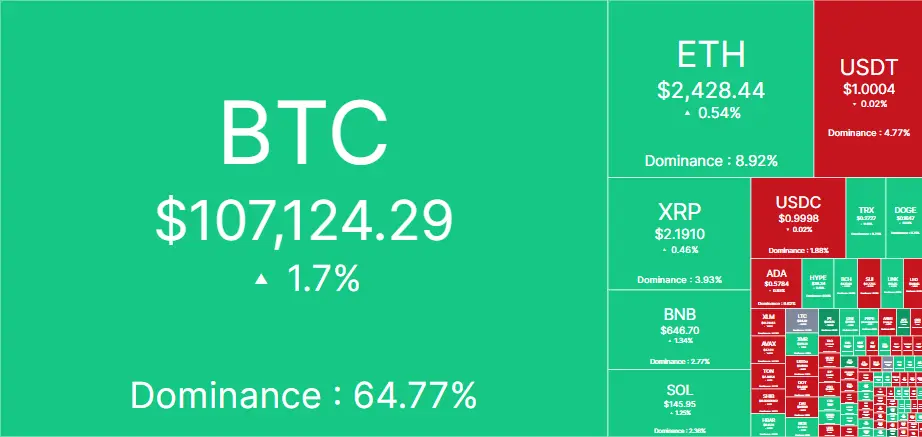

The price of Bitcoin recovered to $107k, Ethereum surged to $2.5k, and Solana reached $145.

The same is true for the remaining market.

When Will Crypto Prices Explode Next?

Despite the ongoing conflict between the United States and Israel, Crypto price is currently experiencing an increase.

The host of the House of Crypto alleged that cryptocurrency experiences a surge in value following significant anxiety events.

In his 18-minute YouTube video, he asserts that historical data demonstrates numerous instances of Bitcoin and altcoins’ robust recovery following acute sell-offs.

Each time, the crypto prices experienced an explosion weeks or months following the collapse due to the FTX liquidation fears and geopolitical tension.

His analysis indicates that the panic selling presents investors with a purchasing opportunity at the market’s nadir.

It is important to note that whale activity has been relatively high for digital assets.

Buyers are actively investing in Bitcoin and Ethereum ETFs, which is why their inflows are at their highest.

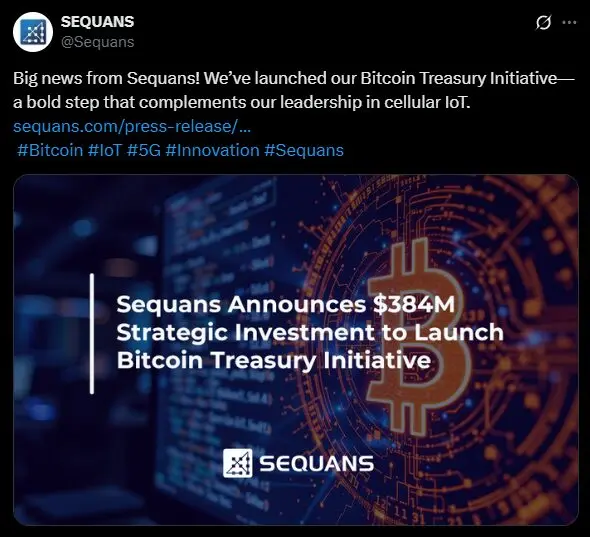

Bitcoin Treasury is initiated by Sequans Communications, in addition to numerous other institutions.

Other companies, such as Metaplent and MicroStrategy, continue to acquire Bitcoin.

In addition, the Genius Act is on its way to the House, which will result in regulatory developments.

Therefore, the surge is not solely due to the US-Israel-Iran confrontation; other factors also contribute to it.

The same can also favor a future surge, presenting the possibility of a crypto price rally.

Solana, Ethereum, and SEI exhibit robust recoveries following the decline. Bitcoin is merely 5% of the ATH.

In addition, the exchange reserve sank to its lowest level in a decade, indicating that investors are confident in the potential for further rallies and are inclined to maintain their positions.

The continuation of the bullish momentum has the potential to generate conditions similar to those of a bull market.

Nevertheless, geopolitical and macroeconomic obstacles continue to persist.

Forthcoming updates may alter the trajectory; therefore, it is imperative to conduct additional continuous analysis.