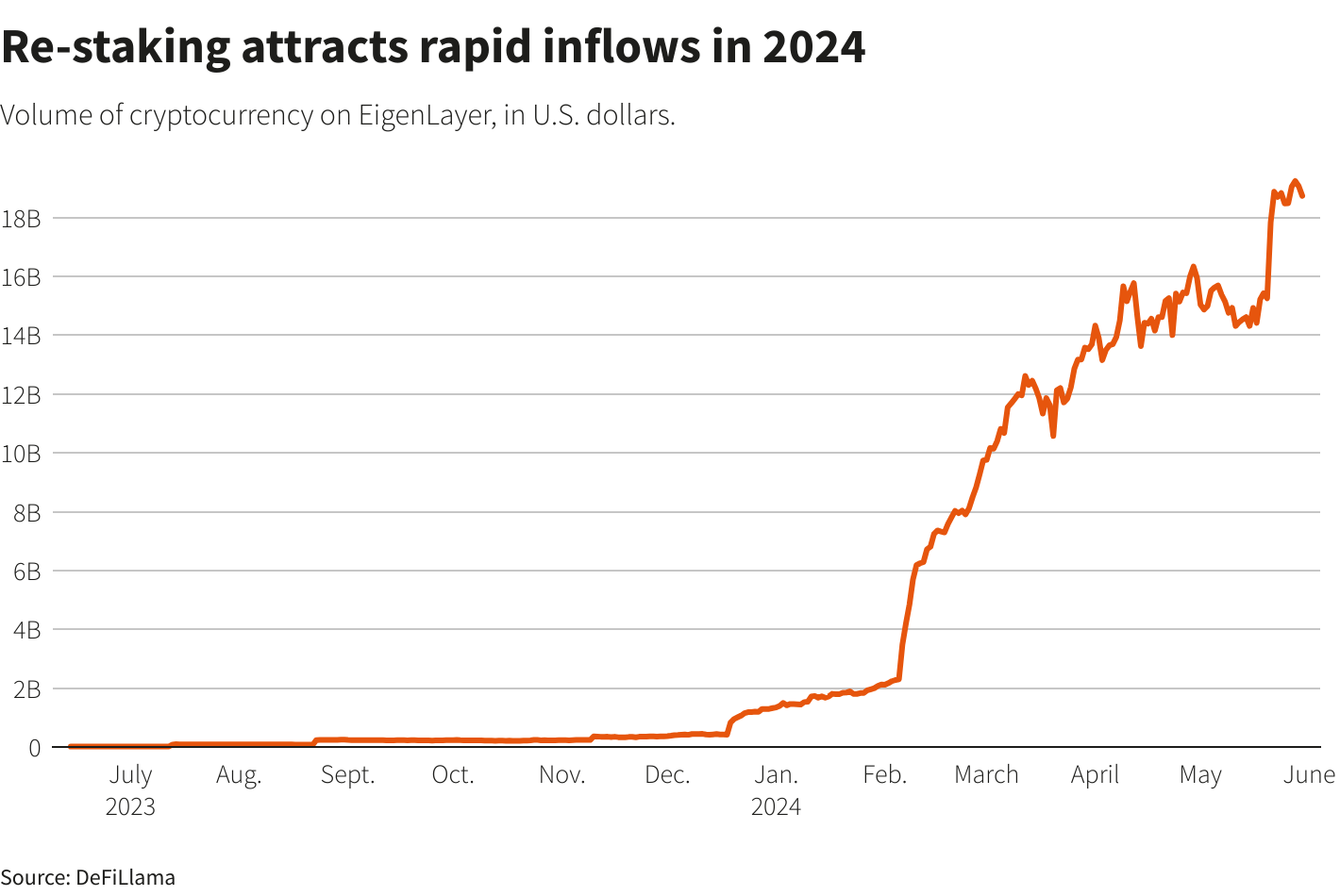

More than $18 billion worth of cryptocurrency has migrated into a new platform that rewards investors for locking up their tokens, In a convoluted plan, analysts worry might harm users and the crypto market

The increasing prevalence of “re-staking” serves as the most recent indication of risk-taking in cryptocurrency markets, where traders seek yield and prices surge.

The largest cryptocurrency, Bitcoin, is approaching all-time highs, whereas the second largest, ether, has increased by over 60% this year.

The essence of the re-staking growth is EigenLayer, a startup headquartered in Seattle. Since raising $100 million in February from the crypto division of U.S. venture capital firm Andreessen Horowitz, the company’s platform has attracted $18.8 billion worth of cryptocurrencies, up from less than $400 million six months prior.

Sreeram Kannan, the founder of EigenLayer, developed re-staking to improve the time-honored crypto practice of staking.

A network of numerous computers maintains blockchains, similar to databases, in that they confirm and establish ownership of specific cryptocurrencies—owners of crypto tokens, such as ether, consent to locking their assets as a validation procedure.

While participating in staking, token holders forfeit immediate access to their tokens but receive a yield in exchange.

Additionally, some staking platforms provide users with newly minted cryptocurrencies in which to pledge the cryptocurrencies they have staked.

Re-staking allows proprietors to stake their newly acquired tokens with additional blockchain-based applications and programs to achieve greater returns.

Regarding the riskiness of re-staking, the cryptocurrency community is divided, with some insiders claiming the practice is too young to be understood.

However, some individuals, including analysts, are concerned that infinite borrowing cycles could ensue in the vast lending markets of cryptocurrencies if new tokens representing the re-staked cryptocurrencies are used as collateral.

Such a scenario would involve a small number of underlying assets. They say that could destabilize broader cryptocurrency markets if everyone attempted to exit simultaneously.

“It’s not ideal when collateral is used as collateral; it introduces an unnecessary level of risk,” said Adam Morgan McCarthy, research analyst at crypto data provider Kaiko.

The yield is the allure for investors: staking returns on the Ethereum blockchain are typically between 3 and 5 percent. However, analysts predict that returns could be higher if investors re-stake, earning multiple yields simultaneously.

Re-staking is the most recent innovation in the hazardous realm of decentralized finance, or DeFi, wherein cryptocurrency holders stake their holdings in experimental schemes expecting to receive substantial returns without selling them.

Although the EigenLayer platform has yet to develop the necessary mechanism to distribute staking rewards directly to users, this has not yet occurred. Users are registering for the platform expecting to receive airdrops, which are forthcoming rewards or giveaways.

At this time, EigenLayer has been distributing a newly minted token to platform users. Users anticipate that this “EIGEN” token will gain value.

According to Kaiko’s Morgan McCarthy, users pursuing airdrops fueled the growth of re-staking platforms; McCarthy described this “extremely, extremely speculative, this free money thing.”

David Duong, chief of research at U.S. cryptocurrency exchange Coinbase (COIN.O), stated, “It’s hazardous.” A new tab is opened, which provides staking but not re-staking.

“They’re doing this pre-emptively right now, (with the) expectation that they will be rewarded with something, but they don’t know what,” according to Duong.

ENTER THE The EIGENLAYER

Sreeram Kannan introduced EigenLayer last year. An academic website states that he was a former assistant professor at the University of Washington in Seattle and a member of the group that launched the first student-designed microsatellite in India.

EigenLayer establishes a connection between applications needing staked tokens and would-be stalkers as a marketplace for validation services.

EtherFi, Renzo, and Kelp DAO are examples of newly emerged re-staking platforms that re-stake the tokens of their clients on EigenLayer and generate new tokens to signify the re-staked assets.

These tokens may be utilized in other contexts, such as as collateral when obtaining a loan.

As opposed to encouraging more crypto-backed borrowing, Kannan stated that the purpose of his platform is to enable users to decide where to stake their tokens and to support the expansion of new blockchain services.

“We have no official affiliations with any of the individuals above… He stated, “This is an emergent phenomenon.”

Duong of Coinbase notes that re-staking may involve “hidden risks”; if re-staking tokens are utilized in cryptocurrency lending, forced liquidations and increased volatility during market downturns are possible outcomes.

High-risk financing exacerbated the bear market decline in cryptocurrencies in 2022, as collateralized crypto tokens lost value rapidly after the Terra and Luna tokens failed.

Kannan takes EigenLayer’s distance from the dangers.

“The lending protocols pose a greater threat than re-staking.” He stated, “The lending protocols are mispricing risk.”

Certain authorities disregard re-staking, arguing that the amount of money involved in re-staking protocols is negligible compared to the $2.5 trillion in net assets of the global cryptocurrency industry.

Regulators have long been concerned that cryptocurrency losses could ripple into broader financial markets.

“At this time, we do not foresee any significant risk of contagion from restacking issues to traditional financial markets,” said S&P Global Ratings’ digital assets analytical lead, Andrew O’Neill.

Nonetheless, institutional investors are beginning to embrace re-staking as the cryptocurrency world becomes more intertwined with traditional finance.

Zodia Custody, the crypto division of Standard Chartered, has observed considerable institutional interest in staking.

However, the company deems re-staking excessive due to the challenge of creating a “paper trail” that tracks the movement of assets and the distribution of rewards, according to Anoosh Arevshatian, chief risk officer.

Kelp DAO announced in April via blog post that Laser Digital, the cryptocurrency division of Nomura, has organized a re-staking partnership with a portion of its funds.

Swiss crypto-focused bank Sygnum stated that it takes the crypto assets of its clients and anticipates the emergence of “a new ecosystem around re-staking.”